Choppy grain trade. Soybeans, soyoil and wheat ended marginally lower. Soymeal and corn traded higher. US stocks, US Dollar, Crude and gold were all mixed.

SOYBEANS

Soybeans had a choppy trade. SH ended near 11.88. Range was 11.85 to 11.99. For the 4th time, SH has tested the 12.00. Some feel 3 tops fail. Soybean futures are supported by talk of drier Argentina weather and the ongoing port strike. Workers want higher wages due to runaway inflation. Some estimate that 4.5 mmt of crops are stuck at docks waiting for export. This could be costing Argentina $50 million dollars per day in needed currency. Only 30-40 pct of Argentina could see over 1.00 inch rain over the next week. This is down from yesterday’s forecast. Soybean futures also supported by talk that record US soybean crush and export demand to date cold increase US soybean crush by 40-50 mil bu and exports 100 mil bu from USDA current guess. This could drop US 2020/21 carryout to only 75 mil bu. Some feel minimum pipeline is 140 mil bu. Trade estimates weekly US soybean sales near 400-900 mt versus 569 last week.

CORN

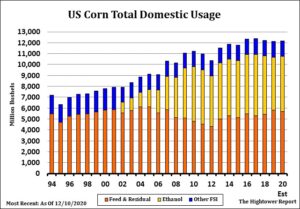

Corn futures traded higher. Chart formation is either a negative head and shoulders formation or a sideways market ready to break out to the upside. Corn futures are also higher on talk that 2021 South America corn crop could be 10 mmt below USDA current estimate. This could add 400 mil bu to US exports. This could also drop US 2020/21 corn carryout to 1,300 mil bu. There is also talk that China could imports 20-21 mmt of corn from all origins versus USDA latest guess of 16.5. All of this could push nearby corn futures closer to 4.50-4.60. Dalian corn futures continue to traded higher. Weekly US corn ethanol production was down from last week and last year. Stocks were up from last week and last year. Margins remain negative. Most hope that a successful virus vaccine will eventually increase consumer demand for gas and ethanol. Managed funds are large longs in corn. Some feel they will need additional bullish news to add to positions. Commercials are large shorts. US farmer is a steady seller of the 2020 corn crop. There is talk of that US farmers have asked for a record delayed 2020 payments until 2021. Still domestic basis remain strong with some feeling demand could be higher than supply. Trade estimates weekly US corn sales near 800-1,600 mt versus 1,362 last week.

WHEAT

Wheat futures saw small losses. WH closed near 5.98. Range was 5.89-6.07. WH had an outside day closing near the midpoint of Tuesdays range. Wheat futures on again and off again trade is off again today. This despite a lower US Dollar. This week Egypt paid $7 dollars per tonne more for EU wheat than their last tender. This was for Feb shipment. Russia prices were not competitive due to added export tax that will be imposed Feb 15. Some could see Russia moving forward the tax and lowering export quota if the 2021 crop is lower than last year. Some could see the crop closer to 72 mmt than USDA 84. Trade estimates weekly US wheat sales near 250-650 mt versus 616 last week. Some look for nearby Chicago wheat futures to trade between 5.50-6.35 in 2021. Highs made in Q1 and lows in Q3. KC wheat range 5.20-6.20 with high also Q1 and low Q3. Key will be north hemisphere weather and if successful vaccine increases US/World food demand in 2021.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.