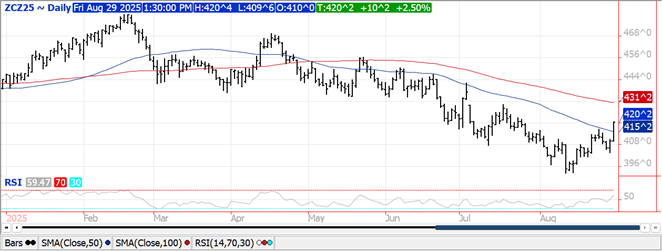

CORN

Prices have surged $.09-$.12 today while spreads also closed firm. Month end speculative and end user buying along with a void of farmer selling combined to inject some late season weather premium. Frost concerns late next week may impact developing crops in the regions affected. Dec-25 plowed thru its 50 day MA resistance stretching out to a new high for the month. Not much resistance until the mid-July high and 100 day MA near $4.31. Since 1990 there has been 18 years where the USDA raised yields in Aug. In those years final yields ended up below the Aug. est. 12 times while above the Aug. est. 6 times. The past 6 times yields were trimmed in Aug. final yields wound up being lower. In Brazil right now there are 21 active corn based ethanol projects which could boost production by 50% by 2027. 12 of these 21 projects are at various stages of construction with 9 in the planning stage. If all 21 projects are completed it will require an additional 14 mmt of grain to produce another 8.2 bil. liters of ethanol. Recall Brazil upped their ethanol blend rated from 27-30% at the beginning of this month. Growth in domestic corn demand in Brazil will continue to support US exports. IMO a close above the mid-July high would confirm the cyclical lows being set shortly after the August report.

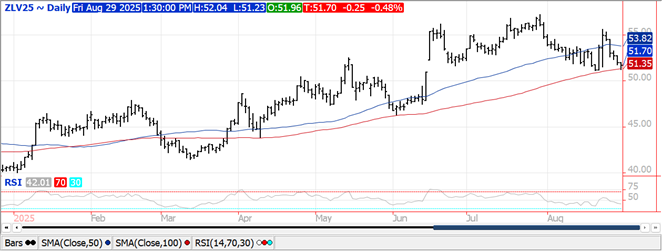

SOYBEANS

Prices were mixed with beans up $.04-$.08, meal ranged from $3 lower in spot Sept-25 to up $21 while oil was down 20-30 points. Bean and oil spreads rebounded while meal spreads weakened. Resistance for Nov-25 beans rests at the Aug-25 high at $10.62 ¾ with support at the 100 day MA at $10.28 ¾. Oct-25 oil held support above its August low at 51.12 while Oct-25 meal held support at its 50 day MA. Spot board crush margins were destroyed again today, down another $.17 ½ bu. and down $.66 bu. for the week to $1.53 ½ bu. a 2 month low. Combined production of biodiesel and renewable diesel in June rose slightly to 409 mil. gallons, up from 408 in May-25, while the highest since Dec-24 it is still down 11.8% YOY. Combined capacity rose less than 1% to 6.743 bil. gallons however down 2.5% YOY. Soybean oil usage in the production of biofuels rose 2% in June to 1.045 bil. lbs. the highest since Dec-24. In the first 9 months of the 24/25 MY bean oil usage has reached 8.477 bil. lbs. down 11.3% YOY, vs. the USDA forecast of down 5.7%. In order to reach the current USDA forecast usage July-Sept will need to reach 3.773 bil. lbs. up 10% over YA. The current USDA usage forecast at 12.250 bil lbs. is looking too high. With no US/China trade deal China has increased imports from Argentina and Uruguay to fill the void. Wire services have reported they expect imports from the 2 SA nations will double in the 25/26 MY to roughly 10 mmt. Census crush after the close of trade on Tuesday is expected to come in at a record high for the month of July at 207 mil. bu. Bean oil stocks are expected to rise to just over 1.9 bil. lbs.

WHEAT

Prices ranged from $.03-$.08 higher, largely in sympathy with the strength in corn. Spreads are mixed. Resistance for Dec-25 CGO is at this week’s high at $5.35 ½. Dec-25 MIAX scored a key reversal day today after establishing fresh contract lows in early trade. A lite freeze for the eastern prairies of Canada is possible while some frost could occur in the upper Midwest. Overnight low temperatures late next week will be closely monitored by the trade on Monday night. Russia raised their wheat export tax to 134.4 roubles/mt for the period ending Sept. 9th, up from the previous week of 32.1 roubles. The BAGE states their wheat crop is developing nicely with 85% of the crops soil moisture in adequate to optimal condition. Expectations for higher production across several key global exporters weighed on FOB values all week. Still awaiting potential peace summit between Pres. Putin and Zelenskiy.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.