CORN

Prices were $.03-$.05 lower today while spreads also weakened. After failing to trade above the 50 day MA resistance earlier this week, Dec-25 pulled back below $4.10. Near term support is at LW’s low of $4.01 ¼. Taiwan reportedly bought 65k mt of US origin feed corn at $1.77 over Mch-26 futures for Nov. shipment. The NCGA reports production costs have slipped 3% from their peak 3 years ago, however prices are down 50% over that same period as profit margins are negative for a 3rd consecutive year. Ethanol production slipped to a 13 week low to 314.6 mil. gallons, down from 315.2 mil. the previous week while in line with YA. There was 107 mil. bu. of corn used in the production process, or 15.23 mil. bu. per day, above the 14.4 needed to reach the USDA forecast of 5.470 bil. If LW’s pace held over the last 9 days of the MY, corn usage would reach 5.477 bil. bu. Ethanol stocks slipped to 22.6 mil. barrels, in line with expectations while below YA inventories at 23.6 mb. Cheaper corn and natural gas continues to support operating margins. Implied gasoline demand rose 4.5% to 9.24 tbd however was still down nearly 1% YOY. Export sales tomorrow are expected to range from 40-105 mil. bu.

SOYBEANS

Prices were lower across the complex with beans down $.02, meal was down $4-$6 lower while oil was down 30 points. Soybean and oil spreads firmed while meal spreads were mixed. Oil spreads made new lows before recovering late. Inside trade for Nov-25 beans with resistance at the Aug high at $10.62 ¾, support is at the 100 day MA at $10.27 ½. Sept-25 oil is back between its 50 and 100 day MA’s. Sept-25 meal held support at its 100 day MA at $290.60. Weakness in the Ag. space is attributed to favorable US weather, lack of a trade deal with China, slowing export demand along with growing expectations for global wheat production. Rains will continue to fill in across the central and southern plains today while stretching into the Delta and Gulf coast region by the end of the upcoming Holiday weekend. While slowing corn harvest in the region it may help yield prospects for later maturing soybeans. Spot board crush margins dropped another $.10 today to $1.95 ½ bu. with bean oil PV ticking up to 47.2%. The market appears skeptical the EPA will have success reallocating the nearly 1.4 bil. gallons of bean oil exempted for small refineries over the last 2 years. Canada’s 2025 canola production is expected to range between 19 – 21.2 mmt vs. 19.5 mmt last month. Tomorrow’s export sales are expected to range between 10-36 mil. bu. of beans, 125-450k tons of meal and 0-15k tons of oil.

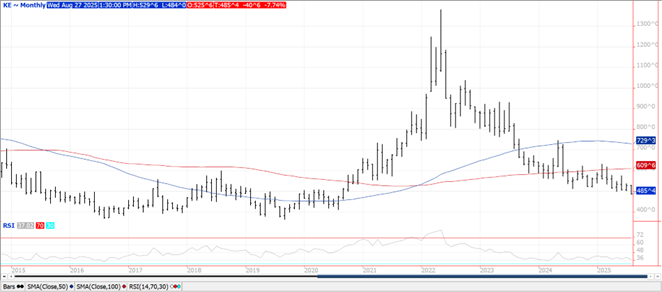

WHEAT

Prices ranged from $.07-$.15 lower today with KC the downside leader. Spreads weakened as Sept/Dec KC slipped to a new low at ($.27 ½) bu. New contract lows for both KC and MIAX futures. Spot KC has traded to its lowest level in nearly 5 years. Spot MIAX traded to a 1 year low. Support for Sept-25 CGO is the contract low at $4.94 ½. This week IKAR raised their Russian production forecast to 86 mmt, above the USDA’s 83.5 mmt est. Analysts have also upped Australia’s production forecast closer to YA production at 34.1 mmt. ABARE is expected to update their production forecast next Tues. likely to come in well above their June forecast of 30.6 mmt. Canadian wheat production is expected to range from 34.2-37.2 mmt vs. 34.4 mmt in August. Tomorrow’s export sales are expected to range from 16-26 mil. bu.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.