CORN

Prices were down $.01 ½ – $.03 finishing near session lows in choppy 2 sided trade. Nearby spreads all made new lows. On day 1 of the Pro Farmer crop tour, participants in OH forecast an average corn yield of 183.3 bpa, just below YA 184 however above their 3-year Ave. of 181. Last week the USDA pegged OH yields at 188 bpa, down from last year’s record yield of 198 bpa. In SD participants found an average yield of 156.5 bpa, down almost a bu. per acre from YA, but well above their 3-year Ave. of 142. The USDA is forecasting SD yields at 162 bpa, matching their previous record from 2020 and well above the 152 bpa from YA. Ratings held steady at 67% G/E, in line with expectations. 74% of the crop is in the dough stage, 30% of the crop is dented, while 5% of the crop is mature, all at or slightly above the historical Ave. Several states are reporting harvest progress led by TX and LA already at 60 and 58% harvested respectively, both well above their historical average pace. EU corn imports as of Aug. 18th have reached 2.9 mmt, up 28% from YA.

SOYBEANS

The soybean complex was mixed in uneventful trade. Beans were within $.01 of unchanged, meal was steady to $2 lower while oil was up 10-25. Spot board crush margins improved $.03 to $1.77 ½ with bean oil PV remaining just below 40%. Weather across the Midwest will be mostly dry the balance of the week with only scattered showers in the NW third of the belt. Temperatures will remain mild for a few more days across the central Midwest keeping crop stress minimal, however heat will gradually build north by this weekend which could threaten later maturing crops, particularly soybeans. A widespread rain event will be needed by early September to optimize soybean yields. The USDA announced the sales of 239.5k mt (9 mil. bu.) of soybeans to Mexico and 132k mt (5 mil. bu.) to China. That’s 30 mil. bu. in the last 20 days. EU soybean imports as of Aug. 18th at 1.64 mmt are down 16% vs. YA. Meal imports at 2.52 mmt however are up 15%. On the Pro Farmer crop tour in OH yesterday participants found average pod counts in 3×3 squares were 1,230, a touch below YA however above the 3-year Ave. Pod counts in SD at 1,026 were slightly above YA however well above the 3-year Ave. This USDA is forecasting a record soybean yield in OH at 59 bpa, vs. YA record of 58 bpa. In SD the USDA is forecasting an average yield of 47 bpa, above the 44 bpa yield from YA, however below the record yield of 49.5 in 2016. Bean ratings held steady at 68% G/E however there was a 1% shift to excellent from good. 81% of the crop is setting pods in line with recent history. A few states are reporting harvest led by LA at 8%, just below its historical average of 6%.

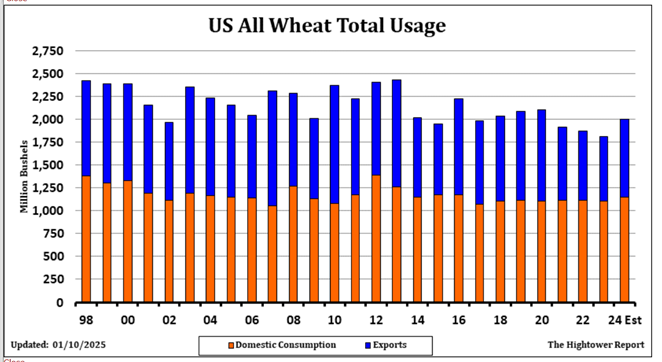

WHEAT

Prices were up $.03-$.05 across all 3 classes today. With little fresh news to drive prices trade appeared to be technically driven. Jordan passed while making no purchase on their recent 120 mt tender for hard milling wheat. Russia’s Ag. Minister was quoted as saying they maintain their grain production forecast of 132 mmt with wheat accounting for 86 mmt. SovEcon raised their Russian wheat production forecast .4 mmt to 83.3 mmt, very near the USDA forecast of 83 mmt. Kazakhstan’s Ag Ministry states they could supply up to 3 mmt of wheat annually to China, above their current agreement to ship 2 mmt. Much of Ukraine and southern Russia will remain in a hot/dry pattern for at least the next week. US winter wheat harvest is winding down at 96%. Spring wheat ratings improved 1% to 73% G/E vs. expectations for a slight decline. 31% of the crop is harvested, slightly behind the historical average. EU soft wheat exports at 3.55 mmt are down 22% from YA.

Charts provided by QST Charts.

>>See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.