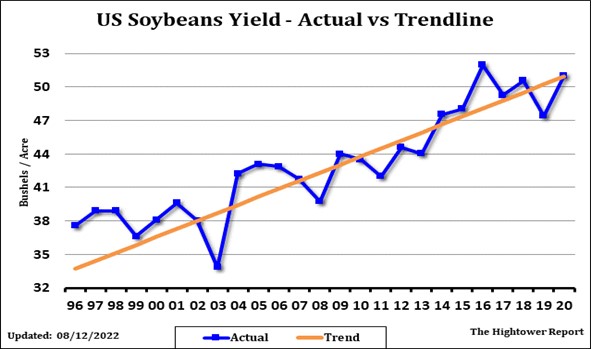

SOYBEANS

Soybean futures ended higher. There may have been some positioning before Pro Farmer release their estimate of US soybean yield based on crop survey this week of a 7 state tour pod count. Pro Farmer yield was 51.7 and near USDA August yield. For the week, SX traded from a low near 14.04 to a high near 14.84. Fact USDA dropped US weekly soybean crop rating offered support. Firm US cash basis also helped. Lack of farmer selling helped support basis levels. USDA weekly export sales report raised more questions than answers especially with China soybean crush margins on decline. China weather and economic problems could reduce their raw material imports. SMZ retraced all of Thursdays losses. BOZ remains sideways between 66 and 68. China Oct-July vegoil imports were only 6.3 mmt vs 12.1 last year.

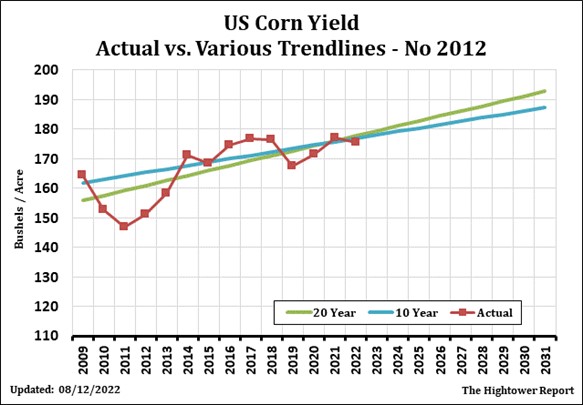

CORN

Corn futures traded higher. CZ rebounded off Thursdays low and ended near Thursdays high near 6.65. Some feel trade was positioning before Pro Farmer released their estimate of US 2022 corn yield based on field survey over the 7 key US corn states. Pro Farmer corn yield was below 6 states including OH, IN, IL, IA, NE and SD. Only MN was higher than last year. Pro Farmer estimated the corn yield at only 168.1 vs USDA 175.4. This is 462 mil bu below USDA August number and would suggest a US 2022/23 corn carryout of only 926. Nearby corn futures rallied this week from 6.23 to 6.66. CZ failed to rally over the 200 DMA near 6.76. Support is near 6.25. Fact USDA dropped US weekly corn crop rating offered support. Firm US cash basis also helped. USDA weekly export sales report raised more question than answers especially on talk of lower Ukraine corn export prices than US and Brazil. Some feel Ukraine now could export 20-22 mmt of corn versus USDA 12.5 if export corridor remains open. Corridor deal ends in October. Ukraine corn export price is 100 cents below US and Brazil. China drought is not expected to impact corn crop but cease of industrial production could reduce their raw material import demand.

WHEAT

Wheat futures ended higher following higher corn and soymeal prices. Corn and soymeal was supported by rumors Pro Farmer might est US corn and soybean yields below USDA August numbers. After the close Pro Farmer estimated US corn yield well below USDA. This could open corn 15-20 cents higher Sunday which should help wheat futures. This week. WZ rallied from 7.71 to 8.21 only to settle back to the 20 DMA near 8.00. Word that Russia may try to aggressively offer their record wheat crop to buyers could limit the upside in prices. US south plains moisture has improved offers resistance. W TX went from record drought to record floods in one day. W EU is still dry. Argentina is dry. Russia is dry. US bakers continue to buy flour as needed. USDA est World wheat trade to increase 3 pct. Pace is more like down 3 pct. There remains uncertainty over Ukraine 2023 crop with 40 pct of Ukraine crop areas under Russian control.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.