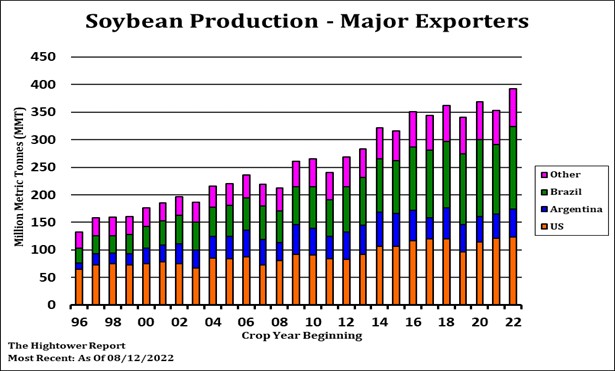

SOYBEANS

Soybean futures ended lower on concern about long term demand for US soybean exports. USDA reported that last week US sold 18 mil bu of old crop soybeans. Total commit is 2,207 vs 2,284 ly. New crop sales were a whopping 172 mil bu. New crop export commit is now near a record 798 mil bu. Some feel data is wrong. Still others feel there may be a disconnect between COFCO and Sino Grain but USDA said the numbers are right until revised. Brazil soybeans are cheaper than US and fact many estimate Brazil 2023 soybean crop at 150 mmt is negative futures. SX rejected resistance near 14..59. Next support is near 14.19.

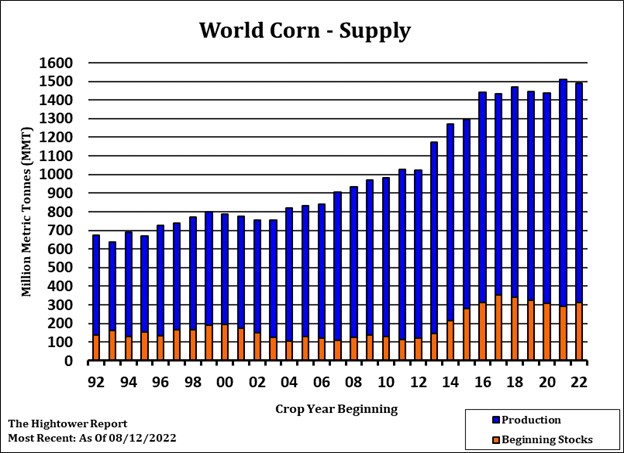

CORN

Corn futures ended lower. US feeders, crushers and exporters need corn which helps support prices. Pro Farmer lower than last year corn yields so far has also helped futures rally to recent highs. Open Ukraine corn export corridor has some estimating that Ukraine could ship 20-22 mmt of corn. Ukraine corn prices are 1.00 cheaper than US. Normal World 2023 corn crops could offer resistance to corn futures. Old crop US corn sales were 12 mil bu. Total commit is 2,412 vs 2,768 ly. Matif corn came under pressure for the second straight day due to further decline in Ukraine premiums. October Fob was quoted at +35CZ against +65 yesterday, which is a full 100¢ below Balkan quotes. The cheap Ukraine offers are also reportedly pushing Brazilian premiums lower. Most farmers remain absent from the market, awaiting the harvest to establish exactly what their level of sales commitments is, the trade is increasingly looking at a French crop of just 10 mmt and an EU crop of 52 mmt which would be the smallest crop since 2007. CZ rejected 6.70. Key support is near 6.30. Some feel CZ harvest low could be close to 6.00.

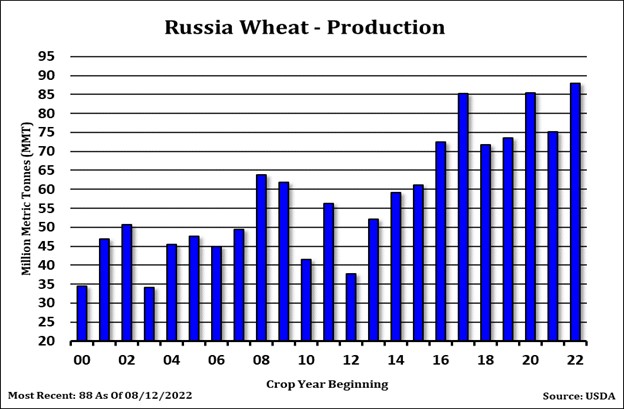

WHEAT

Wheat was lower on talk that Russia needs to export wheat. Fact their crop could be near 95 mmt or higher suggest that Russia will have excess supplies and may need to undercut all export interest to drop supplies. Wheat could also see pressure from US and World entering a steep recession which could limit food demand. US wheat sales were 15 mil bu. Total commit is 339 vs 335 last year. Matif wheat ended lower. The latest quality update of the French crop shows 27 pct of the crop with protein below 11 pct and 58 pct below 11.5% pct pro both lower than last week. Russia export pace still remains below the USDA’s number. Unlike corn, there is no Fob market in Ukraine wheat, with crop estimates falling, almost 40 pct of the acreage under Russian control, and estimates of planting losses this autumn ranging from 30 pct to 75 pct. India’s ban on flour export came into effect today. WZ dropped back below 20 DMA near 8.00. Some feel WZ will remain in a 7.50-8.40 range.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.