SOYBEANS

Soybean futures ended higher. SX and SMZ jumped over the 20, 50 and 100 DMA on talk US crushers need to buy soybeans to satisfy meal demand. Weekly US soybean exports were near 25 mil bu vs 9 last year. Season to date exports are near 2,057 mil bu vs 2,168 last year. Some fear rally could be short lived without new US sales to China and after this week’s Pro Farmer crop tour. Some feel soybean yield potential could be higher than USDA August yield. Interesting to see climatologist could see La Nina lasting into 2023. This could suggest another dry year for Brazil and N Argentina. Soyoil continues to lose soyoil as percent of crush despite higher Dalian soyoil and palmoil prices. Trade estimates US soybean crop 58 pct G/E, unchanged from last week.

CORN

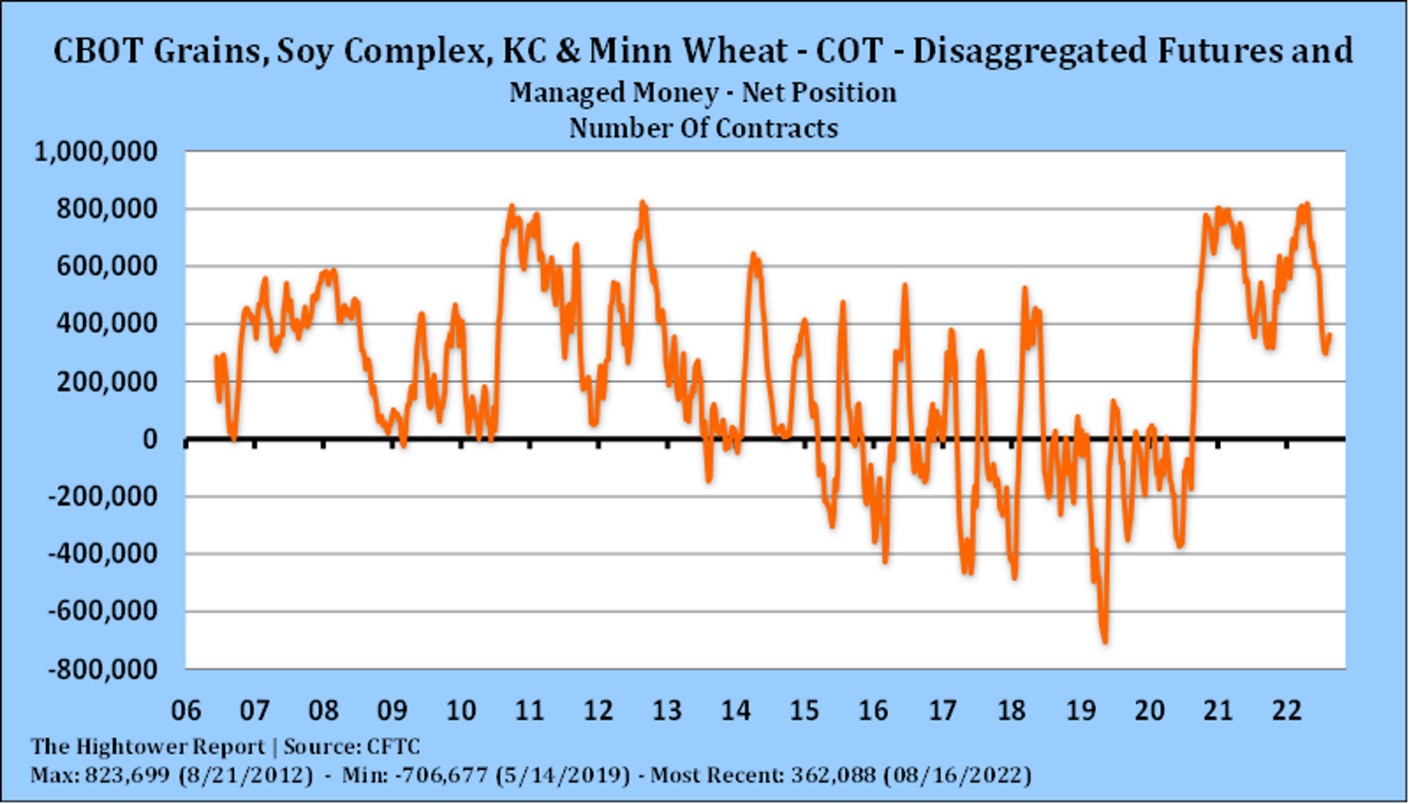

Corn futures managed small gains versus soybeans, soymeal and wheat. Corn futures are trying to bounce off recent lows. Talk of increase Ukraine and Brazil exports has been limiting new buying. Support comes from talk of higher US domestic cash corn basis. Drop is SW feedgrain supply, talk of higher fall export demand and crushers trying to add coverage also offers corn support. CZ is back above key resistance at 200 DMA near 6.28 and near 50 DMA 6.31. CZ held support near 20 day moving average near 6.14. Weekly US corn exports were near 29 mil bu vs 30 last year. Season to date exports are near 2,119 mil bu vs 2,577 last year. Corn bulls need an increase in export demand. Some crop tour participants estimated dry land NE corn below normal due to dry weather. SW feedgrain supply could be down 500 mil bu. COF report surprised trade with higher cattle placements than expected. Trade estimates US corn crop rated 57 pct G/E and unchanged from Llst week. Some climatologist estimate La Nina to continue into 2023. This could suggest another dry summer for Brazil and N Argentina.

WHEAT

Wheat futures continue to try to bounce off recent lows. WZ traded over resistance near7.83. There are rumors that China has bought 5 French wheat cargoes. Interesting that quality and price suggested wheat may have been feed wheat. China may also be looking for US PNW soft wheat. Weekly US wheat exports were near 22 mil bu vs 26 last year. Season to date exports are near 165 mil bu vs 212 last year. Wheat futures need a new story either increase US demand or less talk of Black Sea exports to push prices higher. Ukraine President warned that there will be talks between Ukraine and Russia if Ukraine soldiers guarding Ukraine nuclear plant are put on trial. Will also be interesting to see Russian response to assassination of key Putin aid daughter who was pro Ukraine. Trade estimates US spring wheat Crop rated 64 pct G/E unchanged from last week with 29 pct of crop harvested. Key to futures is demand, from where and at what price. Russia continues to offer wheat for export at low prices.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.