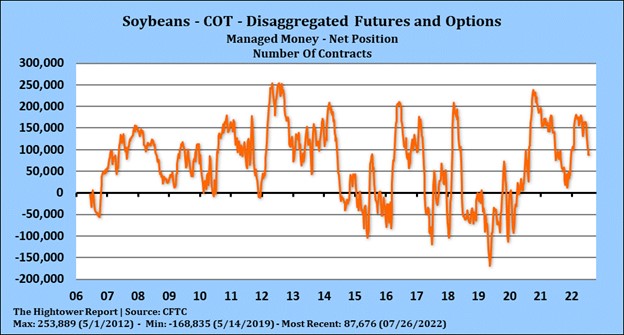

SOYBEANS

Big macro commodity selloff today. Some credited part of the selloff to uncertainty over China action if US Speaker of the House visits Taiwan. Weekly US soybean exports were near 20 mil bu vs 14 last week and 7 last year. Season to date exports are near 1,968 mil bu vs 2,144 ly. USDA goal is 2,170 vs 2,261 ly. China remains slow buyer of US soybeans and continue to buy Brazil beans. Trade est that US soybean crop is rated 58 pct G/E vs 59 last week. EU weather model suggest most of north and east Midwest should see normal weather over next 14 days. SU rejected the 100 day moving average near 15.00 and dropped below the 50 day near 14.75 before ending just above the 200 day near 14.15. EU Midwest weather forecast moderated temps over the next 2 weeks versus Fridays forecast. North and east Midwest rains should near normal. Noon GFS model was warmer and drier.

CORN

Risk off. Over the last few weeks grains have been trading weather, China demand, Ukraine war, recession and money flow. Today all of these issues are negative grains. Trade watching China action if US Speaker of House visits Taiwan. Weekly US corn exports were near 34 mil bu vs 29 last week and 57 last year. Season to date exports are near 2,044 mil bu vs 2,483 ly. USDA goal is 2,450 vs 2,753 ly. Brazil continues to export corn. Some feel once they are done buyers could turn to US. This has some increasing US exports 200 mil bu. Trade est that US corn crop is rated 60 pct G/E vs 61 last week. EU weather model suggest most of north and east Midwest should see normal weather over next 14 days. French crop ratings fell sharply Friday for the second straight week but Matif corn still closed lower. Some of it was the Ukraine corn vessel, some of it was spillover from the US on a mix of unexpected rains on Sunday and fears that Pelosi will hurt Chinese demand for US Ag goods if she goes to Taiwan. EU corn S&D suggest a crop of 65.8 mmt down 6 mmt from last month, remains around 10 mmt above what most of the trade is talking. They also left feed demand unch and kept exports at 5 mmt which may not happen. Some feel EU will be a net importer of corn. The progress of the Ukraine corn cargo will be closely watched, not least for the condition of its cargo and if Lebanon will pay. Some also questioning who will pay the record demurrage bill.

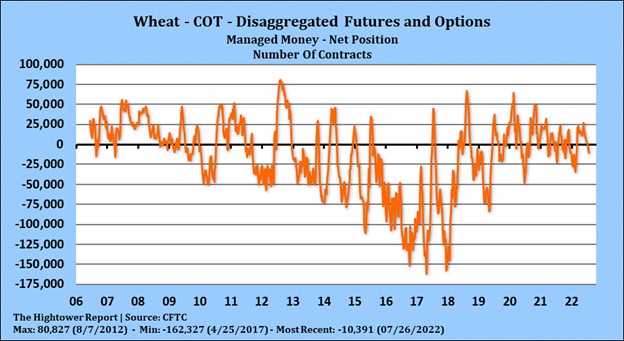

WHEAT

Trade watching China action if US Speaker of House visits Taiwan. Weekly US wheat exports were near 9 mil bu vs 17 last week and 15 last year. Season to date exports are near 104 mil bu vs 139 ly. USDA goal is 800 vs 804 ly. First corn boat with 26 mt left Odesa port raising hope of more Ukraine exports. Trade est that US spring wheat crop is rated 67 pct G/E vs 68 last week. US winter wheat harvest is est near 84 pct vs 77 last week. EU and US wheat futures got hammered after 26 mt of Ukraine corn left Odesa port. Others are expected to follow, but like the first one with no idea of the state of the cargo after 5 months sitting in unventilated holds. Market is also looking at vessel which were already in port when the war began. Lloyds insurers said today that working out the operating procedures for empty vessels to come into the ports is some way off. Algeria is tendering, but with very few offers in any of the cash markets Brussels EU wheat updated S&D with both feed and exports looking too low basis current prices.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.