SOYBEANS

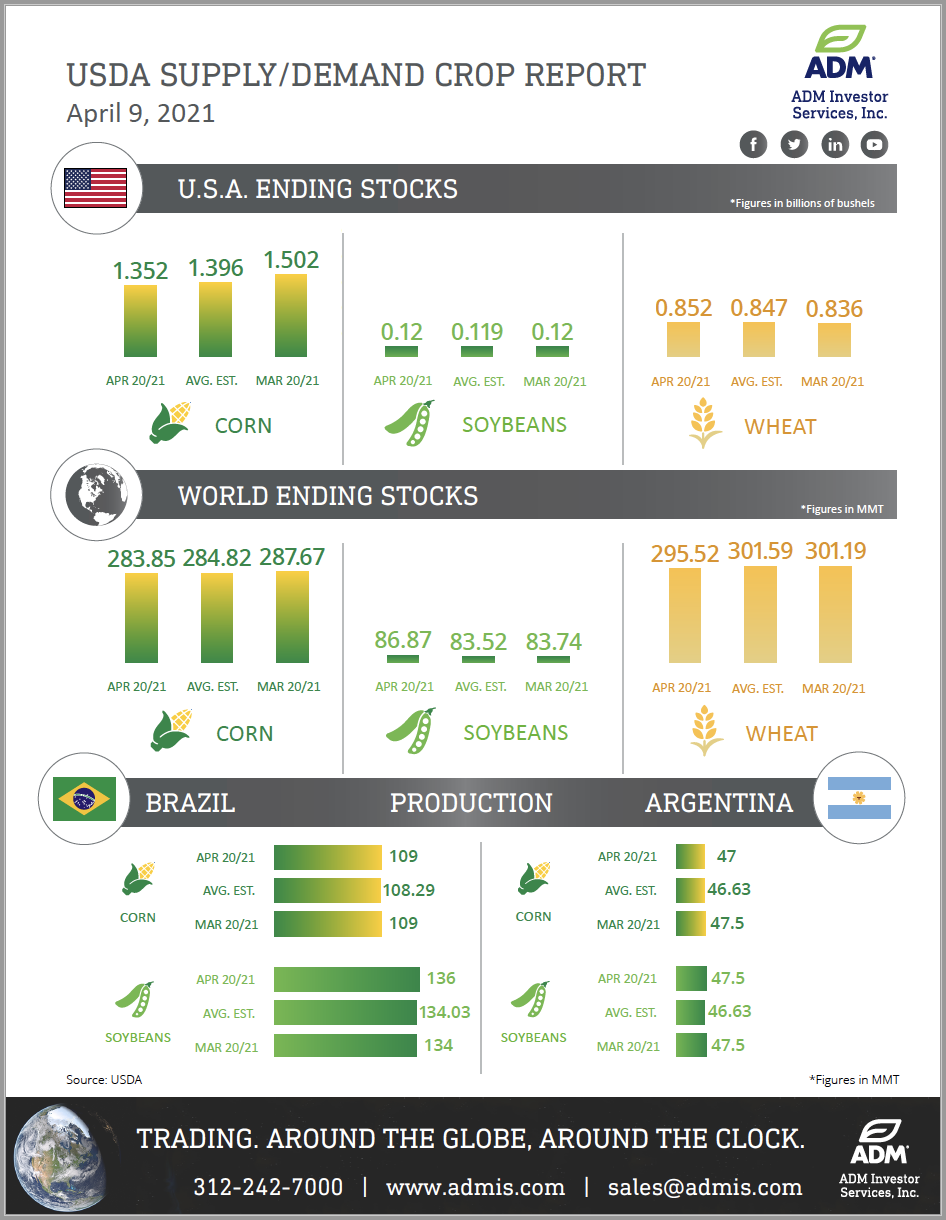

Soybeans traded lower. Talk of one large hedge fund selling out Its long soyoil position before the USDA report weighed on soyoil And soybean futures. Weekly old crop soybean export sales are Estimated near 100-400 mt versus 105 last week. New crop sales Are estimated near 0-200 mt versus 131 last week. US Feb census Soybean exports were 168 mil bu vs 101 last year. This was 10 Mil bu higher than expected and could suggest final exports near 2,350 mil bu vs USDA guess of 2,250. Brazil soybean export prices continue to slip lower. Slower China buying offers resistance. Brazil soybean harvest is near complete. Brazil, Argentina and US farmers have reduced selling of cash soybeans. USDA is expected to estimate US 2020/21 soybean carryout near 118 mil bu vs 120 previous. China soybean crush margins are lower. There is still uncertainty over impact ASF has on China hog numbers. Some estimate China soybean imports near 104-106 mmt vs USDA 100.

Weekly soybean future chart

CORN

Corn futures traded higher. Strong US domestic basis push CK to near 5.61. Lower than expected USDA estimate of US 2021 corn acres is offering support to CZ near 4.80. Some feel domestic end users may lack summer coverage and are beginning to bid up for corn. US farmers may be reluctant sellers over next 6-8 weeks as they plant the 2021 crop. US Midwest 6-10 day and 8-14 day weather Forecast is for normal to below temps and rains. This should help planting. Some are raising concern about dryness in parts of US west Midwest and plains. Weekly US corn export sales are estimated near 500-900 mt vs 797 last week. New crop sales are estimated near 50-300 mt vs 60 last week. There were rumors that China may have bought US new crop corn last week. USDA is expected to drop US 2020/21 corn carryout to 1,379 mil bu vs 1,502 previous. USDA should increase China import 5 mmt to 29, raise US exports 200 mil bu which would lower US carryout. Some could also see higher domestic demand. Weekly US ethanol production was up 1 pct from last week and up 45 pct from last year Covid impact number. Stocks were down 2 pct from last week and 24 pct from last year. A US carryout below 1,350 could push futures higher. Normal US spring weather could offer key resistance.

Weekly corn futures chart

WHEAT

Wheat futures traded higher led by MLS and KC. Concern about US North plains and Canada prairie dry weather may be triggering fund short covering and new buying. WK tested 200 day moving average support near 5.97. Resistance is near the 20 and 100 day moving average between 6.26-6.32. KWK also tested 200 day moving average near 5.50. Resistance is near the 20 day average near 5.81. US Midwest 6-10 day and 8-14 day plains and SRW forecast is below normal temps but should not be cold enough and long enough to hurt the winter wheat crop. This week USDA rated the HRW crop below expectations and SRW and WW above. MWK rallied back over the 100 day average and traded over the 20 day near 6.22 today. Next resistance is the 50 day near 6.32. Weekly US wheat export sales are estimated near 100-500 mt vs 250 last week and new crop 50-200 vs 81 last week. Increase Russia exports offers for Egypt tender offered resistance. Fact MWK is near CK could increase US wheat feeding.

Weekly KC wheat futures chart

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.