SOYBEANS

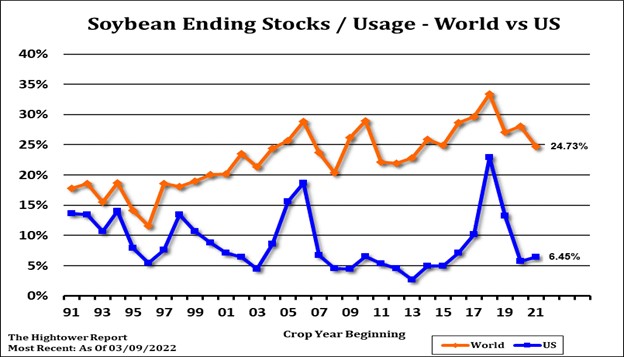

Soybeans ended higher. SK is near 16.45. SX is near 14.66. SK support is near the 50 DMA and 16.23. Resistance is near 20 DMA 16.58. SMK near 458 support. BOK near 73.23 resistance. Soyoil supported by higher palmoil, sunoil and rapeoil prices. Weekly US old crop soybean export sales were 800 mt and 298 mt new crop. Total commit is near 56.1 mmt vs 60.6 last year. There remains talk of increase China buying US soybeans. Season to date China soybean crush is down 10 pct vs USDA estimate of down 6 pct. USDA could also lower China soybean imports. CONAB est Brazil 2022 soybean crop at 122.4 vs 125.4 previous and USDA 127. Some feel Argentina soybean crop could be closer to 39 mmt vs USDA 43.5. Will see if USDA drops Brazil and Argentina soybean crops tomorrow and increase US exports. Where will market find 360 mil bu of lower SA soybean supplies? Potential for higher US demand could help SK test 17.00.

CORN

Corn futures has modest gains led by Dec. CK is testing support near 7.49. CK is losing to CN as Index begin to roll longs and US nearby export demand is slower than bulls would like to see. CZ had an inside day but made a new contract high close. CZ is supported by USDA 2022 acreage guess and wet weather slowing plantings in US east and dry weather in west. Weekly US old crop corn export sales were 782 mt and 145 mt new crop. Total commit is near 54.4 mmt vs 66.4 last year. USDA goal is 63.5 mmt vs 69.9 last year. There remains talk of increase China buying US corn. US season to date census corn exports are 190 mil by above inspections and USDA estimate. Will USDA raise US exports tomorrow and lower carryout? Average trade guess for US 2021/22 corn carryout is 1,415 mil bu vs 1,440 in March. Some are closer to 1,200. CONAB est Brazil corn crop at 115.6 mmt vs 112.3 previous. They est 2nd corn crop at a record 88.5 mt up 46 pct vs ly. Some estimate Argentina corn crop near 49 mmt vs USDA 53. Key remains Ukraine exports. Some feel they may only export 20 mmt vs USDA 27.5. Trade estimates World 2021/22 corn end stocks near 300.9 mmt vs 301.0 in March and 291.4 ly. China 210 mmt stocks is 70 percent of World total.

WHEAT

Wheat is still wheat. Low volume trade sent WK below Wednesday low. WK found resistance near 10.50. Support is back near 9.80. Talk of more and more global demand shifting from old crop to new may have triggered selling to below yesterdays low. Trade does not look for USDA to make many changes to US or World wheat balance sheets tomorrow. Trade still question as much as 10 mmt of Black Sea wheat exports that may not get shipped. USDA estimates World wheat end stocks near 281 mmt vs 290 ly with importing countries 180 mt or 64 pct. Major exporters are 37 mmt or 13 pct. Russia fob values are hard to define but are lowest export prices. USDA will have a big challenge in May with first World 2022/23 S/D especially if Ukraine War continues. Lower 2022/23 Black Sea exports could shift demand to EU and other exporters. KWK also had an inside day closing below the 20 DMA near 10.79. KC wheat price direction up to US spring weather. MWK made a new high for the move near 11.19 before ending lower and near 10.99. Lower US 2022 spring wheat acres is still supportive.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.