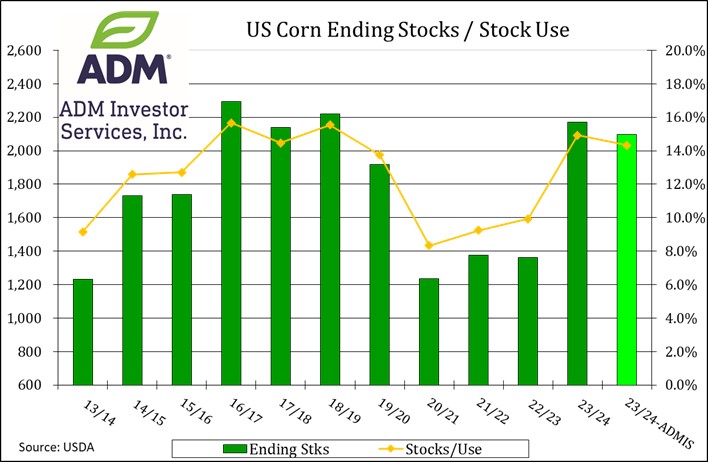

CORN

Prices were steady to $.01 lower today, failing to hold early strength. Early rally efforts in May-24 stalled near its 50 day MA, currently $4.37 ¾. After making new lows earlier in the week, spreads have stabilized with today the first day of the “Goldman Roll”. In the US above normal temperatures across the WCB are expected to gradually slide east by the middle of next week bringing above the much above normal temps across the nation’s midsection. Heaviest rains over the next 7 days to favor Gulf coast and Delta region, with some isolated flooding possible. Delayed plantings with the potential for some replanting is likely. Ukraine’s grain exports for the 23/24 MY have reached 36 mmt as of Fri. down 6.5% YOY. Corn exports account for 19.5 mmt. Today the BAGE lowered their Argentine production forecast another 2 mmt to 52 mmt, now well below the Mch-24 USDA est. of 56 mmt. The exchange cited increased disease from insects for the lowered forecast. Harvest progress has reached 11%. Wire services today report the Biden Administration will not automatically qualify corn based ethanol for tax subsidies for the production of SAF unless the corn is produced from 1 of 3 sustainable growing techniques.

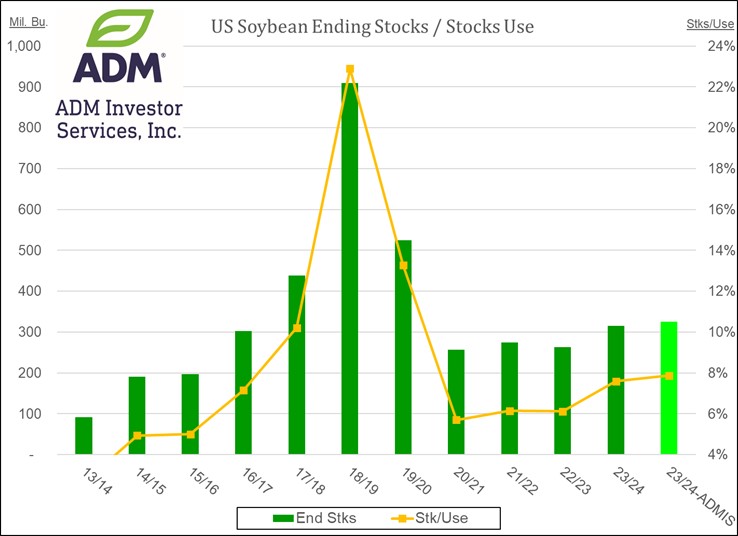

SOYBEANS

Prices were mixed with beans up $.02 – $.05, oil was 65 – 75 higher, while meal was steady to $2 lower. May-24 beans seem to be consolidating near its 50 day MA at $11.85. May-24 oil remains stuck in a $.47- $.50 trading range After falling for 7 consecutive months, the UN World Food Price Index rose to 118.3 in Mch-24, up from 117 in Feb-24. Higher vegetable oil, meat and dairy triggered the increase. Weather forecasts for South America remain mostly favorable with some rains expected to fill in over dry area’s in WC and SC Brazil. Brazil’s Govt. reports bean exports in Mch-24 at 12.63 mmt, down 4.6% from in Mch-23. APK-Inform reports Ukraine’s sunflower processing in the first 7 months of the 23/24 MY has reached 9.3 mmt, up 11% YOY. The BAGE kept their Argentine production forecast unchanged at 52.5 mmt, vs. the USDA est. of 50 mmt. Harvest is officially underway coming in at 2% complete.

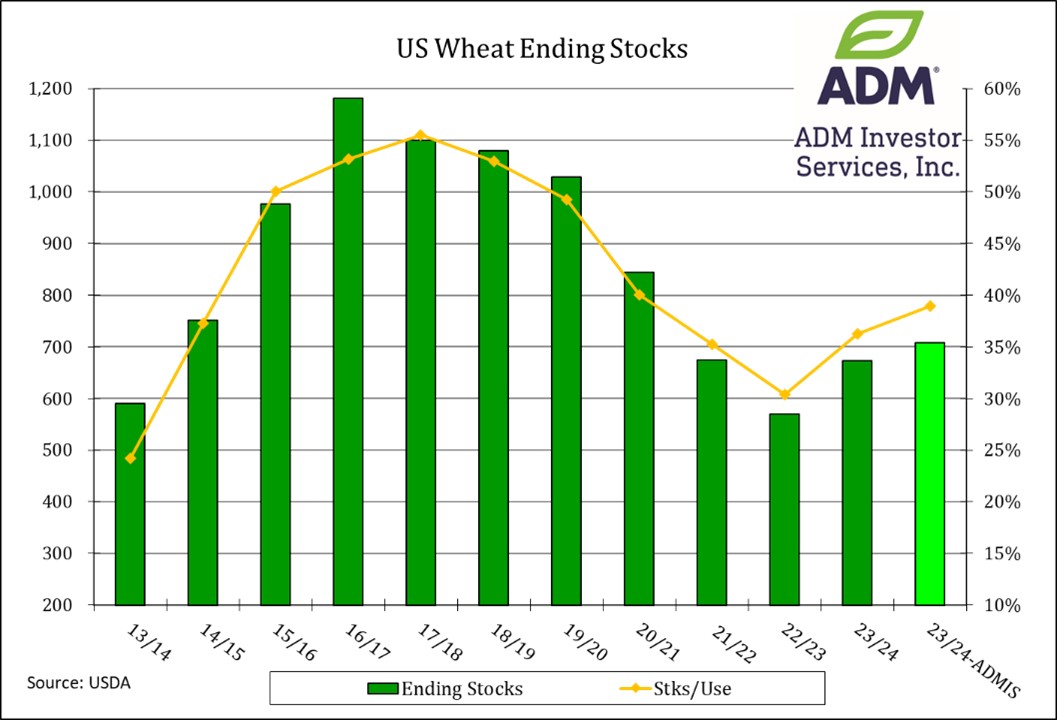

WHEAT

Prices closed higher across all 3 classes however well off session highs. May-24 Chicago failed to close above its 50 day MA at $5.69 after trading above the intraday. The last CFTC-COT report showed Money managers net short roughly 160k contracts of wheat between the 3 classes. Moisture has been added to areas of the southern plains near the TX/OK panhandle, however lighter amounts for much of KN. Despite the 2+ year war, Russian exports account for 24% of the global trade for the 23/24 MY. Combined with Ukraine exports are 31.6% of global trade, the 2nd highest ever. Ukraine’s wheat exports for the 23/24 MY have reached 14.2 mmt thru March-24, no YOY comparisons available. Russia lowered their wheat export tax for the week ended April 16th to 3,236.10 roubles/mt, down from 3,322.80 previous.

Chart source: QST

>>See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.