CORN

Prices were $.02 – $.04 higher today with spreads witnessing a modest rebound. Dec-24 corn held support at its 50 day MA setting up a modest bounce. US forecasts continue to suggest a warmer, dryer outlook by mid-month, which if realized would help stimulate swift corn plantings. Northern growing areas of Brazil will have several chances for rain over the next 7 – 10 days maintaining favorable growing conditions for the 2nd crop corn Exports last week at 37 mil. bu. were at the low end of expectations. YTD commitments at 1.726 bil. are up 18% from YA, vs. the USDA forecast of up 26%. Commitments represent 82% of the USDA forecast, slightly below the historical average of 83%. Census exports in Feb-24 at 211 mil. bu. were well over implied sales based off inspections and up 64% from Feb-23. Thru the end of Feb-24 I show census exports running 134 mil. over inspections. To reach the current USDA export forecast of 2.10 bil. bu. sales will need to reach 1.154 bil. bu. the 2nd half of the MY, up 18% from YA. US corn area in drought increased 1% last week to 25%.

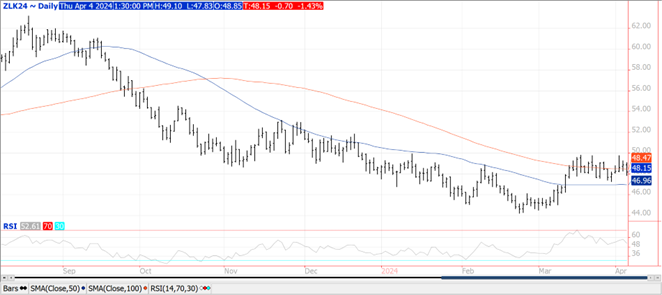

SOYBEANS

Prices were mostly lower today with beans $.01 – $.03 lower, oil was down 70, while meal was the shining star up $3 – $4. The 50 day MA has capped rally attempts in May-24 beans the past 2 sessions while yesterday’s low held. May-24 oil seems stuck between $.47 – $.50 lb. No change in South American weather forecast which remains mostly favorable. Crop areas in SW and SC regions of Brazil are expected to receive precipitation by early next week providing relief from recent dryness. Soybean exports at 7 mil. bu. were below expectations. YTD commitments at 1.490 bil. are down 19% from YA, vs. the USDA forecast of down 14%. Commitments represent 87% of the USDA forecast, below the historical average of 93%. Meal sales at 202k tons were in line with estimates. YTD commitments are up 15% from YA, vs. the USDA forecast of up 8%. In addition the USDA announced the sale of 152k tons (5.6 mil.) of soybeans to Mexico. Census exports in Feb-24 at 193 mil. bu. were above implied sales based off inspections. To reach the current USDA export forecast of 1.720 bil. bu. sales will need to reach 417 mil. the 2nd half of the MY, up 8% from YA. Spot board crush margins increased $.02 ½ today to $.83 ½ bu. with BO PV dipping just below 42%. US soybean area in drought increased 1% LW to 22%. Brazil’s Ag. Ministry reports soybean exports in Mch-24 at 12.63 mmt were down 4.6% YOY, while private forecasts suggest April-24 exports will only reach 10.65 mmt in April-24, down 24% from YA.

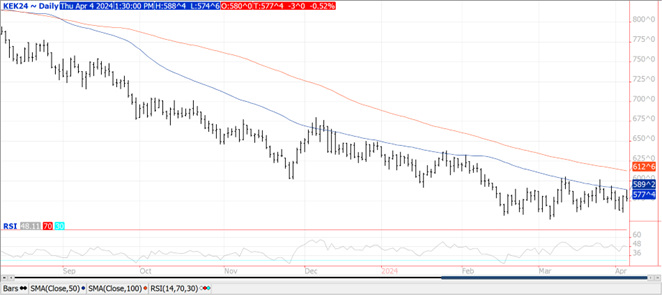

WHEAT

Prices closed mixed to higher. MGEX was up $.07 while both KC and Chicago closed mixed. May-24 KC inverse to July-24 broke $.04 today. Early attempts to rebound in May-24 was capped at its 50 day MA currently $5.89 ½. A major rain event next week has shifted east into the Gulf coast and Delta region leaving the Southern US plains (key winter wheat areas) with much lower precipitation totals. Wheat exports at 10 mil. bu., nearly all for 2024/25 were in line with expectations. Old crop commitments at 689 mil. are up 3% over YA, vs. the USDA forecast of down 6.5%. Outstanding sales of SRW wheat to China are down to 20 mil. bu. after 7.5 mil. were shipped last week. Census exports in Feb-24 at 68 mil. bu. were pretty much in line with the last 4 years. To match the current USDA export forecast of 710 mil. bu. sales will need to reach 220 mil. the last 3 months of the MY, vs. only 160 mil. YA. Russian shipping company Aston has denied the Russian Govt. is holding up grain shipments due to quality concerns. Today, however, sources claim grain shipments destined for Egypt carried by Grainflower DMCC are being held up. Tunisia reportedly bought 75k mt of soft milling wheat and 50k mt of durum in today’s tender.

Chart source: QST

>>See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.