SOYBEANS

Soybeans ended higher on talk of increase China buying Brazil old crop and US new crop soybeans. May Options expire tomorrow. Soyoil bulls are taking profits. Rally to 80 cents may be too early and too fast. US record soybean crush may be too high for now. BON could pull back closer to 72. Could be a buy there is US summer weather is warm and dry. US soybean export sales were 16 mil bu. Total commit is near 2,098 vs 2,235 ly. New crop sales were 45 mil bu with China the big buyer. Drop in China soybean crush margins and congestion in ports due to covid lockdown is switching China US soybean needs to new crop. Some feel like 2012, SN could set back until mid May when a ridge begins to form in the west Midwest and soybean futures then make new highs.

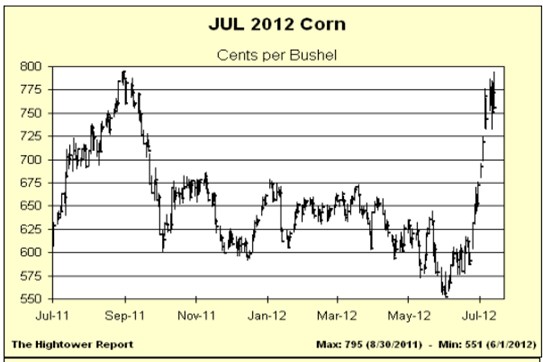

CORN

Corn futures ended lower. Corn bulls are taking profits. South America corn export prices have dropped to near even the July with US export basis +150. Asian, Middle East and N Africa buyers are buying South America. Canada and Mexico are still buying US but some are dropping US corn exports 50 mil bu. US corn export sales were 34 mil bu. Total commit is near 2,230 vs 2,645 ly. Some are also dropping corn use for ethanol 25 mil bu due to rail logistic issues. US weather is in transition which could allow US 2022 corn crop to get planted. Some feel like 2012, CN could set back until mid May when a ridge begins to form in the west Midwest and corn futures then make new highs. International Grain Council lowered World 2022/23 corn crop 16 mmt to 1,197.This due to lower Ukraine and US crops. IGC dropped Ukraine crop to 18.6 mmt vs 41.9 ly. US was lowered to 376.6 mmt (14,800 mil bu) versus 383. 9 ly (15,115). Brazil is est near 123.1 mmt vs 114.6 this year. Argentina 63.7 vs 57.0. NOAA 30 day forecast suggest cold temps around Great Lakes, warm SW. Rainfall is normal in east below in West and SW. NOAA 90 day forecast suggest above normal temps. Rainfall is below normal west and SW.

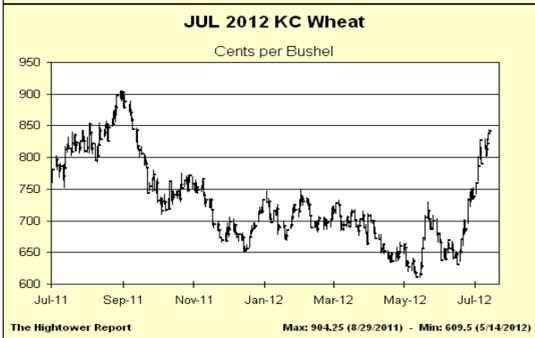

WHEAT

US weather is in transition which could allow for some light rains to move across the HRW area every other week. Still warmer temps and windy conditions could still stress the crop and lower final yield potential. US wheat export sales were only 1 mil bu. Total commit is near 707 vs 932 ly. New crop sales were 8 mil bu. Some feel like 2012, KWN could set back until early May when a ridge begins to form in the south US plains and KC wheat futures then make new highs. International Grain Council lowered World 2022/23 wheat crop 1 mmt to 708. Ukraine is 19.4 vs 33.0, Russia up to 82.5 vs 75.0 and Canada 31.6 vs 21.7. NOAA 30 day forecast suggest warm temps SW and below normal rains. NOAA 90 day forecast suggest above normal temps and below normal west and SW. Wheat was also under pressure on reports Russia 2022/23 wheat exports at 41.0 mmt vs 33.9 this year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.