Soybeans, soyoil and corn traded higher. Soymeal and wheat traded lower. US stocks were lower led by continued tech selloff. Crude traded lower. US Dollar was higher. Crude dropped due to concern about demand and the higher US Dollar.

SOYBEANS

Soybeans traded higher. Managed funds continued to buy soybean. USDA announced new sales to China. Good weekly soybean exports also offered support. Talk that USDA will drop US soybean rating to 64 pct good/ex versus 66 last week also helped prices. Some feel USDA should increase US 2019/20 soybean export guess 25 mil bu. Weekly US soybean exports were near47 mil bu versus 36 last year. This is the start of a new market year. Season to date exports are near 17 mil bu versus 21 last year. USDA 2020/21 goal is 2,125 mil bu versus 1,650 last year. Average trade guess for Friday USDA soybean crop estimate is 4,292 mil bu versus USDA Sep guess of 4,425. Average guess for US 2020/21 soybean carryout is 469 mil bu versus USDA 610 (-141). Average trade guess for World 2020/21 soybean carryout is 93.5 mmt versus USDA 95.4. Soybean futures managed to close higher for the 11th straight day.

CORN

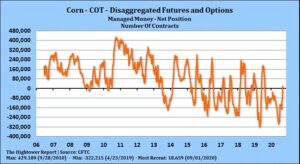

Corn futures managed to traded higher. Early calls were lower on talk of US Midwest rains and approaching US harvest pressure. China Dalian futures traded sharply higher. Some link this to concern recent floods may have reduced China corn supply. Others feel China end users may have added to coverage in case US and China trade relations sour. POTUS warned he would decouple US and China economies. Weekly US corn exports were near 31 mil bu versus 24 last year. This is the start of a new market year. Season to date exports are near 9 mil bu versus 18 last year. USDA 2020/21 goal is 2,225 mil bu versus 1,795 last year. USDA announced 101.6 mt of new US corn sales to unknown. Over the weekend parts of SD, MN, E IA, WI, N IL, N IN and OH saw .75-2.50 inches of rain. Rains should move across the Midwest early this week. Temps are normal to below. Next week should be warmer and drier which should help early corn harvest. Europe, Black Sea and Argentina are dry. Average trade guess for Fridays USDA report for the corn crop is 14,891 mil bu versus USDA Sep guess of 15,278. Average trade guess for US 2020/21 corn carryout is 2,461 mil bu versus USDA 2,756. Average trade guess for World 2020/21 corn carryout is 311.1 mmt versus USDA 317.5.

WHEAT

Wheat futures traded lower. Some link the selloff to estimates that the 2020 wheat crop near 28.9 mmt versus USDA 26.0. They also estimated exports near 20.0 mmt versus 9.5 last year. Higher US Dollar, lower US stocks and lower energy prices may have also Weighed on wheat futures. Weekly US wheat exports were near 25 mil bu versus `5 last year. Season to date exports are near 274 mil bu versus 257 last year. USDA 2020/21 goal is 975 mil bu versus 965 last year. Average trade guess for US 2020/21 wheat carryout is 926 mil bu versus USDA 925. Average trade guess for World 2020/21 wheat carryout is 316.1 mmt versus USDA 316.8. USDA is expected to estimate US spring wheat harvest near 83 percent done versus 69 last week. Trade estimates that 4 pct of US 20210 wheat crop is planted. Soil conditions are dry but most of the area could get rains this week. It remains dry in Europe, Black Sea and Argentina.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.