Soybeans, soyoil and corn traded lower. Soymeal and wheat traded higher. US stocks were higher. US Dollar was higher. Crude turned higher.

SOYBEANS

Soybean traded lower. Soymeal gained on soyoil. World plamoil values traded lower. Overnight, soybean prices started higher on talk of new end user buying. Lower China trade turned soybean futures lower. Rebound in US stocks and energy helped support soybean prices. US Midwest 2 week weather forecast suggest normal temps the rest of this week and normal to below temps the second. 2 week rainfall will be mostly below normal. Fact USDA announced 266 mt US soybean to China and 264 mt US soybean to unknown offered support to soybean prices. USDA estimated US soybean crop is 63 pct good/ex versus 63 last week. USDA estimated US soybean harvest near 6 pct done. One crop watcher is still estimating US soybean yield near 51.0 versus USDA 51.9. One group estimates Brazil 2021 soybean acres near 95.0 million versus 91.1 in 2020 and production 132 mmt versus 126 in 2020. Argentina 2021 soybean acres near 42.7 million versus 42.4 in 2020 and production 52 mmt versus 49.7.

CORN

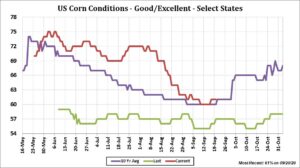

Corn futures traded lower. Corn futures were supported by the lack of US farmer selling and more US corn sales to China offered support. Talk of lower US crop size also is offering support. Approaching US corn harvest could offer seasonal resistance. USDA announced 140 mt US corn to China and 320 mt of US corn to unknown. The forecast of good US Midwest harvest weather could be offering resistance to corn futures. Weekly US ethanol production could be down slightly from last week Stocks could also be down slightly. This could be due to regular seasonal maintenance. There is still concern that demand may not increase with US consumers driving less miles. USDA estimated US corn crop is 61 pct good/ex versus 60 last week. USDA estimated US corn harvest near 8 pct done. One crop watcher is still estimating US corn yield near 176.0 versus USDA 178.5. One group estimates Brazil 2021 corn acres near 48.4 million versus 45.4 in 2020 and production 110 mmt versus 102 in 2020. Argentina 2021 corn acres near 15.3 million versus 15.3 in 2020 and production 50 mmt versus 50.

WHEAT

Wheat futures traded higher. Some link the buying to continued dryness across parts of Russia and Ukraine. Ukraine lowered their 2020 wheat crop to 25 mmt versus USDA 27. Winter wheat is 60 pct of Russia total wheat crop and 95 pct of Ukraine total wheat crop. West Ukraine could see rains next week but East Ukraine and most of Russia look to remain dry. USDA estimated that 20 pct of the US 2021 winter wheat crop is planted. Ok is 15 pct. MO and IL SRW has yet to start planting their crop. WA state is 49 pct planted. Some feel lower crops in the Black Sea could offer support to World 2021 wheat prices. Egypt bought 405 mt of Russian wheat. Prices were near $256. Previous prices were near $249. WZZ help support near Mondays low and the 20 day moving average. Open interest is going up. Funds were net buyers of 4,000 contracts and added to their 25,000 contract long.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.