Soybean, soyoil and wheat traded higher. Corn traded unchanged. US stocks were higher. US Dollar was lower. Gold was higher.

SOYBEANS

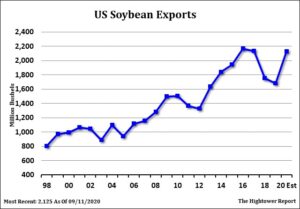

Soybean extended its summer rally on talk of continued US soybean sales to unknown and China and recent USDA drop of US 2020 crop and US 2020/212 soybean carryout. Managed funds added to their net soybean long. Despite lower palmoil prices funds also added to their net soyoil long. Soybean futures are overbought but momentum traders continue to add to their bullish bias. Weekly US soybean exports were near 47 mil bu versus 24 last year. Season to date exports are near 67 mil bu versus 45 last year. USDA goal is now 2,125 mil bu versus 1,680 last year. Today, USDA announced 318 mt US soybean sold to unknown. They also announced 129 mt soybean to China. One analyst estimates US final soybean yield near 52.5 versus USDA 51.9. This suggest a US 2020/21 soybean carryout near 495 versus USDA 460. Still, another analyst estimates US final soybean yield near 51.4 versus USDA 51.9. This plus higher demand suggest a US 2020/21 soybean carryout near 375. versus USDA 460. Trade expects USDA to keep weekly US soybean crop rating near 65 pct good/ex.

CORN

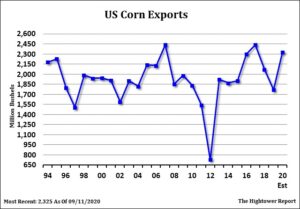

Corn futures traded unchanged. There is a battle near season highs between the supply bears and demand bulls. Fact China continues to buy US corn is supportive. It is also supportive that recent cold weather has slowed maturation of the US 2020 corn crop and could delay harvest. This is firming nearby basis and end users scrambling for supply. 2 week US Midwest weather should be favorable for maturation and start of harvest. USDA is expected to keep weekly US corn crop rating near 61 pct good/ex with harvest estimated near 5 pct done. Weekly US corn exports were near 34 mil bu versus 16 last year. Season to date exports are near 45 mil bu versus 35 last year. USDA goal is now 2,325 mil bu versus 1,765 last year. Today, USDA announced 140 mt US corn switched from unknown to China. They also announced 350 mt corn to China and 160 mt US corn to Japan. One analyst estimates US final corn yield near 179.5 versus USDA 178.5. This suggest a US 2020/21 corn carryout near 2,765 versus USDA 2,503. Still, another analyst estimates US final corn yield near 177.0 versus USDA 178.5. This plus higher export demand suggest a US 2020/21 corn carryout near 2,090. versus USDA 2,503.

WHEAT

Wheat futures managed small gains. There continues to be a debate between US Dollar bears and commodity bulls verso supply bears. Most feel wheat prices are overvalued and need to trend lower to find demand. Lack of farmer selling in Russia and continued dryness in the Black Seas has helped support prices near season highs. Fact USDA increased World supply on their last repot especially in export countries offers resistance. WZ trade back below the 200 day moving average but found support near the 20 day. Support is near 5.30. Resistance is near 5.70. Most suggest US farmers add to 2020 and 2021 cash sales. Weekly US wheat exports were near 23 mil bu versus 19 last year. Season to date exports are near 297 mil bu versus 276 last year. USDA goal is now 975 mil bu versus 965 last year. USDA raised World wheat end stocks 3 mmt to 319. This suggest wheat futures may be overvalued.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.