SOYBEANS

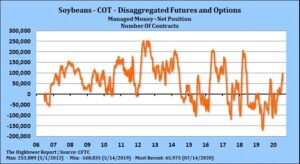

Soybeans trade lower. Soybean market has held recent gains due to pick up in China buying US soybeans. Most of the buying is new crop. Some fear that if they do not keep buying prices might turn lower. Old saying, you have to feed a bull market twice a day but only a bear market once a month. Talk of higher US 2020 soybean yields offers key resistance near critical price levels. Managed funds have been buyers 2,000 soymeal and sellers of 2,000 soyoil and 3,000 soybeans. Managed funds are net short 23,000 soymeal and long 91,000 soybeans and 20,000 soyoil. US Midwest temps should warm up this weekend. First part of next week rains could fall across parts of ND, MN and IL. Midwest temps should moderate. Late next week rans could fall across NE, IA, MO, IL and IN. Soybean futures this week are only up 5 cents. Talk that US soybean yield may end up higher than USDA last estimate is weighing on prices. Recent China buying US new crop soybean offers support. US farmer continues to be a reluctant seller of supplies. Brazil, Argentina and Russia farmers are also slow sellers of supplies.

CORN

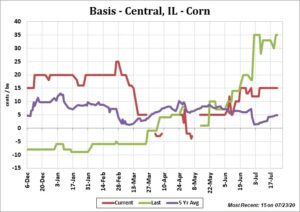

Corn futures were mixed. Futures put more of a carry in values. Some link this to talk of higher US supplies. Managed funds were sellers of 2,000 corn. Managed funds are net short 124,000 corn.US Midwest temps should warm up this weekend. First part of next week rains could fall across parts of ND, MN and IL. Midwest temps should moderate. Late next week rains could fall across NE, IA, MO, IL and IN. Corn futures were down 3 cents this week on low volume. Talk that US corn yield may end up higher than USDA last estimate is weighing on prices. Recent China buying US new crop corn offers support. US farmer continues to be a reluctant seller of supplies. This also helps basis levels. International Grain council lowered their estimate of World corn production 12 mmt to 1,164. Thus due to drop in US crop acreage. They increased the Ukraine crop 3 mmt to 37 mmt. US export prices remain high. Big unknown is how much US corn China will buy. There remains concern that World feed and fuel demand may drop due to Covid.US Congress is debating new stimulus package. House version is $3.4 trillion. Senate version is $1 trillion. Both would add funding to CCC and focus on dairy, poultry, meat and specialty crops.

WHEAT

Wheat futures traded higher. On again off again wheat trade due in part to talk of lower Europe and Russia supplies and higher futures there versus fears Covid will reduce global wheat import demand and overall food demand. U.S. All Wheat export sales are running 5% ahead of a year ago, shipments up 1% with the USDA forecasting a 2% decline on the year. The International Grains Council (IGC) cut its global wheat crop forecast by 6 million tons to 762 million tons with production in the EU downwardly revised to 125.6 million tons versus a previous projection of 128.4 million. Russia’s wheat crop was seen at 78 million tons, down from a prior projection of 79 million. Paris wheat futures were higher. Russia Black Sea futures were also higher. United States was expected to produce 49.6 million, down from 51.1 million seen previously. Managed funds were buyers of 7,000 wheat. Managed funds are net short 2,000 wheat.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.