Soybeans, soymeal and wheat treaded higher. Corn and soyoil traded lower. US stocks were lower. US Dollar was lower. Gold, silver and copper were higher.

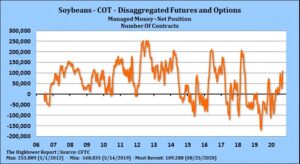

SOYBEANS

Soybean trade was mixed. Talk of lower US supply and a dry US west Midwest weather forecast offered support. Large Funds net long, Slow US weekly exports and forecast of rains in the east over the next week offered resistance. Increase US farmer selling and aggressive new crop Brazil farmer selling also offers resistance. Trade estimates US soybean rating near 66 pct good/ex versus 69 last week. Weekly US soybean exports were near 29.5 mil bu versus 47.4 last year. 2019/20 marketing year is over. Season to date exports are near 1,584.6 mil bu versus 1,680.6 last year. USDA goal is 1,650 versus 1,752 last year. USDA 2020/21 goal is 2,125. Trade estimates US July soybean crush at a record 183.0 mil bu and previous record in 2019 of 179.4. In August, USDA estimated US harvested soybean acres near 83.0 and yield near 53.3. Most doubt acres will drop but yield could be closer to 52.0. This could drop production 100 mil bu. Bears are adding to 2020/21 carryin and taking 2020/21 demand down but 2020/21 carryout could be closer to 510 than USDA current guess of 610.

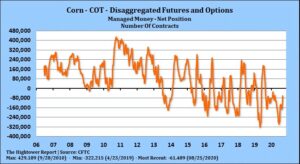

CORN

Corn futures traded lower and erased the overnight gains. Dry west US Midwest weekend weather and a dry 7 day forecast offered support. Slow US weekly corn exports and talk of a wetter US east Midwest forecast for next week offered resistance. Noon US weather maps continue to call for drier than normal US west Midwest weather next week. Trade estimates US corn crop rating near 61 pct good/ex versus 64 last week. Weekly US corn exports were near 15.8 mil bu versus 14.0 last year. 2019/20 marketing year is over. Season to date exports are near 1,640.4 mil bu versus 1,857.0 last year. USDA goal is 1,795 versus 2,066 last year. USDA 2020/21 goal is 2.225. USDA announced 596 mt US corn was sold to China for 2020/21 marketing year. Next USDA report is Sep 11. In August, USDA estimated US harvested corn acres near 84.0 and yield near 181.8. Some feel acres could be down 500 t and yield closer to 178. This could drop production 415 mil bu. Bears are adding to 2020/21 carryin and taking 2020/21 demand down. This could suggest a carryout near USDA current guess of 2,756.

WHEAT

Wheat futures traded higher. Wheat continues to follow higher trade in grains, energies and metals. Some link the wheat rally also to higher EU and Russia prices. Higher prices there due to lack of farmer selling. WZ made new highs for the move and highest level since April. Resistance is near 5.70 with support near 5.40. Futures are overbought. KWZ traded above the 200 day moving average. 5.00 is next resistance. 4.60 is support. MWZ tested the 200 day moving average. 5.50 is next resistance. 5.30 is support. Weekly US wheat exports were near 18.9 mil bu versus 20.5 last year. Season to date exports are near 247.8 mil bu versus 242.4 last year. USDA goal is 975versus 965 last year. USDA continues to estimate World 2020/21 wheat crop near 766 mmt versus 764 last year. Exports are estimated near 188 mmt versus 190 last year. This estimate could be high given impact Covid has had on demand. USDA estimates World end stocks near a record 317 mmt. This limits the upside in prices.

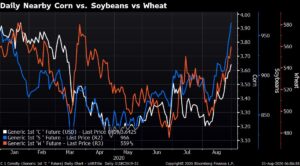

2020 nearby corn, soybean and Chicago wheat futures chart

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.