Soybeans, soymeal and soyoil traded lower. Corn and wheat traded higher. US stocks were higher. US Dollar traded lower. Crude traded higher. Gold traded higher.

SOYBEANS

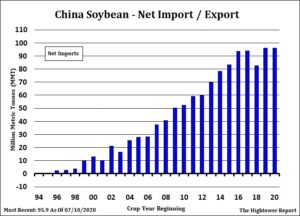

Soybeans traded lower. Some link the lower traded to lower China prices and concern China may not buy as much soybean as hoped. There may have also been some selling of soybean and buying corn and wheat. Nov soybean traded below initial support which could signal additional weakness technically. Weekly US soybean export sales is estimated near 200-550 mt old crop versus 257 last week and 600-1.200 mt new crop versus 3,344 last week. Food and Ag Commodity Economics estimated US 2020 soybean crop near 4,355 mil bu versus USDA 4.135 and Stones estimate of 4,496. They also estimated World 2020 crop near 371 mmt versus USDA 362. There is still concern that final US crop will be larger and increase the carryout over USDA 425. Central US Midwest could see rains August 10-18. July Brazil soybean exports were a record 10 mmt. Season to date exports are 69 mmt. 71 pct of Brazil soybean exports were to China.

CORN

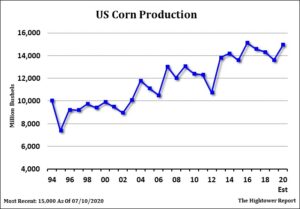

Corn traded slightly higher. Corn managed small gains due to fact prices may be oversold. Yesterday, Managed funds were big sellers of corn futures with open interest going up. This could suggest new short positions at contract lows. Corn futures tend to make lows in September. This week USDA suggested that most of the crop was silking and ahead of average. This could suggest an early harvest. Central Midwest could see warmer temps this weekend. Next week the central Midwest could see normal rains. Food and Ag Commodity Economics estimated US 2020 corn crop near 15,036 mil bu versus USDA 15,000 and Stones estimate of 15,320. They also estimated World 2020 crop near 1,159 mmt versus USDA 1,163. There is still concern that final US crop will be larger and increase the carryout over USDA 2,648. Weekly US ethanol production was down from last week and last year. Stocks were unchanged from last week but down from last year. Margins are a little negative. Deferred margins are negative. Margins turn negative if CZ trades over 3.30. Weekly US old crop export sales are estimated near 100-600 mt versus -29 last week and new crop 2,000-2,600 mt versus 638 last week.

WHEAT

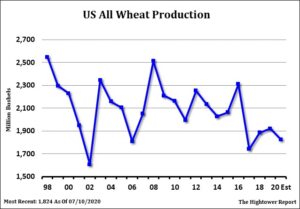

Wheat futures managed small gains. WU is back testing support near 5.00. Some feel key support is near 4.75-4.80. KC support could be near 4.05-4.10. Talk of higher Russia winter wheat yields has pushed US futures lower. Wheat futures tend to make bottoms in late September. Food and Ag Commodity Economics estimated US 2020 all wheat crop near 1,843 mil bu versus USDA 1,824. They est HRW near 712 versus 833 last year, SRW 280 versus 239 last year and spring wheat near 558 versus 563 last year. They estimated World wheat crop near 759 mmt versus 769 last year. They lowered EU crop 5.5 mmt. They increased Canada wheat crop 1.4 mmt to 35.6. They dropped Argentina wheat crop .8 mmt to 20.0. Argentina needs a rain. Weekly US wheat export sales are estimated near 200-800 mt versus 676 last week. US HRW export prices remain $10 above Russia prices.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.