AFTERNOON COMMENTS

Spread breakdown. Cattle hitting record highs, and dryness creeps into the eastern corn belt.

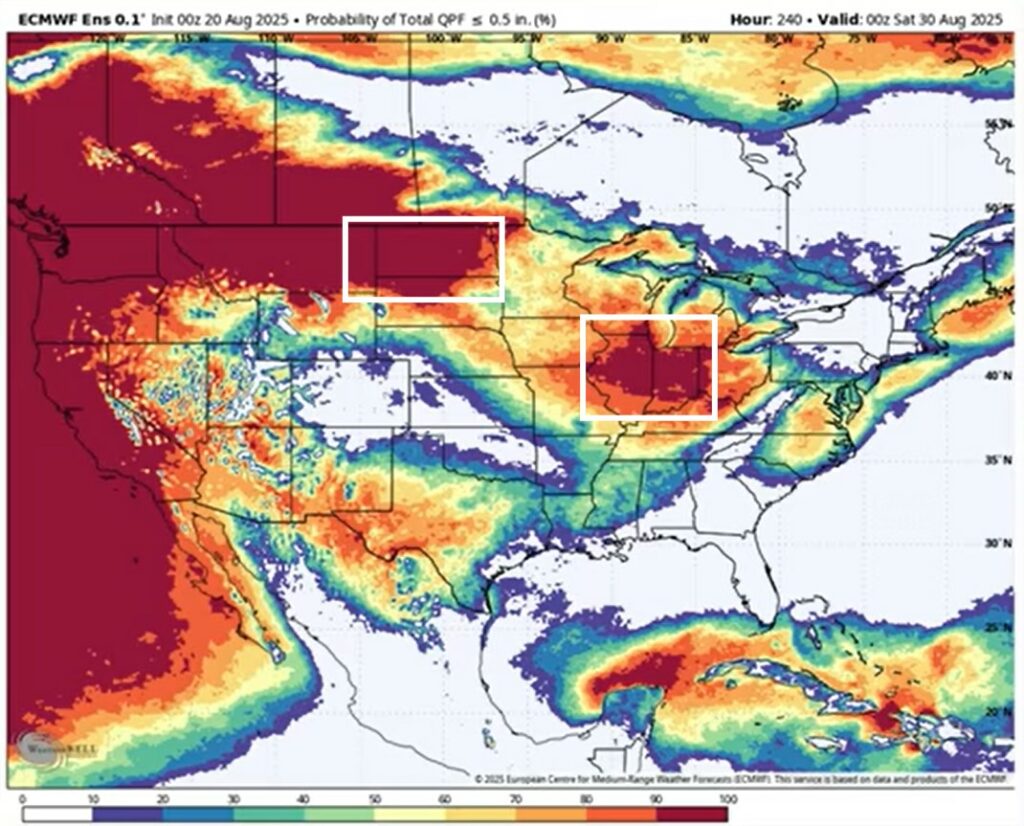

The Probability of Less Than 1/2 inch of Rain will almost certainly be the case within the two white boxes below. So expect producers in these areas to start to talk about dryness and yield drag.

September Feeder Cattle (White) and Bitcoin (Red) Both assets have been on historic runs. I just thought these two charts looked interesting next to each other. Sep Feeder Cattle is up 46% from October lows, while Bitcoin is up 91% in the same time. Folks have been trying to call the highs in both.

Nearby Spreads

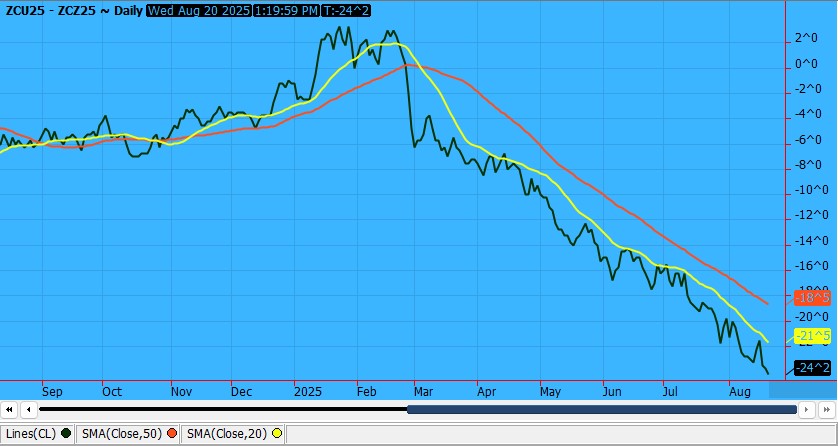

The U5-Z5 Corn Spread (-24¢ carry) Is now stretching down to 80% full carry, using 6.1% interest rate. This is due to both farmers having more than expected old crop and no real threat to early corn harvest pace in the forecast. Corn exports are solid with another 1M bu sale to Mexico yesterday and another 225K MT of corn flashing across this morning to Mexico and Colombia.

The X5-F6 Soybean Spread is now trading above 70% full carry (using 6.1% interest rate). Folks using 8.25% would say the X/F spread is only at 63% full carry. The silence from China is loud when looking at this chart. Soybean crush has recently exceeded expectations, but China typically makes up for about 20% of the US soybean demand.

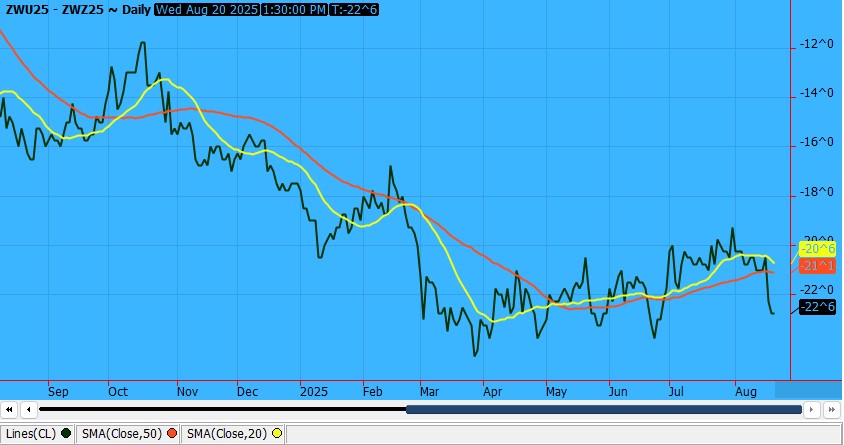

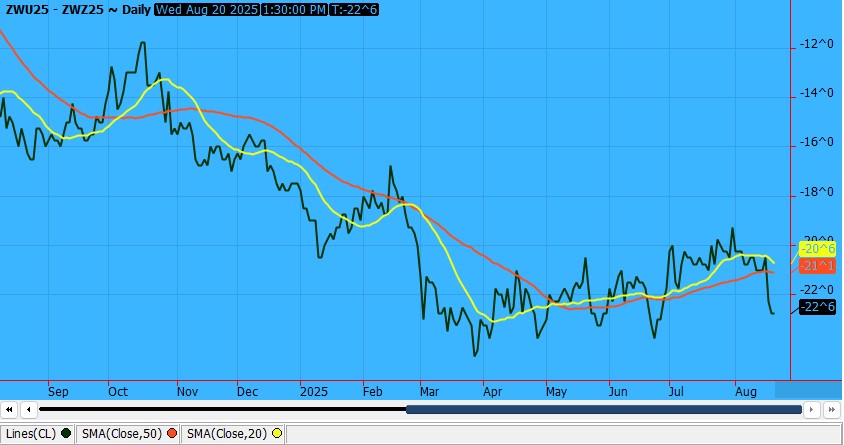

The U5-Z5 Chicago Wheat Spread is retesting lows again, closing at -22’6¢ carry. That is nearing 90% full carry. SRW harvest is nearing 100% complete and farmers are not allowing wheat to take up space they will need for corn and beans in the next 40-60 days.

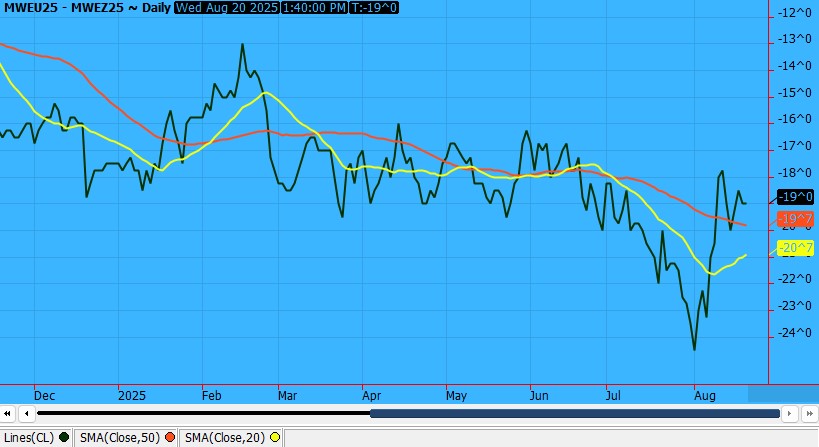

The Minneapolis Wheat U5-Z5 Spread may weaken back out to -22¢ if harvest pace picks back up. North Dakota got another shot of rain on Sunday that slowed farmers down, but they were able to get back out in the fields yesterday and today to regain time. They should not get another douse of rain for at least a week.

Kansas City Wheat U5-Z5 Spread

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.