OPENING COMMENTS

Ag Fundamentals: Argentina’s export taxes are back. 48 hours is all it took for China to help Argentina meet their goal of $7 billion in export sales. China is rumored to have bough between 28-42 cargoes of Argentina soybeans. This happened while the US treasury is planning to swap $20 billion of US bonds with Argentina Pesos to help stabilize their currency exchange. US Treasury Secretary Scott Bessent met with President Trump and Argentina President Javier Milei yesterday. The Argentinian peso has lost about 30% of its value vs. the US dollar in 2025. This purchase by China may allow them to wait well into November before their first large purchase of American soybeans. The Quarterly Grain Stock report is out at 11:00am CST on Tuesday September 30th.

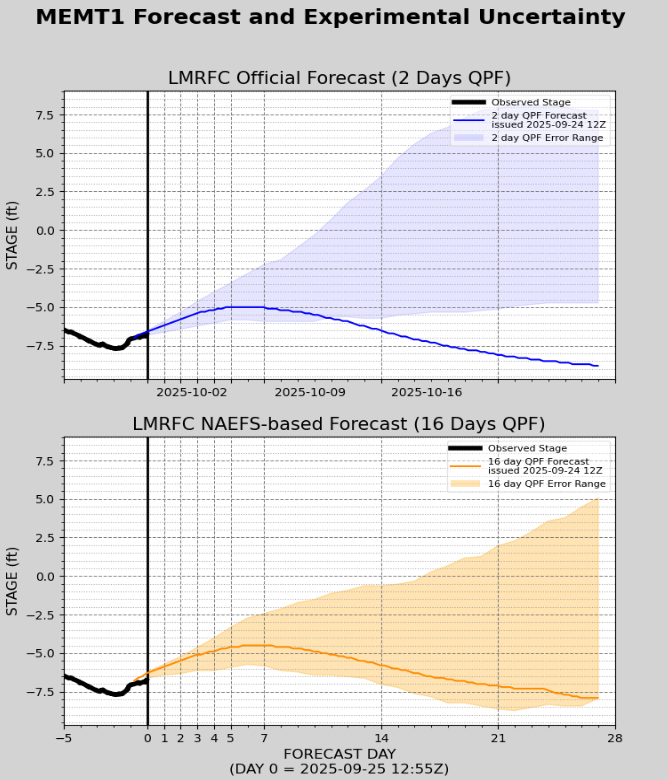

River Levels on the Mississippi at Memphis are expected to rise 2.5 ft. At -5 feet on the river gauge facilities there can load between 10’0-11’0 ft drafts. Still not fully loaded, but an improvement from the last week.

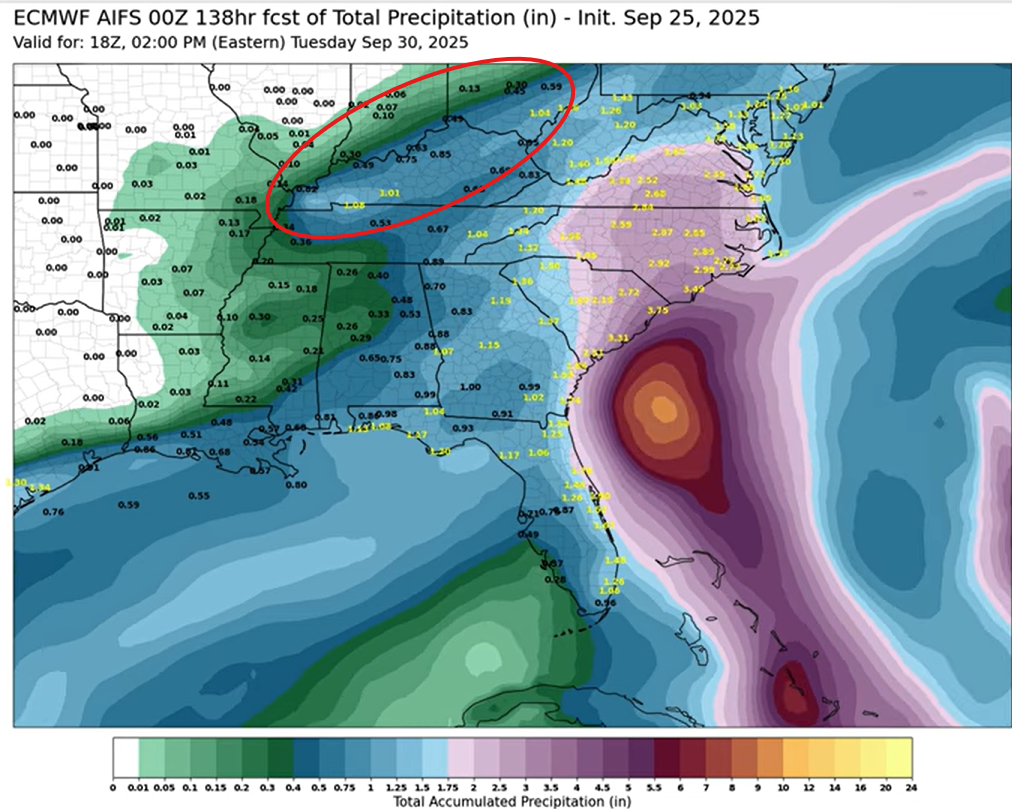

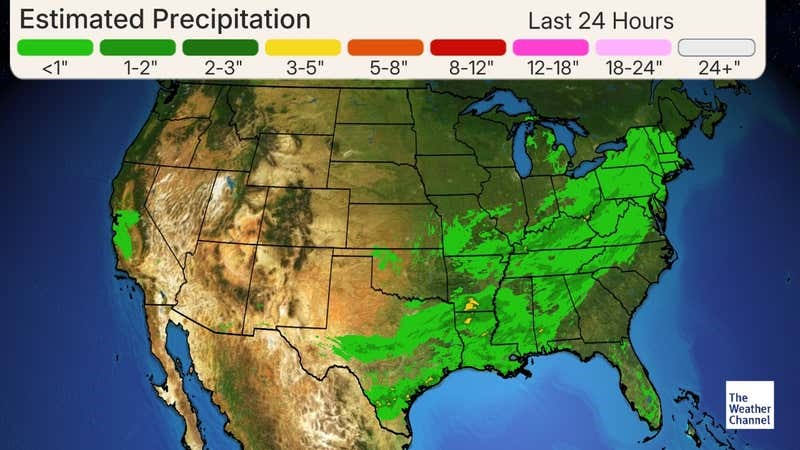

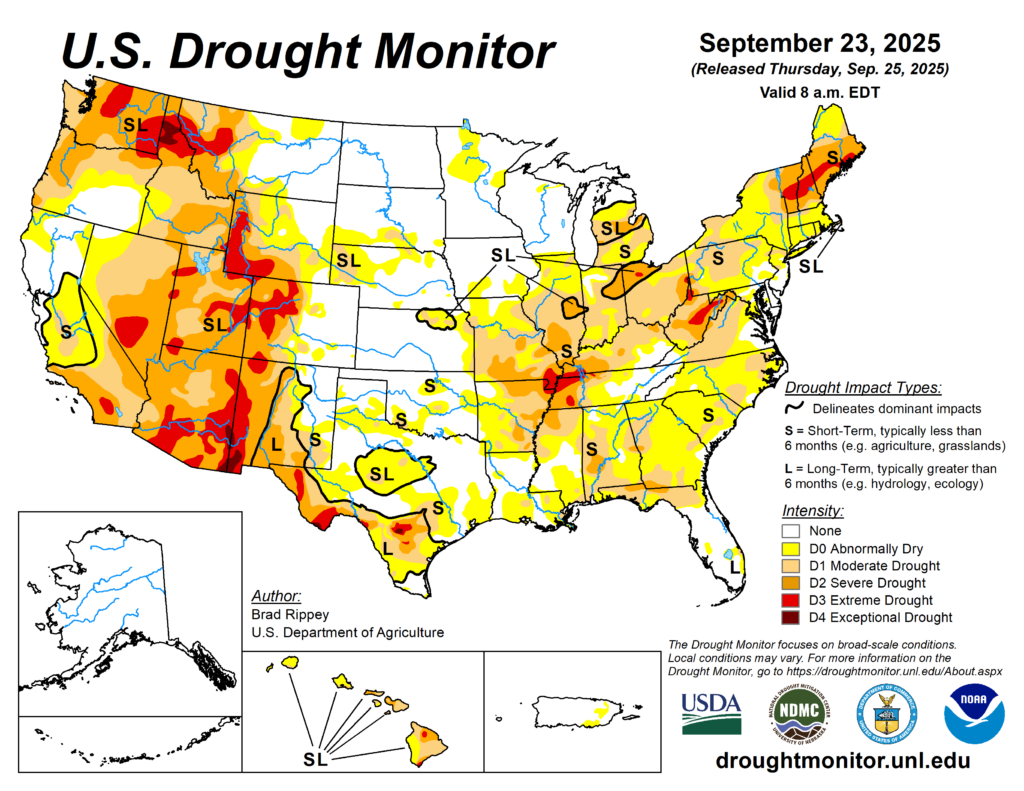

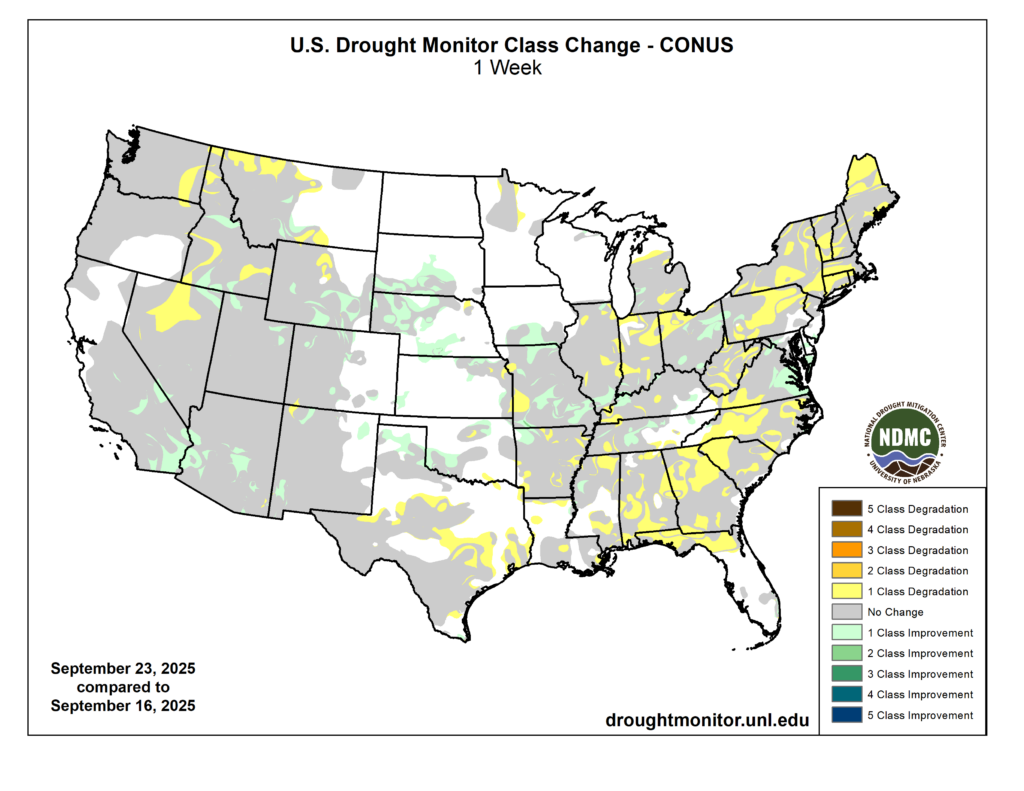

Not Much Rain in the Right Places

The tropical storms off the east coast are not turning up the gulf. This is the expected Precip in inches now through the end of September. The Ohio River Valley is only expected to see 1 inch at the most in some areas.

Weekly Export Sales

|

Export & World News

|

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.