|

Spreads at the Close (6.1% int rate)

Spread | Last | Chg | Full | % of FC |

CU25/CZ25 | -20 3/4 | – 3/4 | -30 | 68% |

CZ25/CH26 | -18 | – 1/4 | -29 1/2 | 61% |

CH26/CK26 | -10 3/4 | – 1/4 | -20 1/4 | 53% |

SX25/SF26 | -18 1/4 | 1/4 | -26 1/4 | 70% |

SF26/SH26 | -16 1/2 | 0 | -25 | 67% |

SX25/SN26 | -61 | 3/4 | -104 | 59% |

MWU25/MWZ25 | -22 | 1 | -29 1/2 | 75% |

WU25/WZ25 | -20 1/4 | 0 | -22 3/4 | 89% |

KWU25/KWZ25 | -20 3/4 | – 1/4 | -22 3/4 | 91% |

Sep/ Dec Corn Spread (-20'4 ¢)

The Delta crop and mid-south production will continue to put pressure on this spread. Currently hovering near 68% full carry. The US farmer still holds 5-8% of their old crop corn in the bin and basis levels have dropped slightly alongside the board in the last 10 days. Dec corn was able to steer clear of dropping below $4 for now.

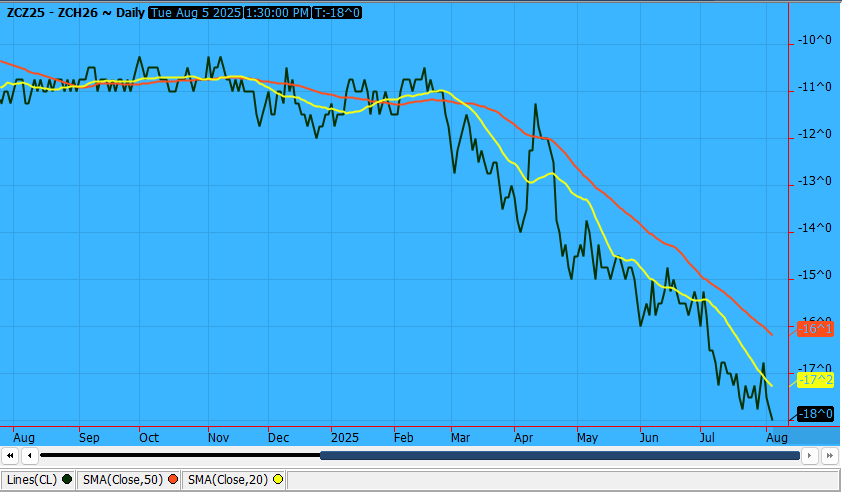

Dec/March Corn Spread (-18¢)

How low can the Dec/March corn spread go? -25’2¢ would be 85% full carry. Currently this spread closed at it’s contract low today at 61% of full carry. Anything above a 184 bu/acre yield on the WASDE report would suggest a record production of over 16 billion bushels.

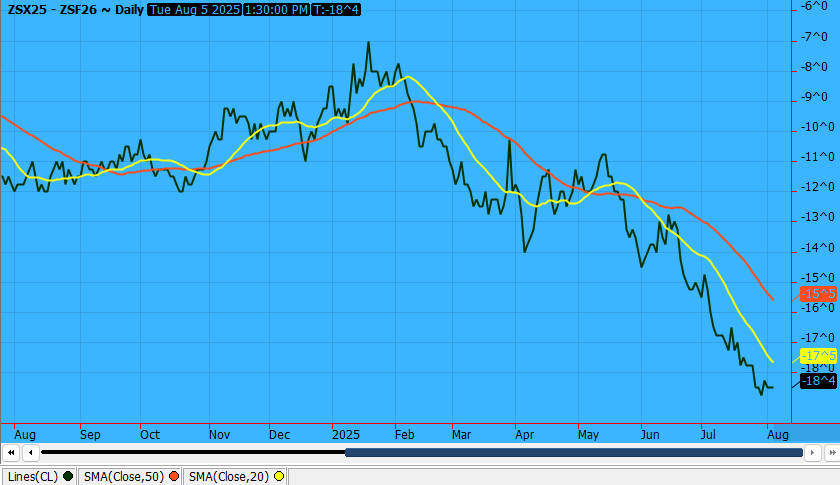

Nov/ Jan Bean Spread (-18'4 ¢)

The Nov/Jan bean spread is currently trading near 70% full carry. 85% full carry would be down near -22’5¢. Despite a tightfisted Brazilian farmer, China is content buying their more expensive beans. As South America continues to satisfy the worlds largest buyer, our production seems to look better and bigger.

Jan/July Bean Spread (-42'6 ¢)

At 59% full carry, the Jan/July bean spread could have more downside pressure if a yield above 53.5 bu/acre yield is confirmed. Estimates of another record 140 MMT Brazilian crop has been thrown out there already for next year. 85% full carry would be near -88’4¢. Expectations are that new domestic demand will make up for the potential lack of export business.

Sep/ Dec Chicago Wheat Spread (-20'2 ¢)

Winter wheat harvest is over 87% complete. Montana and South Dakota are 7-10% behind the 5-year harvest pace, but Idaho Washington are making up for it. Some rains have cause slight delays and possibly lighter test weights, but overall we are near the 5-year harvest pace and farmers will begin to run out of wheat space soon. Currently at a 89% full carry, the Sep/Dec needs to see more than just scattered rains to disrupt grain flow as harvest wraps up. Additionally, farmers and elevators alike will need to clear space for a large corn and bean crop.

Dec/ March Chicago Wheat Spread (-19 ¢)

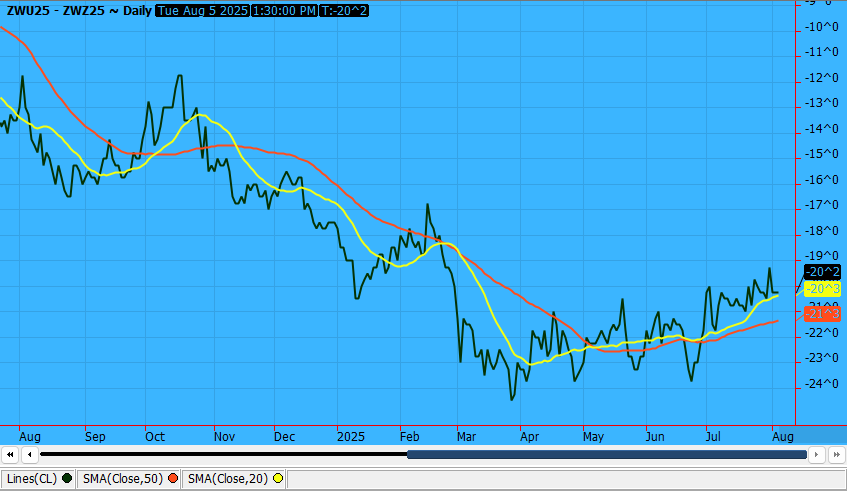

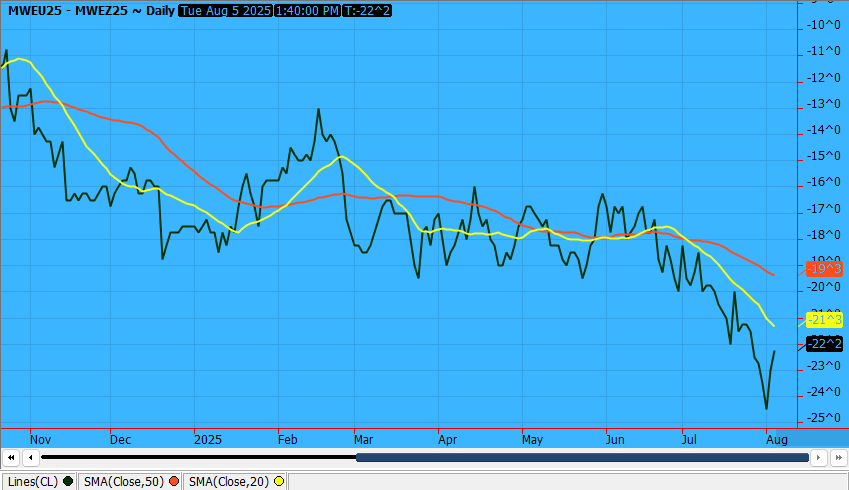

Sep/Dec Spring Wheat Spread (-22'2 ¢)

Spring wheat harvest is over 5% complete, but behind the 5-year average of over 9% at this time. Rain is moving across North Dakota today, slowing pace even further. This may be why we saw some recovery from the contract lows today, and this spread is still sitting near 75% full carry. We snapped back up from hitting over 80% full carry to start the month of August. South Dakota is 17% behind the 5-year average harvest pace at 23% harvested as of Sunday.

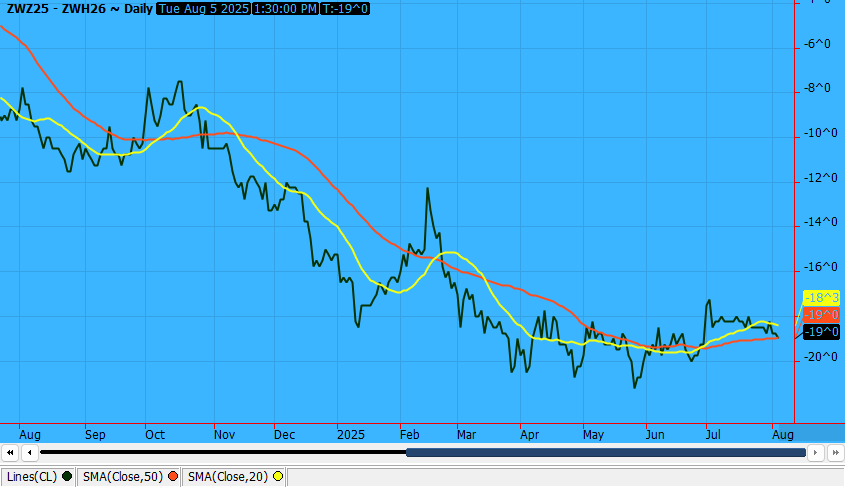

Dec/March Spring Wheat Spread (-22'2 ¢)

The Dec/March spring wheat spread hit contract lows today. As harvest progresses, the overall condition numbers have declined. 48% good/excellent is a 4 week low. Last year we were at 74% good/excellent at this point in the year.

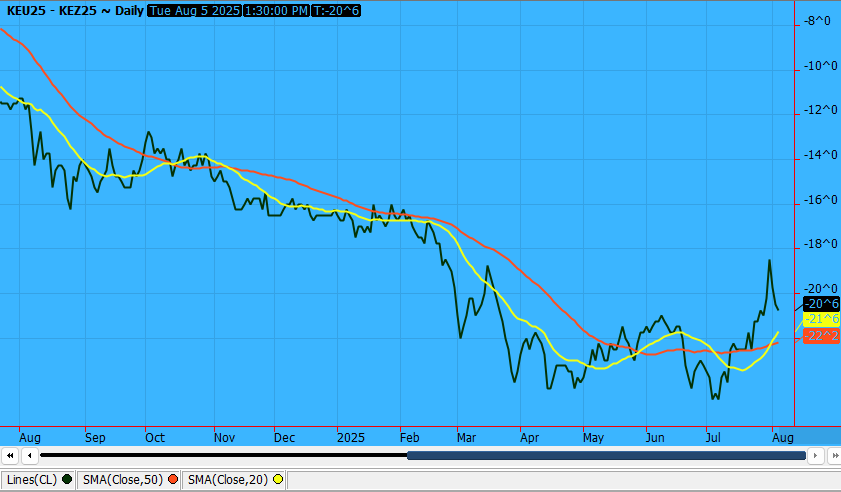

Sep/Dec KC Wheat Spread (-21'4 ¢)

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.