AFTERNOON COMMENTS

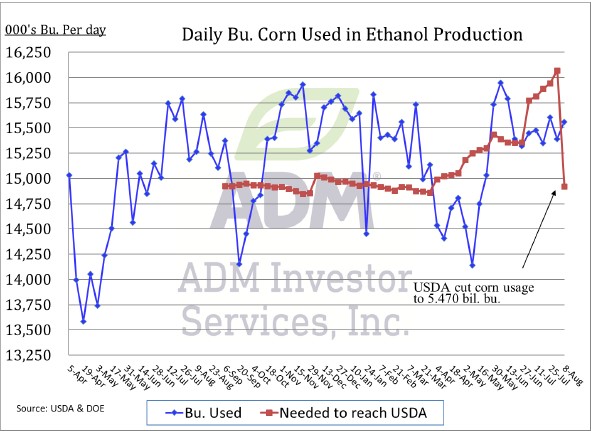

Weekly Ethanol Production for week ending 8/8 was at 1.093 million barrels/day. The USDA lowered old crop corn usage for ethanol from 5.5 billion to 5.47 billion bu. This dropped the necessary bu/day used from over 16K to below 15K bu/day. On the other hand, the USDA raised corn usage expectations for 2025/2026 crop from 5.5 billion to 5.6 billion bushels.

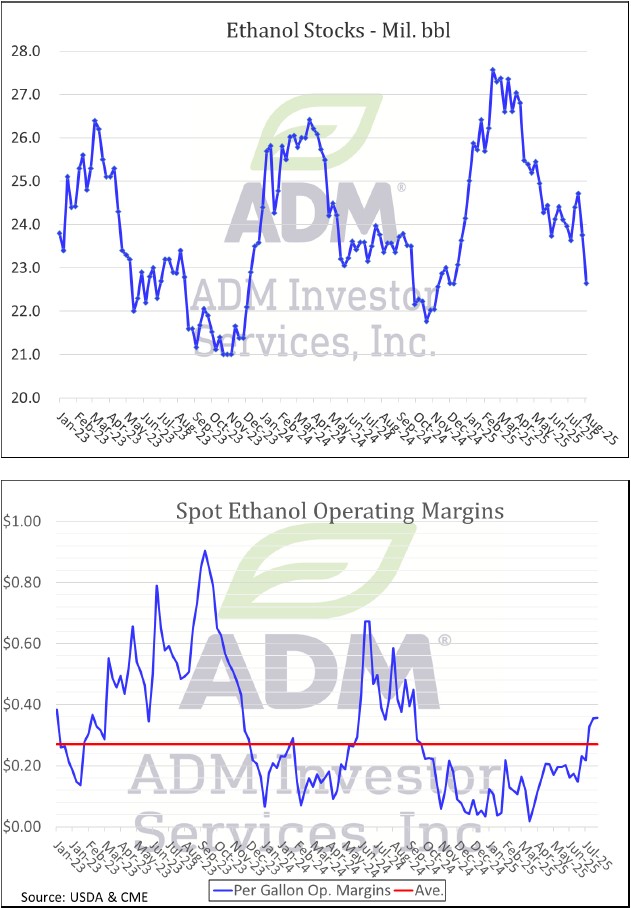

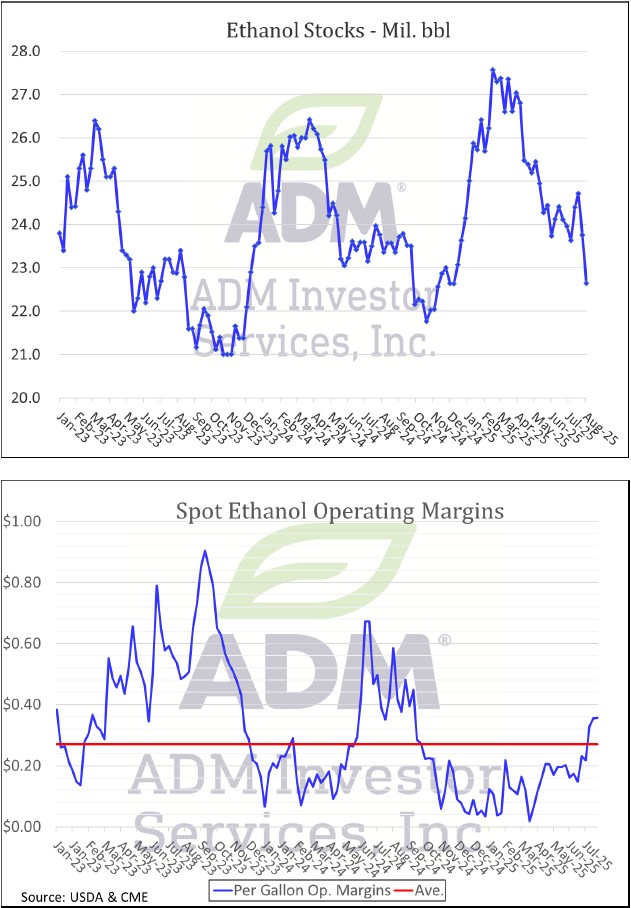

Ethanol Stocks slipped further to 22.65 million barrels while margins remain strong. In this margin environment, processors are not needing to pay up for old crop corn because there has been enough flowing to the market from farmers emptying bins.

Spread Chatter

The SX5-SF6 Spread is now sitting at 75% full carry (-19’6). Despite -2.5 million fewer acres and -43 million bushels less production. Nearby demand needs to come in the form of heavier biofuel blends or China stepping into the batter’s box.

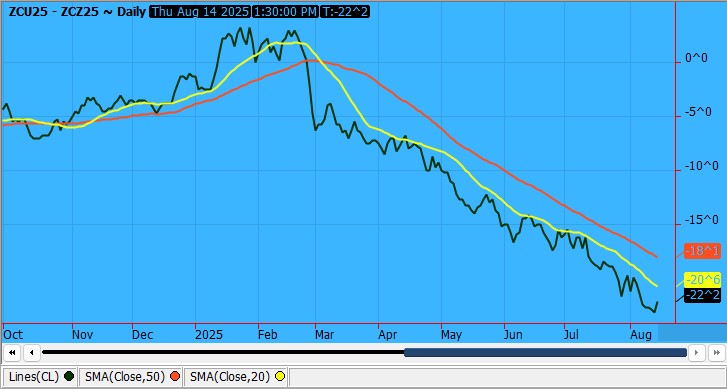

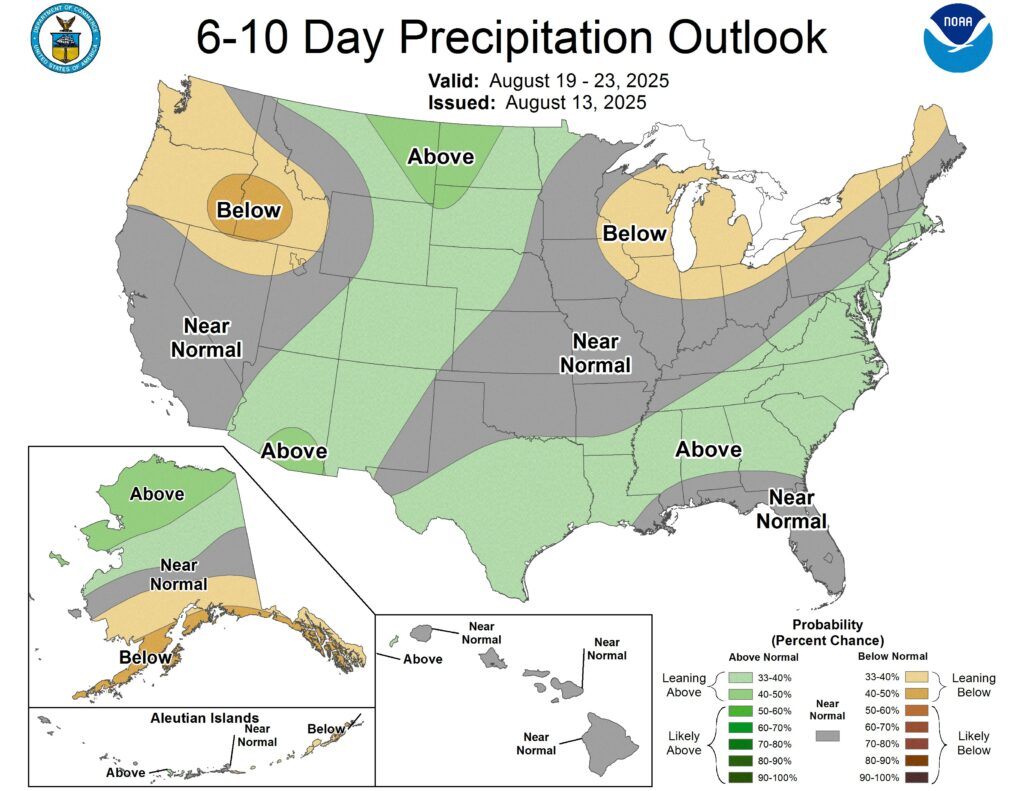

The CU5-CZ5 Spread firmed a penny today, but still remains at a 75% full carry. It seems there is more corn out there in the country from the last crop to comfortably bridge the gap between old and new crop. Recent dryness in the mid-south should allow for harvest progress to keep pace without fear of disruption.

Spreads

Spread | Last | Chg | Full | % of FC |

CU25/CZ25 | -22 1/4 | +1 | -29 3/4 | 75% |

CZ25/CH26 | -16 3/4 | +1 | -29 1/2 | 57% |

CH26/CK26 | -10 1/2 | +1/4 | -20 1/4 | 52% |

SX25/SF26 | -19 3/4 | -1 1/4 | -26 1/2 | 75% |

SF26/SH26 | -15 | -1 1/2 | -25 1/4 | 59% |

SX25/SN26 | -54 3/4 | -5 | -105 1/2 | 52% |

MWU25/MWZ25 | -20 | -1 | -29 1/2 | 68% |

WU25/WZ25 | -21 | 0 | -22 3/4 | 92% |

KWU25/KWZ25 | -21 3/4 | – 1/2 | -22 3/4 | 96% |

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

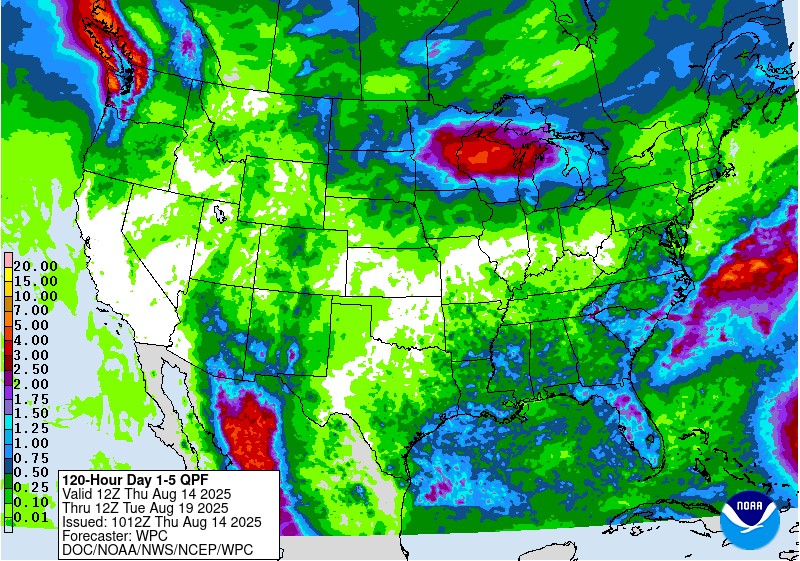

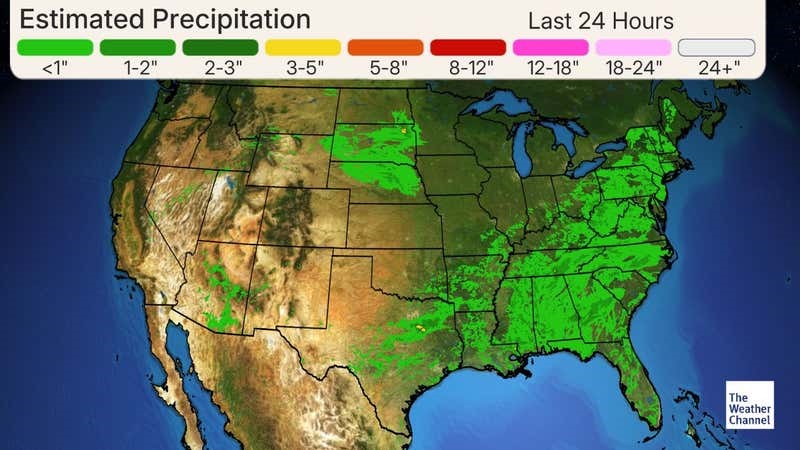

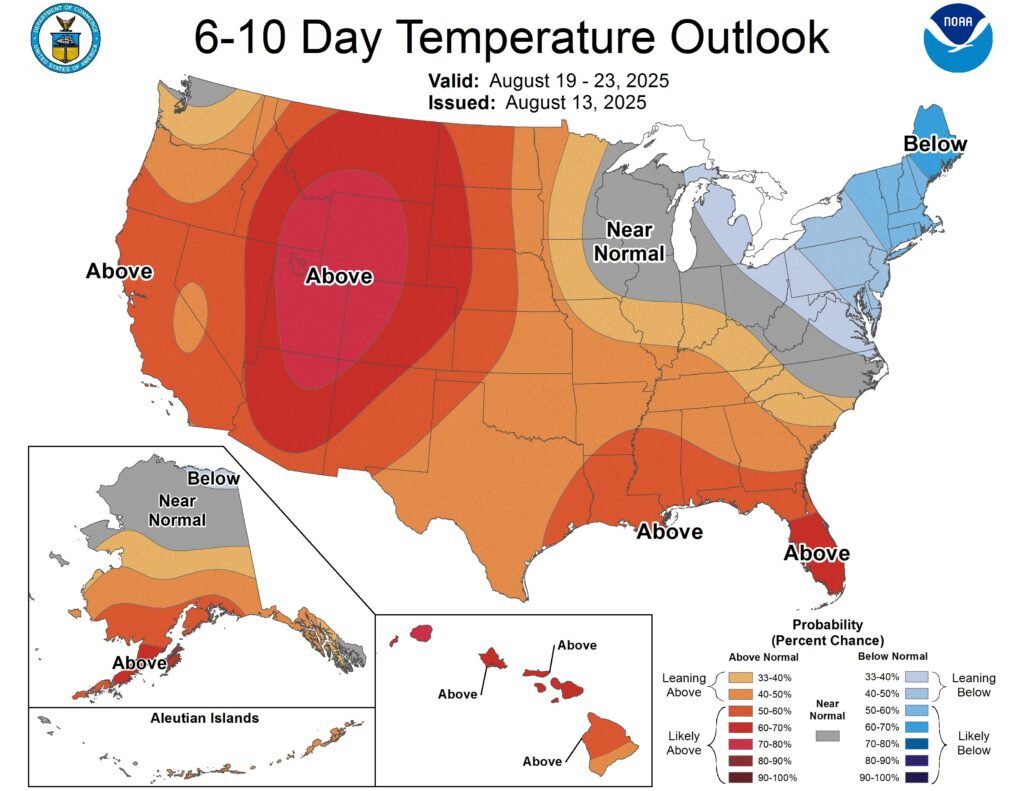

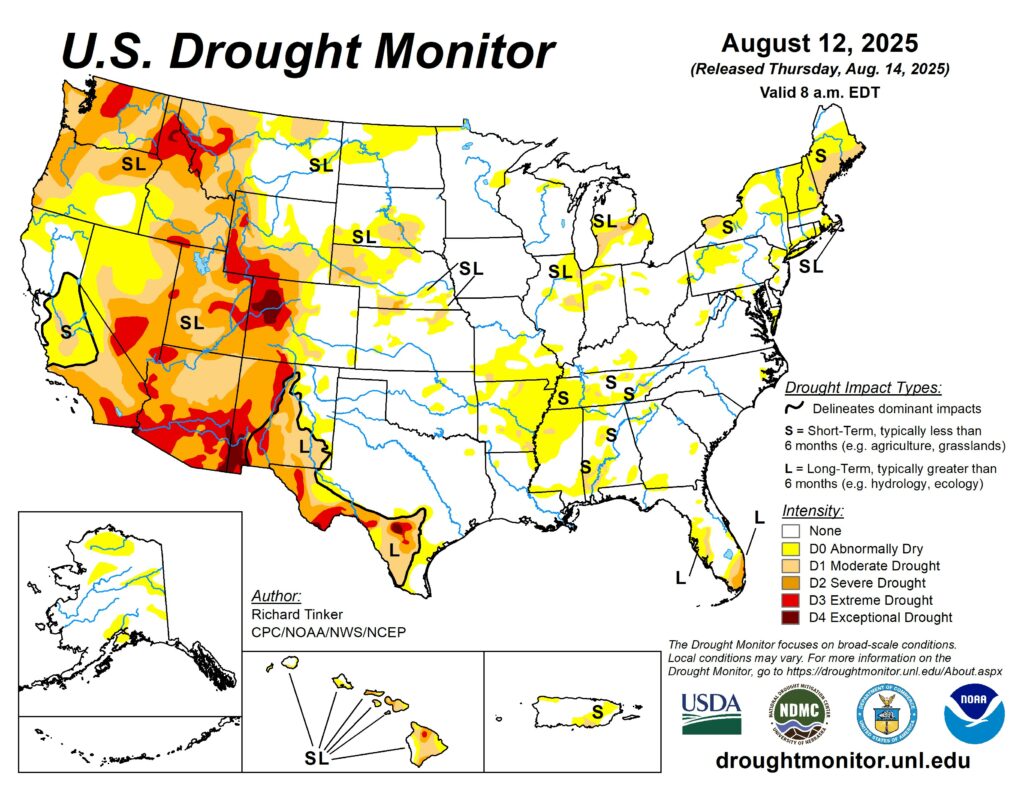

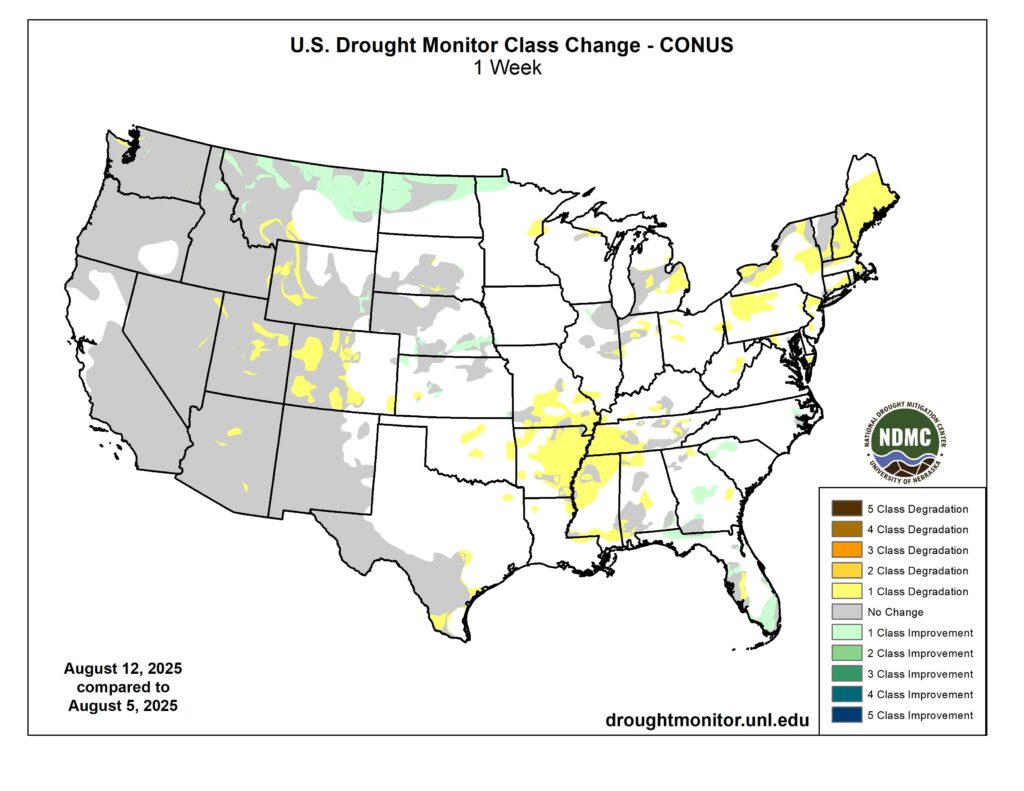

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.