OPENING COMMENTS

Geopolitics:

The “Big Beautiful Bill” was passed and signed into law over the holiday weekend. This was a big win for Republicans and President Trump. Some of the main agriculture changes as a result of this bill: $10 billion in tax cuts to farmers and ranchers, up to 2 million farmers will not be subject to the inheritance tax, and through reference prices an additional $3.8 billion in income for the agriculture industry. Education funding and pulling some stoppers off the energy sector will also promote businesses in rural communities.

Ag Fundamentals:

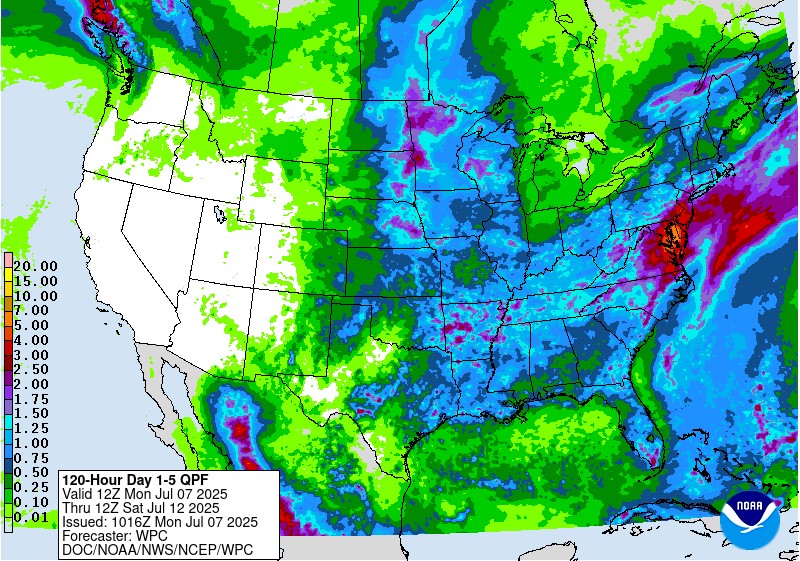

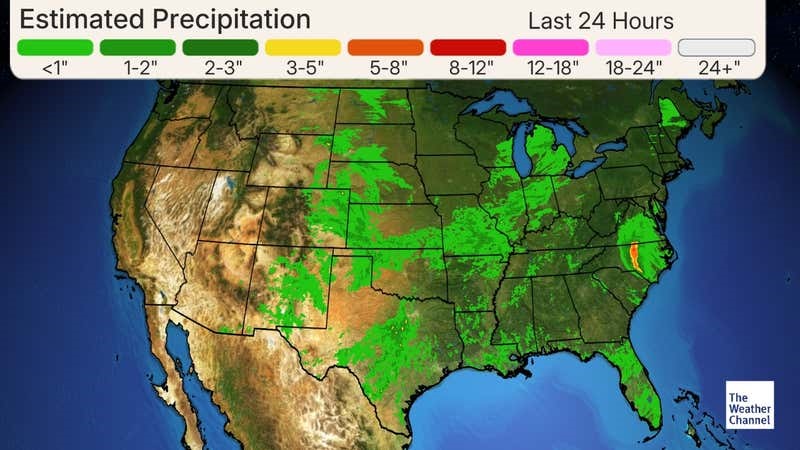

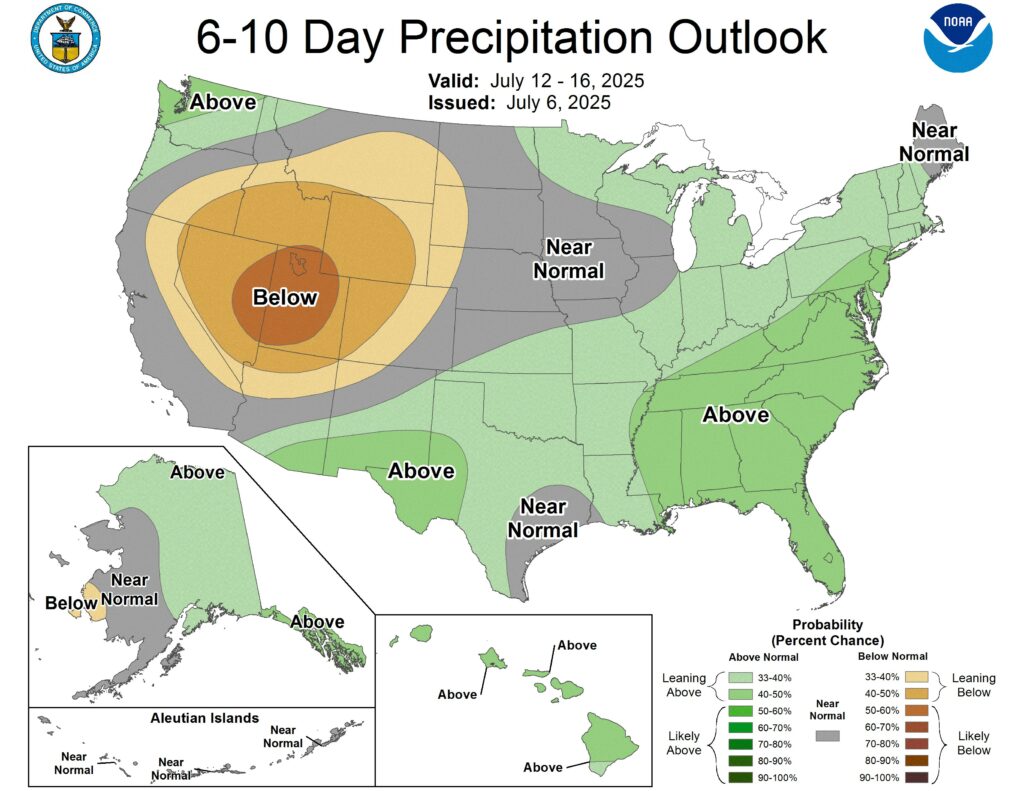

President Trump did not announce any new trade deals over the weekend. Rumors of Trump delivering good news to Iowans gave life to the row crop markets last week. We have gaped lower this morning due to the fact that it could be weeks or months before a deal is struck. Particularly with China. The “reciprocal tariff” deadline is on July 9th. The market is expecting to see some flexibility to the deadline depending on the other nation’s willingness to negotiate. August 1st is the likely push back date. Which means there could be two market movers before any deal with China is struck: the WASDE on Friday, and the Fed meeting at the end of July. The USDA will release the July WASDE at 11:00am CST on Friday July 11th. In the last 15 years the USDA has only changed US yields twice from June to July and they were lower both times. Despite a near record corn export program an better than normal usage for ethanol, the US and global supply of corn is keeping a cap on prices. Odds are that the USDA increases Brazil’s corn production and possibly bean production as well. The next 7 days offers the US growing regions between 1 and 3 inches of rain. After this week’s WASDE we may only need to see one more rain event to call this crop done.

Export & World News

Jordan issued an international tender to buy up to 120K MT of milling wheat for 25/26 marketing year. South Korea is in the market to buy up to 60K MT of soybean meal from either the US or South America.

Malaysian palm oil futures were up 8 ringgit overnight, now at 4070.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

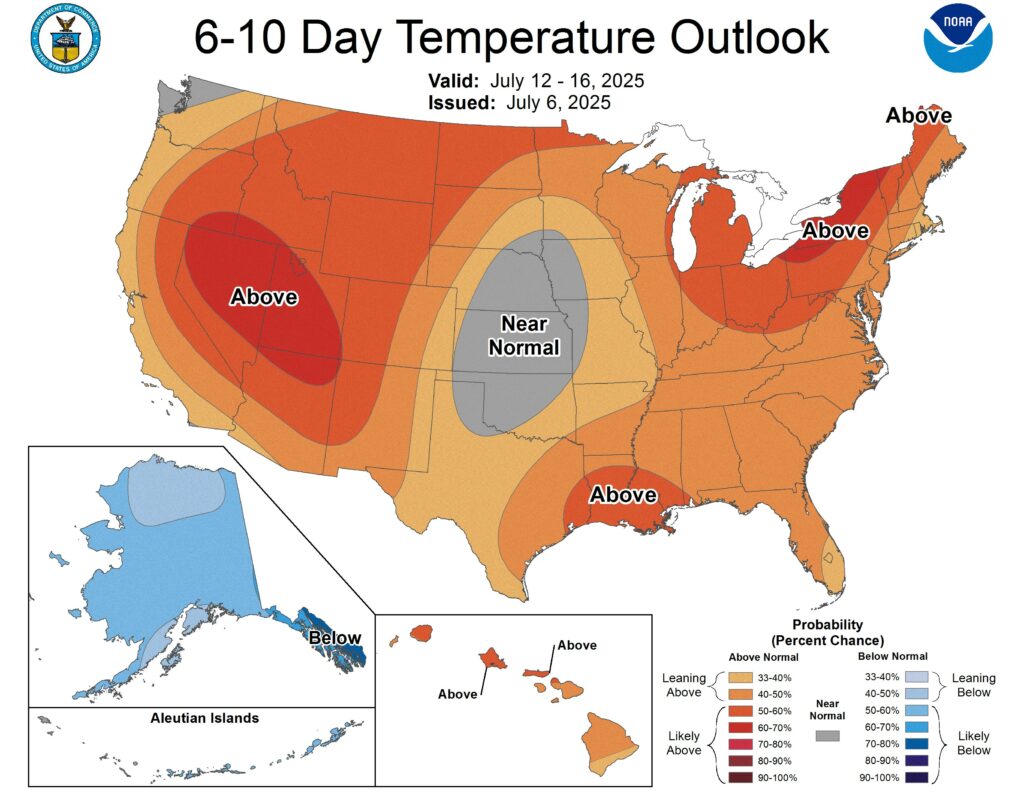

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.