OPENING COMMENTS

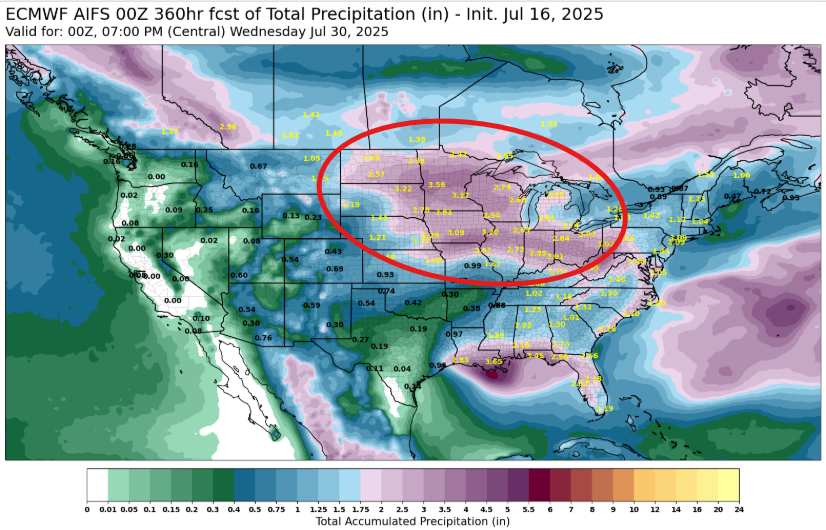

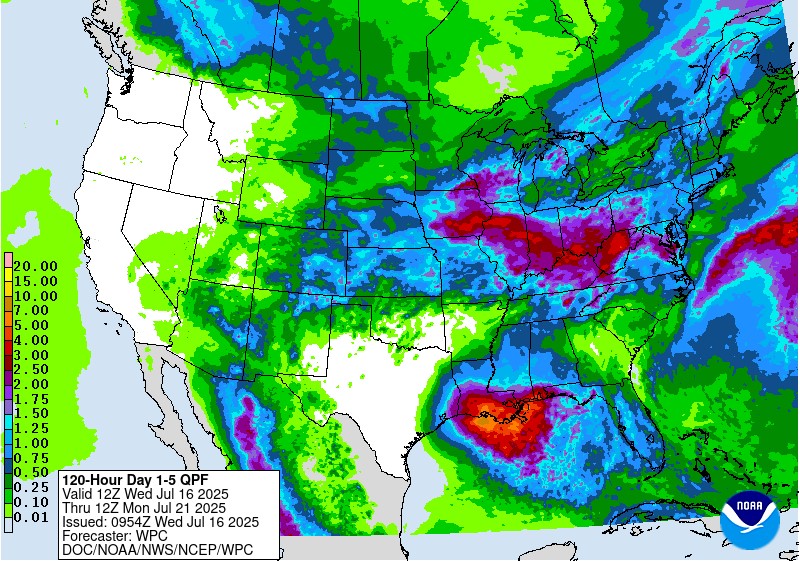

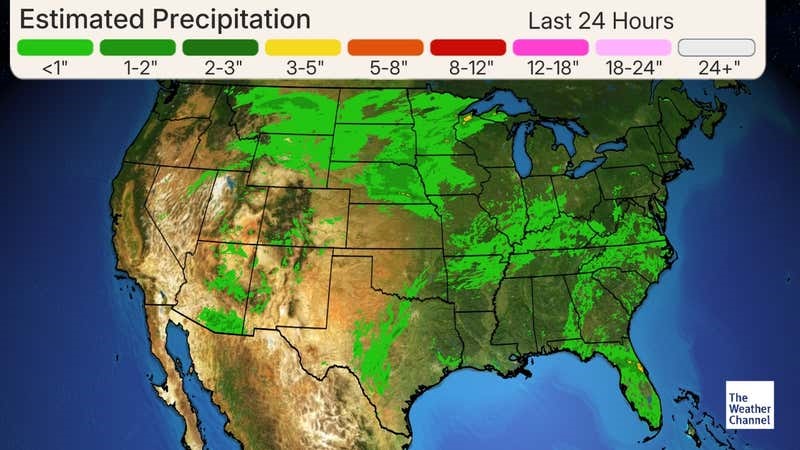

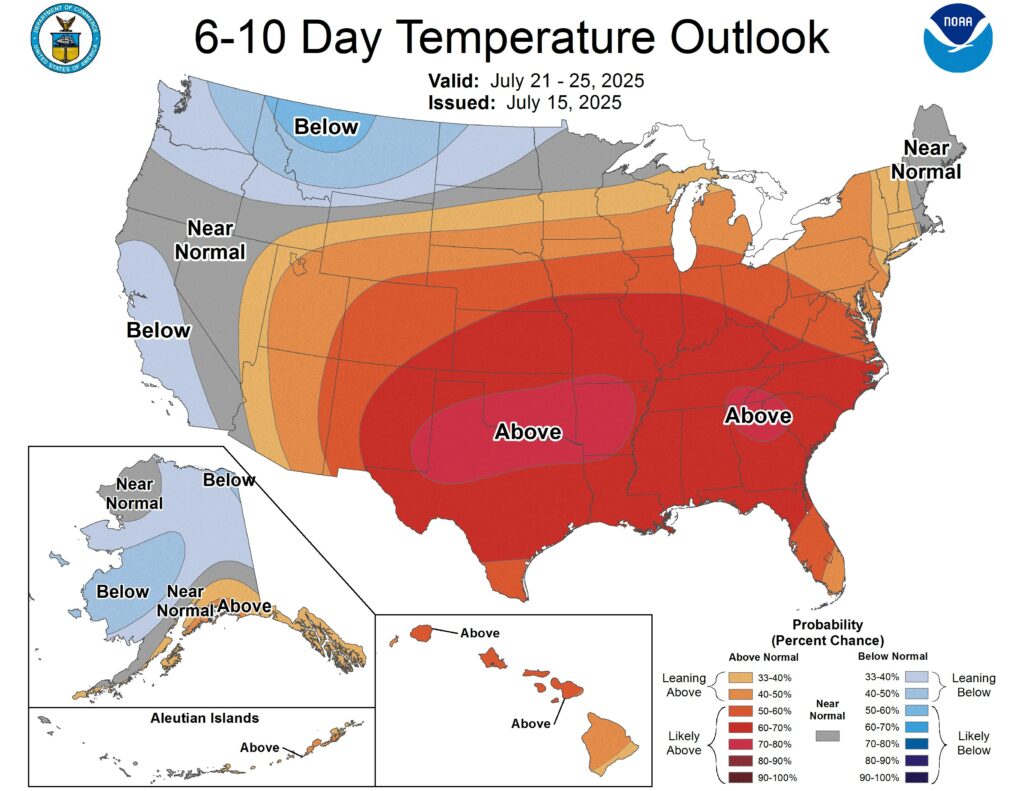

Widespread Rains in all the right places (now-end of July). Moisture coming up from the gulf may disrupt the Louisiana harvest, but they will have windows to work with come early August

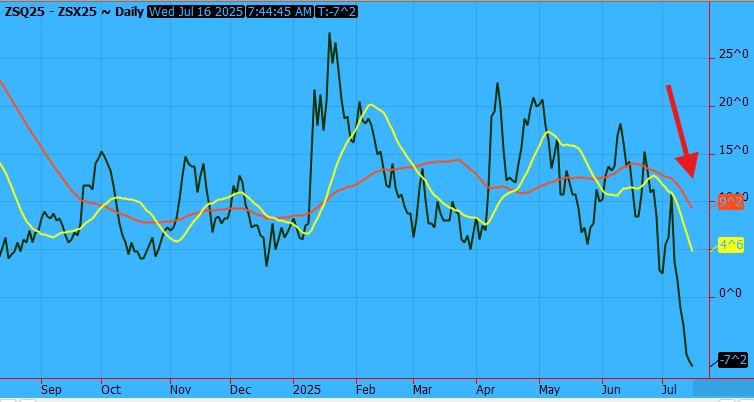

August-November Bean Spread has fallen from a +15¢ inverse to a -7¢ carry in the last month due to the Delta and mid south crop conditions improving -primarily in Louisiana (92% gd/ex this week). They can not easily store grain for longer than 3-40 days due to humidity, so it will have to hit the market. This drives out any sort of premium and may domino into wider carries for the Nov-Jan in the Midwest and north.

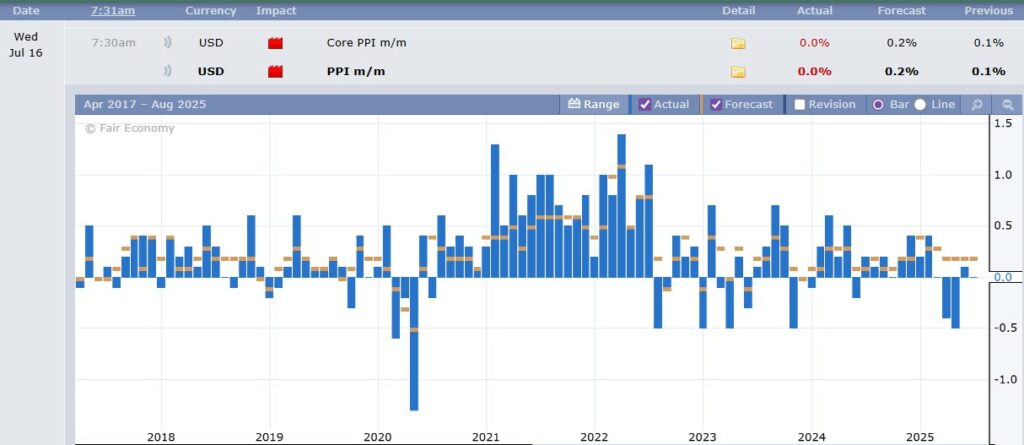

CPI (Consumer Price Index) Year-over-year was reported yesterday at 2.7% increase. That is 0.3% higher than May and 0.1% higher than expectations. Core CPI which excludes food and energy was slightly less than expected. Consumer goods have never been as expensive as they are today, but inflation is lower than the peak 9.1% in 2022.

PPI (Producer Price Index) Month-over-month came in lower than expected at 0.2% Expectations were at a +0.2% increase.

Export & World News

Algeria state grains agency bought around 1 million MT of milling wheat in an international tender. Algeria is also in the market to buy about 240K MT of animal feed corn from optional origins. Thailand is in the market to buy up to 60K MT of animal feed wheat.

Malaysian palm oil futures were up 36 ringgit overnight, now at 4182.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.