OPENING COMMENTS

Macroeconomics:

The EU and Mexico are now subject to a 30% tariff on nearly all goods imported into the US starting August 1st. Mexico is the #1 export destination for US corn and the EU fall at #5 destination for US corn. The EU is also the 2nd largest destination for US soybeans, right behind China.

Ag Fundamentals:

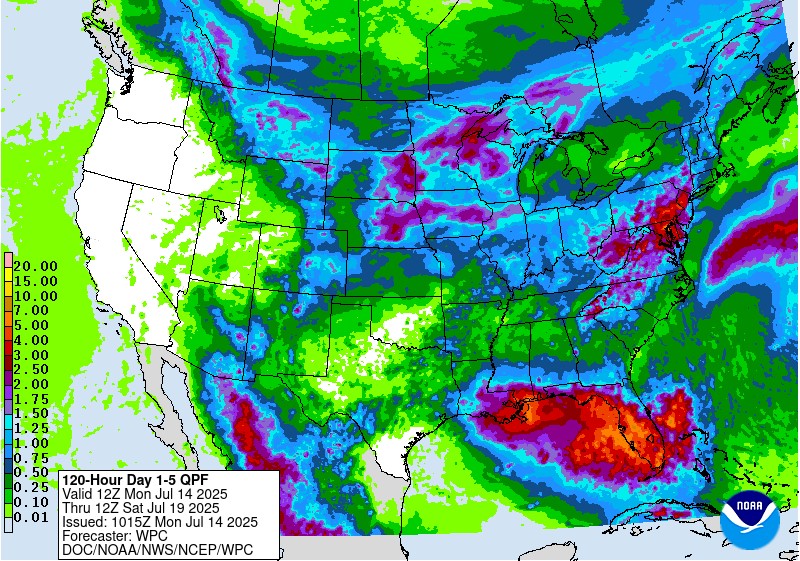

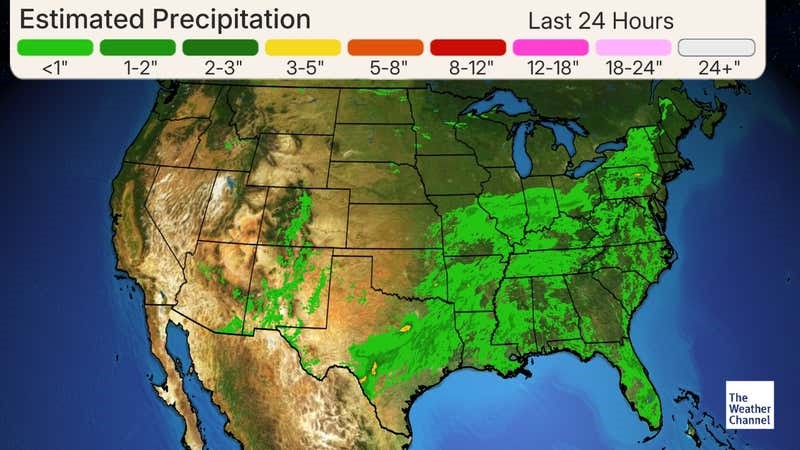

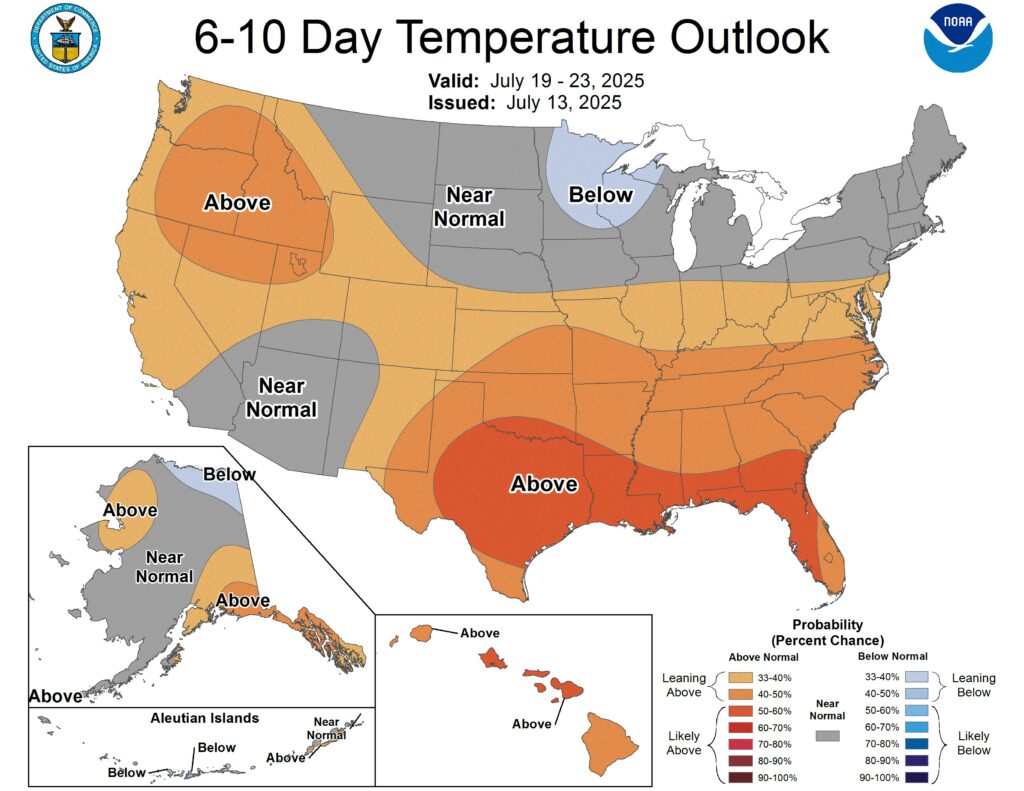

The USDA WASDE did not offer any major catalysts for grain prices. Mostly neutral with a slightly bullish corn ending stock adjustment. Wheat yields increased +1 bu/acre which was foreshadowed by the +29% jump in good/excellent numbers for Nebraska wheat conditions last week. Iowa and Illinois received more rain over the weekend, and the northern plains are expected to see scattered rain over the next 2 days. Northern IL and Norther ND and MN seems to be the only concerning areas on the drought monitor.

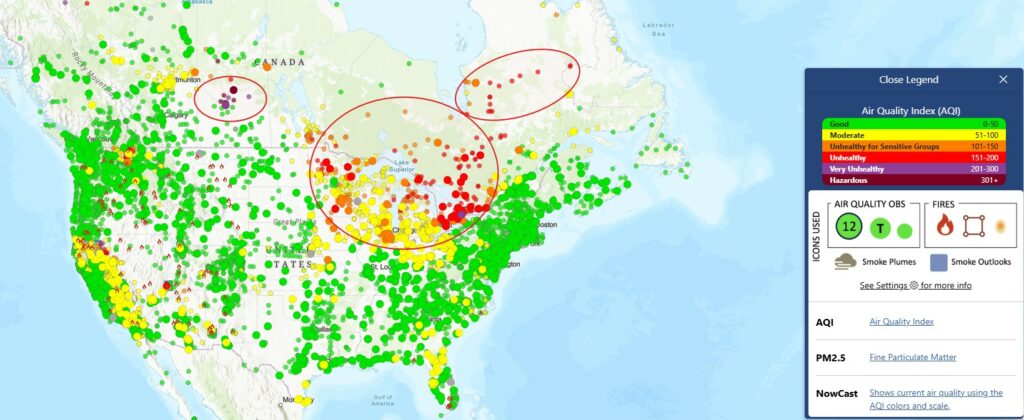

Canada Wildfires continue to cause air quality concerns in the northern Midwest. Air quality is important in plant development and it can cause damage to roots, hinder flowering and lower yields.

Export & World News

The USDA reported a flash sale of 219K MT of US soybeans for Mexico for the 25/26 marketing year.Algeria is in the market to buy some milling wheat and up to 240K MT of animal feed corn.

Malaysian palm oil futures were up 58 ringgit overnight, now at 4232

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

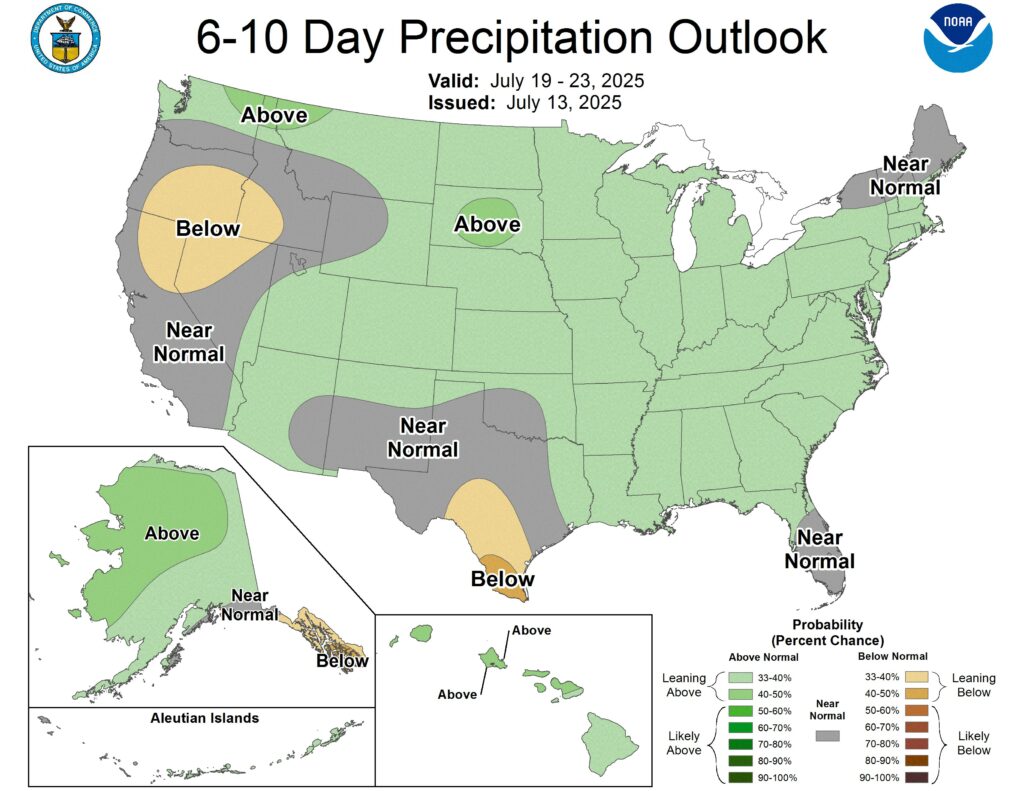

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.