OPENING COMMENTS

Ag Fundamentals:

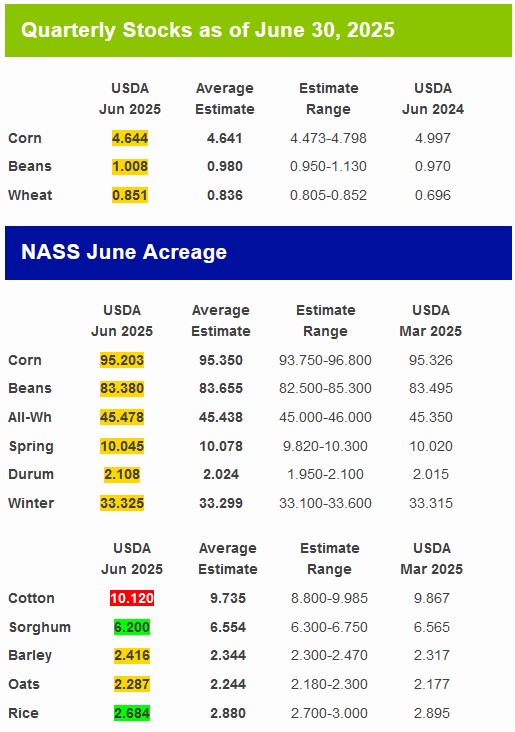

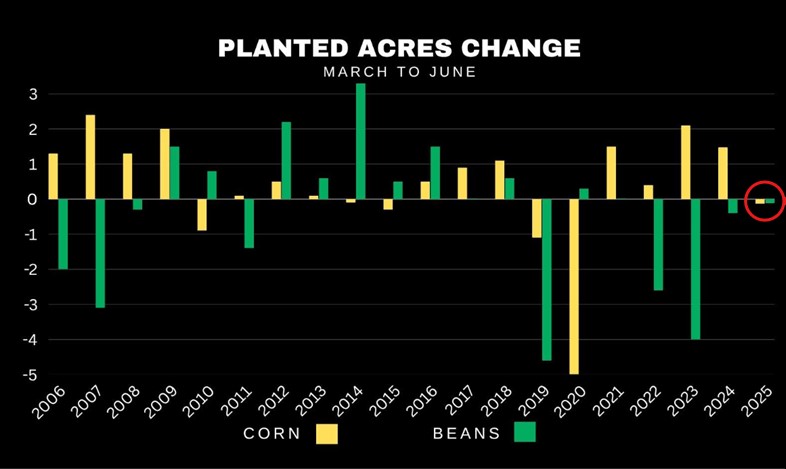

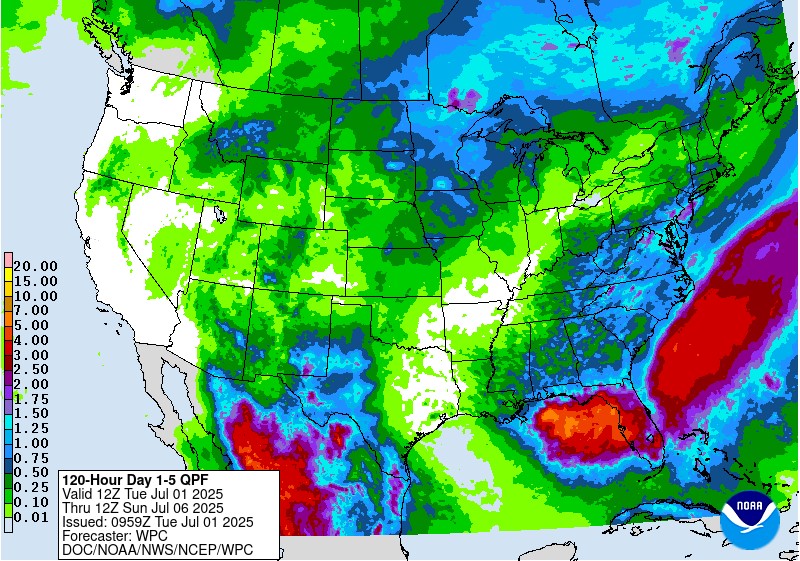

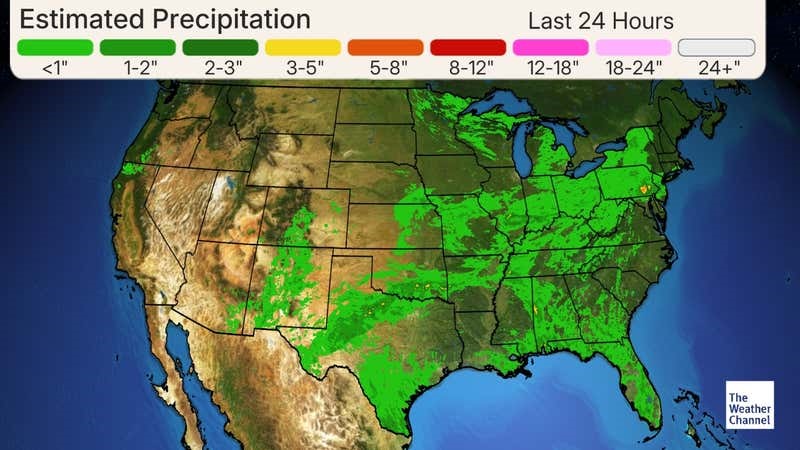

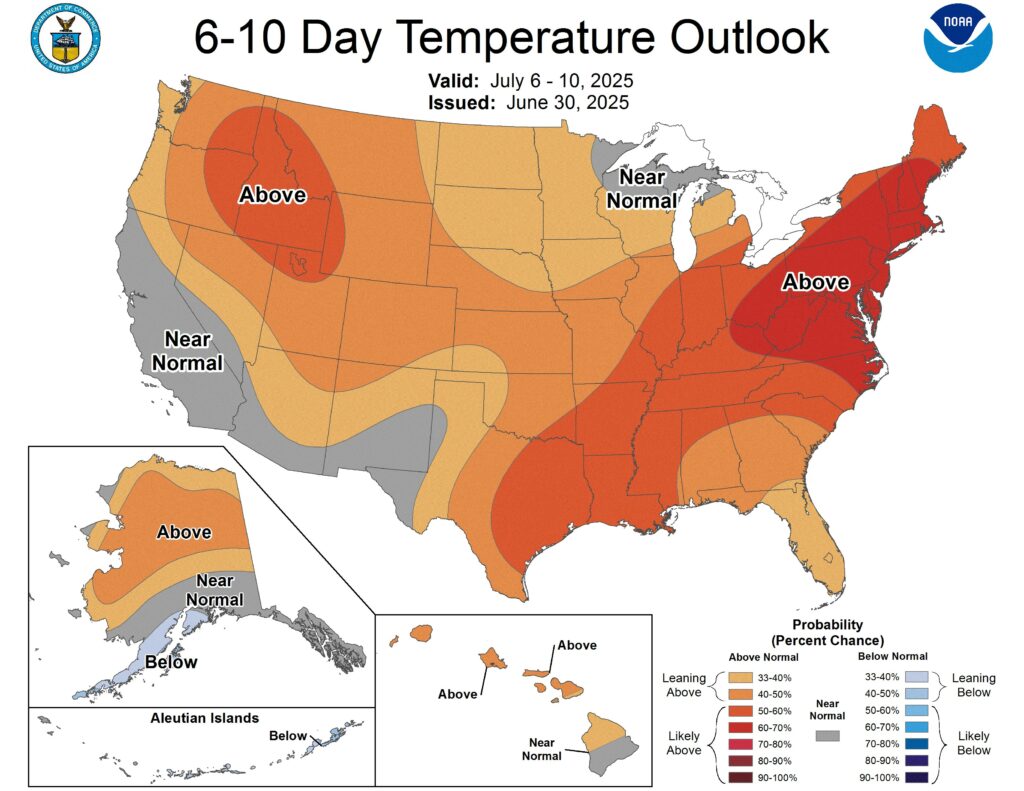

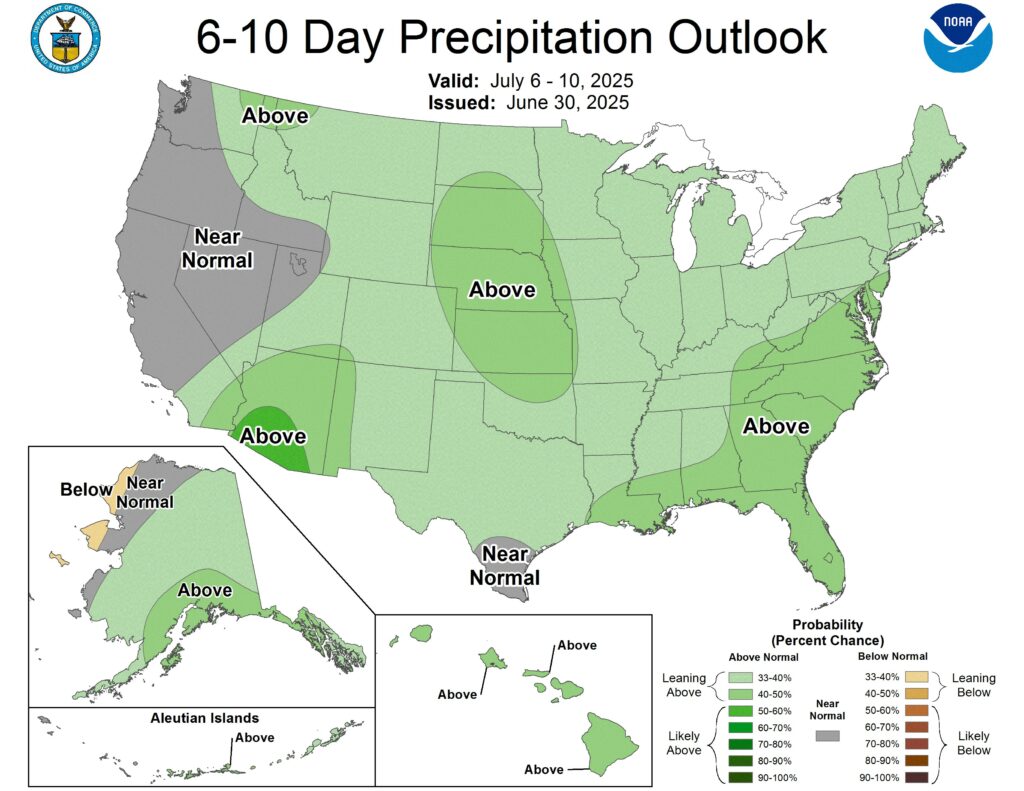

Yesterday’s Stock and Acreage report was mostly uneventful. It was the smallest change to corn acres since 2014, and the smallest for soybeans since 2021. Driving through Minnesota, North Dakota and South Dakota I didn’t see a single field missed. Everything was planted and with a healthy start. In some of the Southern Minnesota areas the low grounds may have received a bit too much rain. Storms that blew through southern North Dakota and Northern South Dakota may have compromised up to 10M bushels of storage which could keep a cap on mid-harvest basis levels and possibly promote carries in the northern cash market. Weather becomes the focus for today’s market, alongside South American harvest. Most of the Midwest will receive about an inch of rain between now and mid July. Northern Illinois and northern Indiana are the only areas with little to no rain in the 7-day forecast. Crop conditions can be seen below and both Illinois and Iowa are both exceeding their average corn conditions at this time of year bey over 10% good/excellent. We are expecting to see July temperatures 1-2 degrees above the 20-year average. I am recalling last year when we saw a very dry last half July, August and September while still producing heavy yields. Considering the resilience of improved agriculture practices, better hybrids, and the current forecast, It is now hard for me to argue the USDA’s current yield projections.

USDA June 30, 2025 Acreage, Stocks Report

March to June Change in Corn and Bean Acres was the smallest for corn since 2014, and the smallest for beans since 2021.

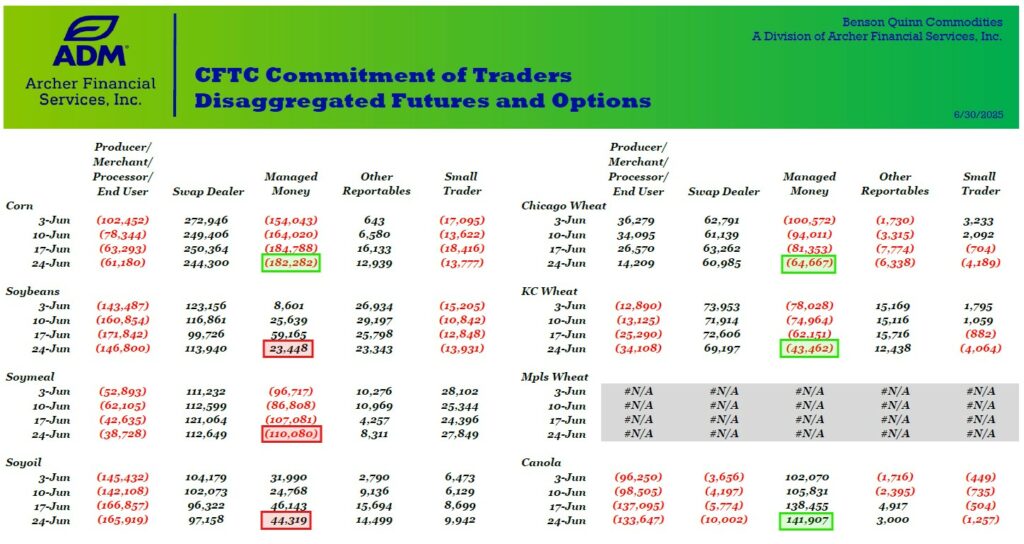

The CFTC Commitment of Traders Report

Change in Managed Money Positions (June 27th)

Corn: +2,506

Soybeans: -35,717

Soybean Meal: -2,999

Soybean Oil: -1,824

Chi Wheat: +16,686

KC Wheat: +18,689

Canola: +3,452

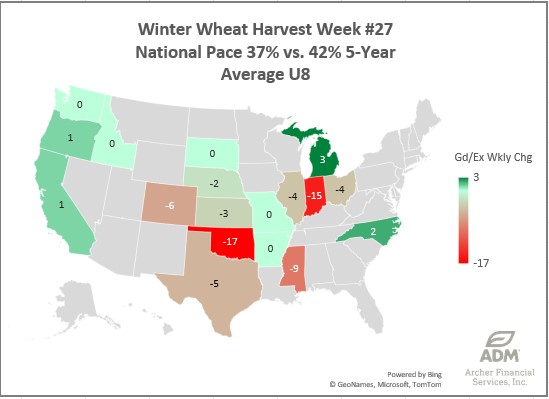

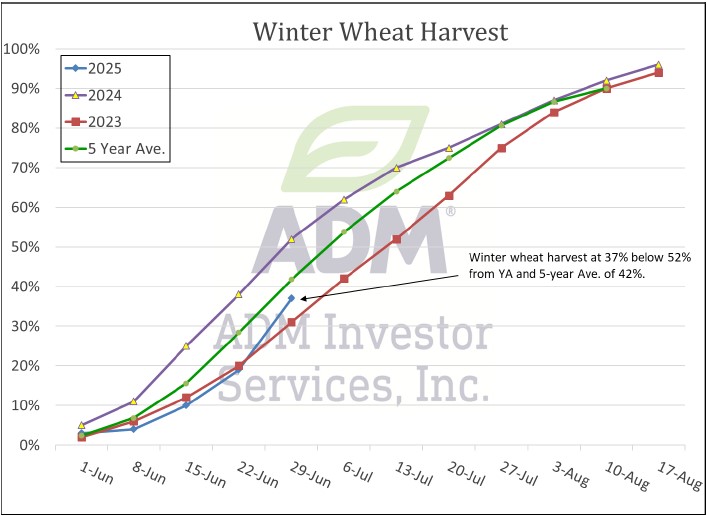

Winter Wheat Harvest Progress (37%, +18% Change)

Winter Wheat Harvest progressed +18% to 37% as of yesterday afternoon’s USDA crop progress report. This is about 5% behind the 5-year average harvest pace. Indiana and Oklahoma are the furthest behind.

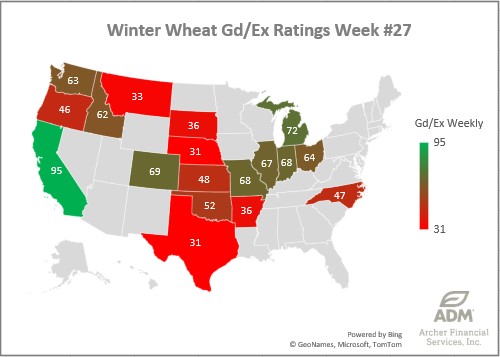

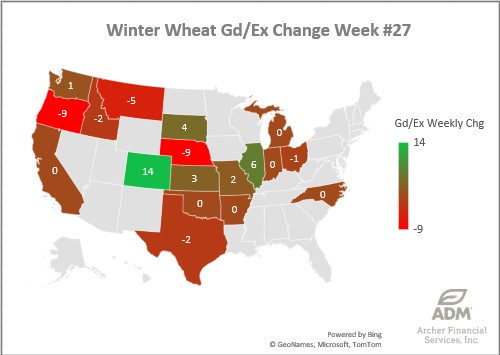

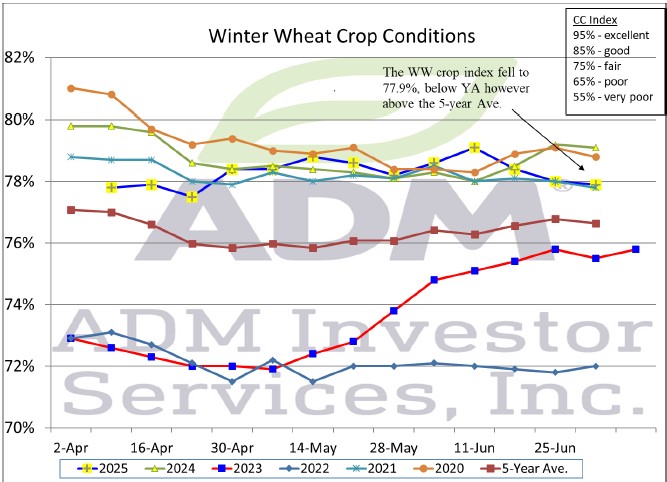

Winter Wheat Crop Conditions (48% Gd/Ex, -1% Change)

Winter Wheat Crop Conditions were down -1% week-over-week to 48% good/excellent. The PNW and Nebraska were the drivers behind the lower average rating. 48% is below the 5-year average and suggests the USDA needs to drop winter wheat yields at least 1 bu per acre.

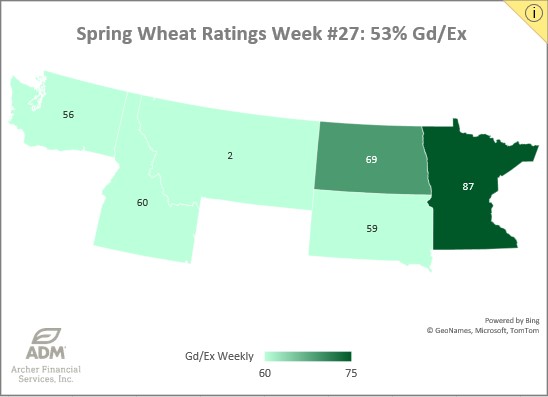

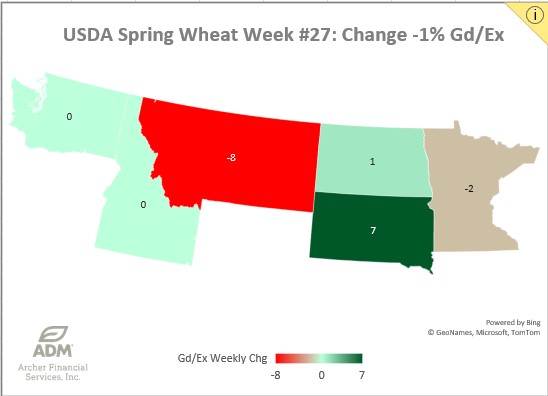

Spring Wheat Crop Conditions (53% Gd/Ex -1% Change)

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Spring Wheat Crop Conditions were fell to 53% good/excellent. This was -1% less than last week’s estimate and below expectations. 38% of the Spring wheat crop is headed, +1% ahead of the 5-year pace.

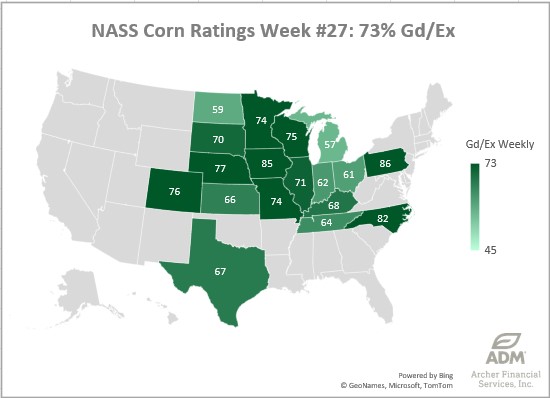

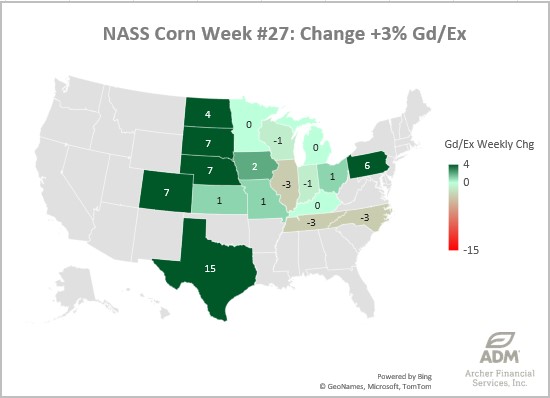

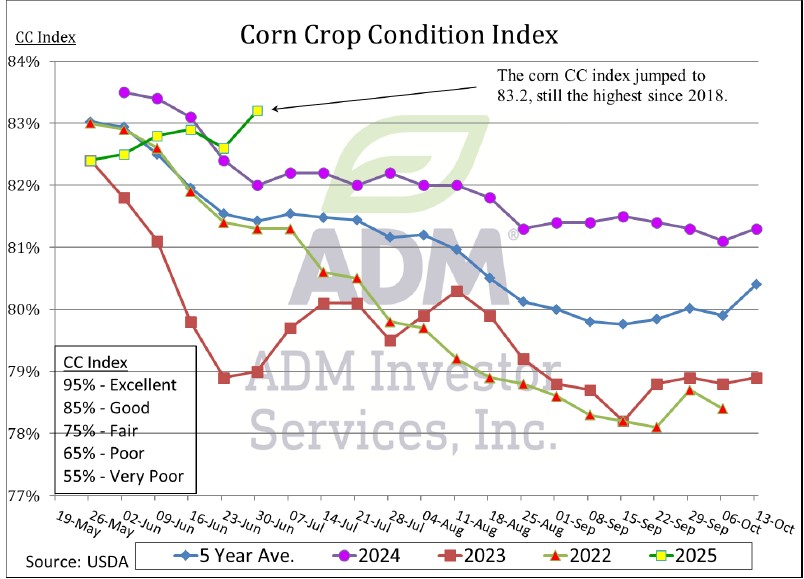

Corn Crop Conditions (73% Gd/Ex +3% Change)

Corn Crop Conditions increased +3% to 73% good/excellent, thanks mostly to the wheat belt. Texas corn ratings popped +15% alone. Check out Iowa at 85% gd/ex, vs 72% Iowa avg. Illinois is also +11% better than Illinois average.

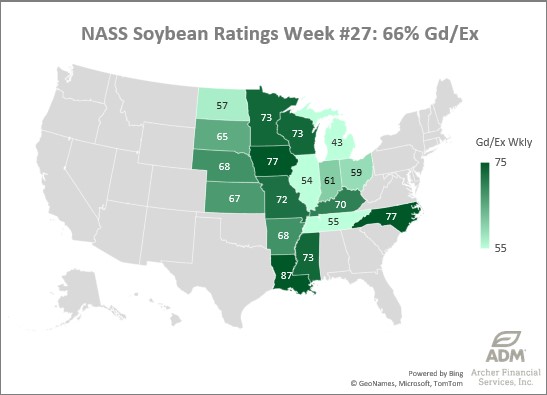

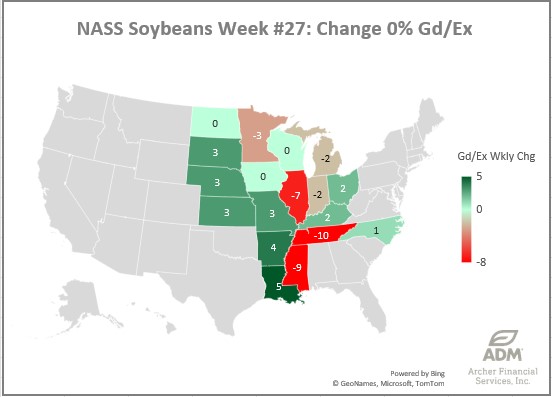

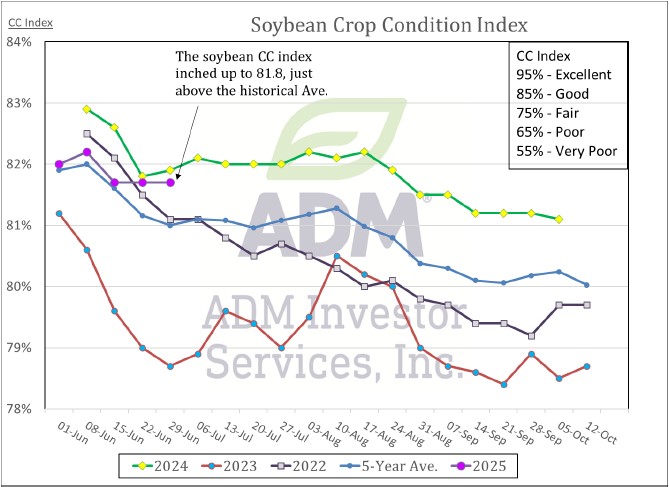

Soybean Crop Conditions (66% Gd/Ex, Unchanged)

Soybean Crop Conditions held steady at 66% good/excellent. The wheat belt improved while beans in Illinois dropped -7% week-over-week.

Export & World News

The USDA confirmed a sale of 204K MT of soybean meal to unknown destinations.

Malaysian palm oil futures were down 13 ringgit overnight, now at 3973.

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.