CORN

Prices recovered late to close within $.01 ½ of unchanged as spreads weakening. Support for Mch-26 is at this month’s low of $4.24 as prices remain rangebound between $4.15-$4.40. The USDA announced a flash sale of 230.6k mt (9 mil. bu.) to an unknown buyer. EIA data showed ethanol production rebounded to 1,110 tbd, or 326 mil. gallons in the week ended Fri. Feb. 6th, up from 281 mil. gallons the previous week. Production was above expectations and up 2.6% from YA. There was 110 mil. bu. used in the production process, or 15.72 mil. bu. per day, above the 15.36 needed to reach the USDA forecast of 5.60 bil. bu. In the MY to date there has been 2.439 bil. bu. used, or 15.34 mbd, an annualized pace of 5.60 bil. The Ave. US Farm price at $4.10 appears a bit high historically with a 12.9% stocks/use ratio. Global stocks/use among major exporting countries slipped to 10.2% in Feb-26, down from 10.5% in January. Tomorrow’s export sales are expected to range between 25-60 mil. bu.

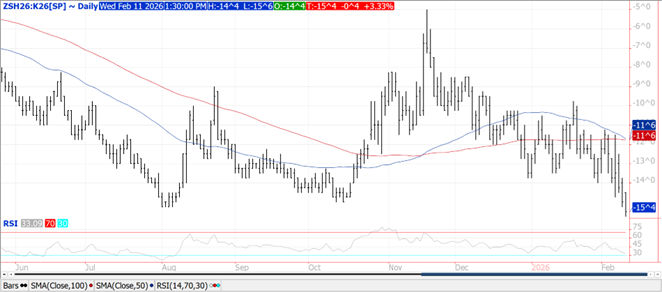

SOYBEANS

Prices across the complex were mixed in 2 sided trade. Beans were $.01 ½ to $.04 higher, meal was $1-$2 higher while oil closed 20-25 points lower. Bean spreads weakened with some Mch-26 spreads making new lows. Meal spreads firmed while oil spreads weakened. Mch-26 beans have held within Friday’s range all week. Mch-26 oil established a new contract high before pulling back. Mch-26 meal briefly traded above its 100 day MA. Spot board crush margins rose $.01 to $1.70 bu. while bean oil PV slipped to 48.5%. Yesterday’s speculative buying in soybeans and bean oil saw OI up nearly 14k in oil and just over 4k in soybeans. The Trump Admin. is working to keep an open dialogue with China ahead of the President’s visit in April, however them buying another 8 mmt of old crop US soybeans seems like a stretch. Brazilian FOB offers remain $.80-$1.10 below US Gulf thru May. The USDA raised Brazilian production 2 mmt yesterday to a new record high of 180 mmt however most private estimates lean closer to 185 mmt. Paraguay up .5 mmt to a record 11.5 mmt. I’d lean slightly lower with Argentine production currently forecast at 48.5 mmt. Anec forecasts Brazil will export 11.7 mmt of soybean in Feb-26, a record amount for the month well above the 9.8 mmt from YA. The USDA Ave. farm price at $10.20 bu. is historically consistent with stocks/use ration at 8.2%. Global stocks/use among major exporting countries increased to 19.5%, up from 19.3% in January. Tomorrow’s export sales are expected to range between 12-48 mil. bu. of beans, 200-450k tons of meal and -10-16k tons of oil.

WHEAT

Prices ranged from $.02-$.09 higher with CGO and KC the upside leaders. CGO Mch-26 peaked right at this month’s high of $5.40 with next resistance at the January high of $5.44 ¾. KC Mch-26 continues to bounce off MA support at $5.26 ½ with next resistance at $5.50. EU soft wheat exports as of Feb. 8th at 13.43 mmt are up 2% YOY. While US stocks were up 5 mil. bu. on lower food usage, global stocks slipped to 277.5 mmt on higher exports from Canada and Argentina. Exports from Ukraine remain extremely low with only 27k mt shipped so far this month while there is 700k mt contracted for shipment. Blackouts due to Russian missile strikes continue to limit their export capabilities. The USDA kept their export forecasts unchanged for both Ukraine and Russia at 14 and 44 mmt respectively. Global stocks/use among major exporting countries slipped to 17.7%, down from 18% in January. Export sales are expected to range between 8-18 mil. bu.

Charts provided by CQG

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.