PRECIOUS METALS

Gold/Silver:

The massive range down trade to the lowest level since December 16th yesterday in gold certainly alleviates a portion of the dramatic overbought condition into the most recent record high. Furthermore, reports that Ukraine attacked Russian president Putin’s residence has reduced prospects of a peace deal, and with the US president yesterday threatening to sue the Federal Reserve Chairman over incompetence with respect to remodeling Fed headquarters and the prospect of renewed weakness in the dollar should provide a solid base of fundamental support in February gold at $4350.20.

BASE METALS

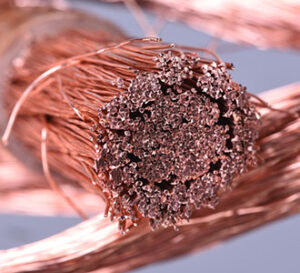

Copper:

While yesterday’s sharp rally to the highest level since the end of July points to the ongoing existence of a strong bull trend, yesterday’s large washout was forged on a significant jump in trading volume and a decline in open interest which suggests a short-term profit taking bias could linger in thinning conditions.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.