Base Metals

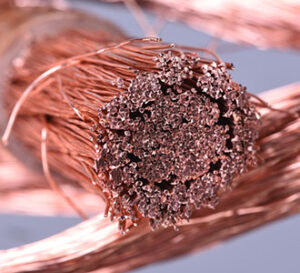

Copper: Copper price hit another record high on Friday following an announcement from Citi, which lifted its price outlook for the metal. Expectations of a Fed rate cut next week have also lifted prices, while supply worries have provided structural support, despite worries easing slightly. Benchmark three-month copper on the LME was up 1.5% to $11,616 earlier in the morning after rising as high as 2.2% to an all-time peak of $11,705. Citi expects copper to average about $13,000 in the second quarter, much higher than its $12,000 outlook in October. The bank said the metal would receive support from macro-fund buying as the US is positioned for a soft landing, alongside current supply shortages, which have given way for prices to rise recently.

LME-COMEX arbitrage continues to provide support for copper prices as well. Copper continues to flow into the US ahead of potential tariffs on US copper imports, which has drawn down LME stocks and sent COMEX warehouses to all-time highs. Comex warehouses currently sit at just under 436,000 tons, while LME stocks are below 100,000 tons. Recent warrant cancellations had caught the market off-guard after price falls on Tuesday and added to various supportive factors, including concern over tight supply outside the US. Glencore lowered its 2026 copper production guidance to a range with a midpoint of 840,000 tons for 2026, down from 930,000 previously. The spread between the LME cash copper contract and the three-month forward has eased from $88 on Wednesday to around $24.

Markets also continue to assess the impact of news that top copper smelters in China will cut production by more than 10% in 2026 to counter overcapacity in the industry. Smelters in China have been facing negative processing fees due to extreme competition. The move follows comments by Chen Xuesen, vice president of China’s Nonferrous Metal Industry Association, who said last week that the state-backed association “firmly opposes any free and negative processing” of copper concentrate. However, skepticism in the markets remains, as previous attempts to curb overcapacity in China have ultimately proved to be fruitless.

Zinc: Zinc was flat at $3,091 after touching $3,125, its highest in almost a year.

Aluminum: Aluminum slipped 0.4% to $2,892.

Tin: Tin eased 0.9% to $40,000.

Lead: Lead added 0.1% to $2,016.

Nickel: Nickel nudged up 0.1% to $14,915.

Precious Metals

Gold: Gold prices are higher ahead of today’s September PCE inflation figures. Expectations that the Fed will lower rates next week have been supportive of gold, although the metal is currently little changed on the week. Recent labor data, including private and government figures, has been mixed but ultimately has resulted in markets upping bets on a December cut. Jobless claims came in well below expectations of 219,000 at 191,000, but it is likely that the shortened Thanksgiving holiday week distorted the figure. Meanwhile, ADP reported a net 32,000 drop in private payrolls in November, the third drop in four months, and one of the lowest readings since 2023. Elsewhere Challenger job cuts data showed that US employers announced 71,321 job cuts in November, the highest for the month since 2022, compared to 57,727 a year earlier. However, layoffs fell from 153,074 in October, although they are still at elevated levels compared to last year. Markets will likely not receive a solid understanding of the labor market until the next official report scheduled for December 16, which is after the Fed’s meeting. Markets are pricing an 87% chance that the Fed will lower rates next week.

Kevin Hasset is expected to become the next head of the Fed when Powell’s term is over in May. At a White House event on Tuesday, President Trump dropped a major hint about the Fed chair role, saying that a “potential” future chairman of the Fed was in the room, while Hassett stood close by.

Silver: Silver futures are up 2% to $58.70.

Platinum: Platinum is 0.16% lower at $1,657.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.