CORN

Prices were $.02 ½ – $.04 ½ higher today drawing support from the surge in soybeans. Spreads also firmed. Dec-25 held a challenge of its 50 day MA support at $4.28 ¼ overnight while closing at about the midpoint of Friday’s range. Export inspections at 81 mil. bu. were above expectations and a MY high. They were well above the 59 mil. needed per week to reach the revised USDA forecast. YTD inspections at 624 mil. are up 73% from YA vs. the USDA forecast of up 9%. Noted buyers were Mexico – 23 mil., Japan with 17 mil. and Korea with 14 mil. AgRural is reporting Brazil’s 1st crop plantings have reached 85%, just below the 87% from YA. Friday’s USDA updates show global stocks among major exporting countries are expected to grow to 10.1% of usage, a 6 year high, largely due to higher US stocks. The USDA’s projected Ave. farm price at $4.00 bu. for the 2025/26 MY appears reasonable given the current stocks/use ratio of 13.3%.

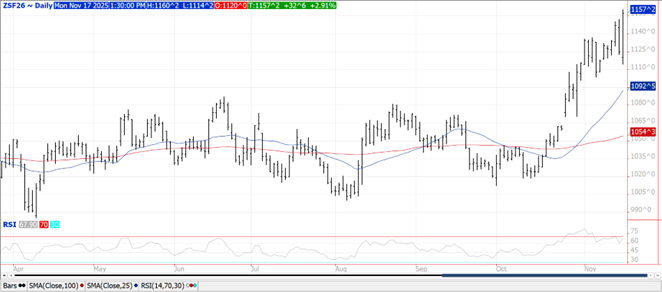

SOYBEANS

Prices were sharply higher across the complex with beans up $.20-$.32, meal was up $5-$8 while oil was up a full $.01 per lb. Bean spreads surged while product spreads were slightly higher. Outside day up in Jan-26 beans with prices surging to a fresh 16 month high for the spot contract. Fresh 9 month high for Dec-25 meal with next resistance at $334. Dec-25 oil stalled just below LW’s high, next major resistance is at the 100 day MA at 52.18. The massive NOPA crush figure at 227.7 mil. bu. would suggest the USDA crush estimate at 2.555 bil. bu. is way too low. Oil stocks rose 5% to 1.305 bil. lbs. only slightly above expectations of 1.257 bil. lbs. despite the huge production figure. The Dec-25 WASDE could move more beans out of exports into crush. As expected the USDA did lower 24/25 bean oil usage for biofuel production by 350 mil. lbs. to 11.9 bil. while more than offsetting with a 400 mil. lbs increase in other domestic usage. Export inspections at 43 mil. bu. were in line with expectations. YTD inspections at 371 mil. are down 43% from YA vs. the USDA forecast of down 13%. Noted buyers were Italy, Mexico, Turkey and Egypt all taking 5 – 7 mil. bu. AgRural reports Brazil’s soybean plantings have reached 71%, up 10% in the past week, however down from 80% this week YA. Friday’s USDA updates show global stocks for 2025/26 MY among major exporting countries is forecast to slip to 18.7% down from 19.4% in Sept-25 and if realized would be the lowest in 12 years. The USDA projected Ave. farm price at $10.50 bu. for the 2025/26 MY appears reasonable given the current stocks/use ratio of 6.7%. Given current prices it appears the market is discounting tighter stocks in subsequent USDA reports.

WHEAT

Prices surged $.05-$.17 across the 3 classes. Spreads also firmed. Rumored Chinese interest in US wheat off the PNW fueled the higher trade. Fresh 2 month high for Dec-25 MIAX futures while both CGO and KC held below last week’s high. The market continues to add “war premium” with no end in sight for the Ukraine/Russia conflict. US export inspections at 9 mil. bu. were at the low end of expectations and below the 15 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 454 mil. bu. are up 19% from YA, vs. the USDA at up 9%. IKAR is reporting Russia’s export price ended last week at $229/mt, down $3 for the week. They have held their Russian export forecast for Nov-25 steady between 5.2-5.4 mmt, while SovEcon lower their projection to 4.6 mmt. Global stocks in 2025/26 among major exporting countries is forecast to jump to 16.5%, up from 15.5% in Sept-25 and if realized would be the highest in 7 years.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.