CORN

Prices were $.06 lower today, largely in sympathy with the lower soy complex. Dec-25 held above its low for the week as it consolidates near $4.30. Near-term resistance is at LW’s high at $4.37 with support at the 100 day MA near $4.20. Spreads were mixed with tomorrow being the 1st day of the Goldman roll. The flow of speculative money into the long side of the Ag. space appears to have come to a screeching halt. US corn remains competitively priced into the late winter months which should continue to drive a solid US export program. No exports sales report as the Fed. Govt shutdown reaches a record 37th day. The average est. for corn sales last week was 55 mil. bu. Record ethanol production yesterday may prompt the USDA to raise their usage forecast of 5.60 bil. bu. in next Friday’s WASDE update. US corn acres in drought held steady at 30%.

SOYBEANS

Lower trade across the complex with beans down $.20-$.25, meal was $8-$12 lower while bean oil was off 30 points. Bean and meal spreads eased while oil spreads were steady. Jan-26 beans fell to a new low for the week after reaching 16 month high yesterday. Next major support at LW’s low near $10.70. Dec-25 meal also fell to a new low for the week with next support at $300 ton. US soybean FOB offers remain slightly above those from Brazil for both Dec-25 and Jan-26 even before factoring in the 10% tariff differential for soybeans into China. By Feb-26, as we get deeper into Brazil’s harvest, their offers fall to nearly a dollar per bu. below the US. Argentina’s oilseed crush association reached a labor agreement with workers avoiding a strike which also weighed soybean valuations. Dec-25 oil held up much better while seeing 2 sided trade. Overnight strength was capped at its 50 day MA. Spot board crush margins slipped $.02 ½ to $1.39 bu. while bean oil PV rose back above 44%. We had speculative traders buying 9k contracts of beans yesterday taking their long position to over 100k contracts, the largest since July-23. Aggressive selling today likely drove that long position back below 100k. IMO it will be difficult to rally bean prices further until we see evidence of much larger Chinese buying, which is going to require US prices falling below the competition in Brazil. The recent surge in meal prices has left the US uncompetitive in the global marketplace. Farmers there have just begun planting this year’s soybean crop. Recent EIA data would suggest soybean oil demand being shifted away from biofuel production into domestic usage or exports in next Friday’s WASDE report. The average est. for soybean sales last week was 44 mil. bu. US soybean acres in drought fell 2% to 32%.

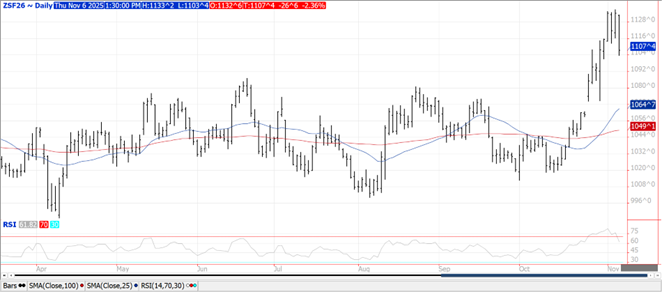

WHEAT

Prices ranged from steady to $.19 lower across the 3 classes with CGO and KC the downside leaders. The Dec-25 contract for both CGO and KC closed just below their respective 100 day MA’s. Prices had benefited from speculative short covering, particularly in the past week on news of some Chinese buying interest. I also think index funds have been active buyers in the Ag. Space during this govt. shutdown which might help explain why MIAX futures lagged as index funds do not allocate to that futures contract. A S. Korean milling group is seeking 50k mt of US wheat for Jan/Feb shipment. The offer deadline is tomorrow. A S. Korean feed group has reportedly bought 60k mt of feed grade wheat for $263/mt CF for Mch-26 shipment. Winter wheat acres in drought fell 2% to 38%. The average est. for US wheat sales last week was 16.5 mil. bu.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.