MORNING LIVESTOCK FUTURES OUTLOOK

PORK COMPLEX

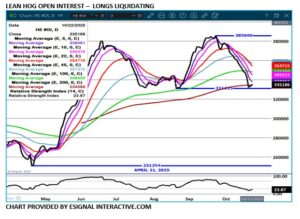

After 4 days of lower trade, lean hogs reversed Tuesday off the past 3 days lows and closed higher. But December lean hogs still closed $12.31 below the CME Lean Hog Index. Other than spec trading, it is going to be difficult to have hogs rally with cash pork falling day after day. Pork prices especially hams and loins have been dropping because US slaughter has been increasing and countries are buying less US pork going instead to Brazil. China has too much of their own pork. Tariffs hurt and countries have increased tariffs on US pork. Canada for instance has increased trade agreements with Brazil in order to buy less US pork.

CATTLE COMPLEX

Tuesday’s trade was a continuation of Monday and making up the loss from last Friday when President Trump announced increased beef imports. Volume was light to moderate . A majority of the trading on Tuesday were speculators buying live cattle and selling lean hogs with similar volumes on corresponding cattle and hogs on December, February and April.

>Read full report here

Interested in more futures markets? Explore our Market Dashboards here

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.