OPENING COMMENTS

Shutdown continues, payment announcement postponed, river levels receive relief, next 7 days mostly dry south of MN and WI, El Nino to return in March 2026, and forecast models can not agree on Brazil’s next 14 days

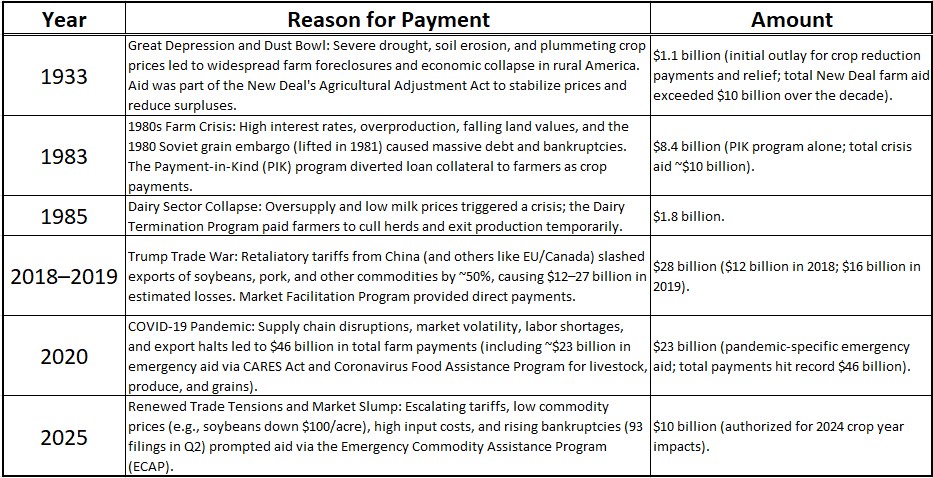

History of Direct Payments to Farmers

The announcement for more direct payments was expected to be yesterday, but was postponed due to the gov shutdown. Other reports including the WASDE and crop progress will not be released as long as the shutdown continues.

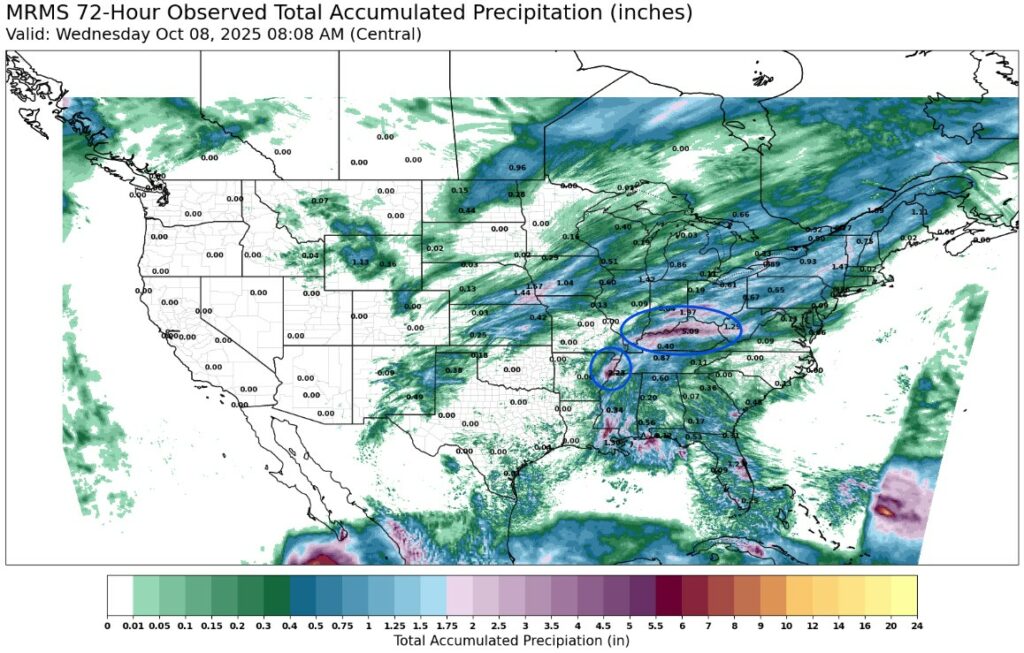

Last 72 hr Rainfall

Up to 5 inches of Rain in Southern Indiana and Northern Kentucky. 3 inches near Memphis and scatters rains dropping over an inch in the upper Midwest.

The Mississippi River at Memphis is getting some relief from recent rains in the Ohio River Valley.

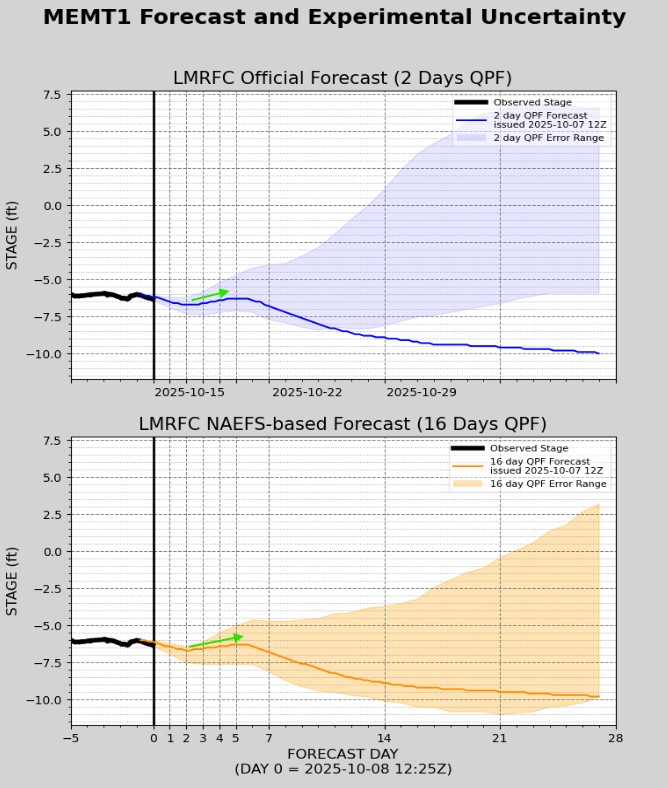

The Next 7 Days of Rain in the US

Kentucky and southern Indiana catching over an inch of rain while the rest of the country is fairly dry.

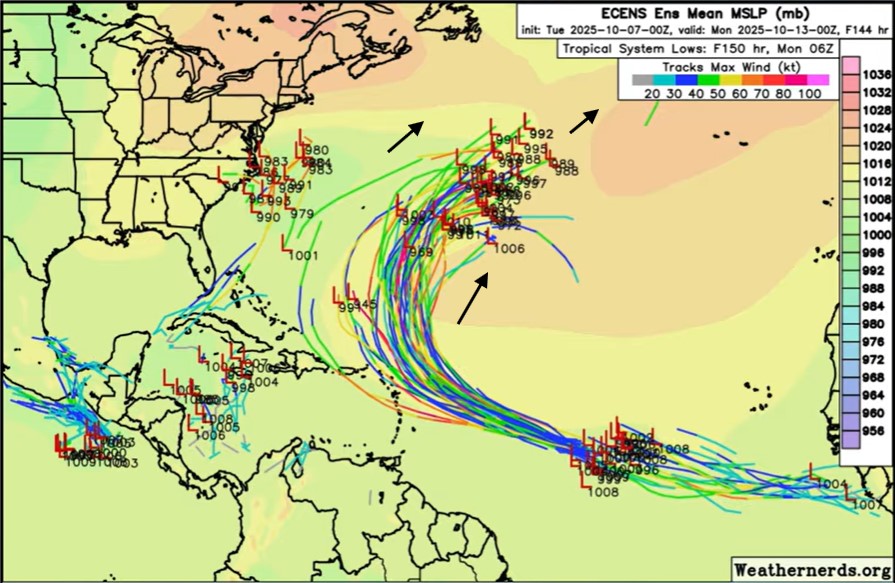

Tropical Storm Jerry will bend North to miss the eastern coast of the U. The Image below is though Sunday 10/12.

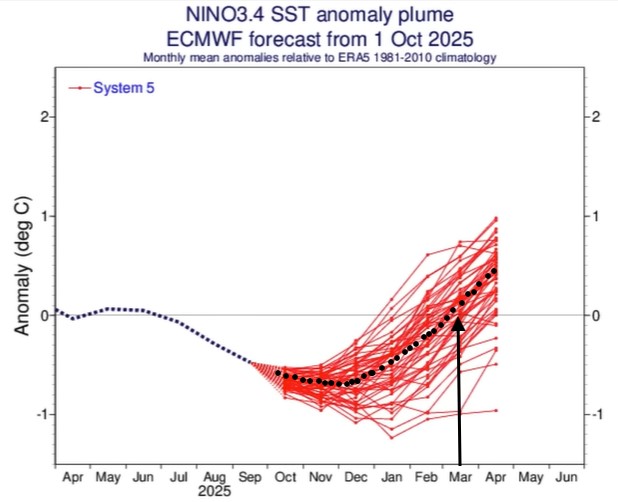

La Nina Expected to flip to El Nino by March 2026

A brief and weak La Nina will likely change to El Nino between February and Mid-April 2026.

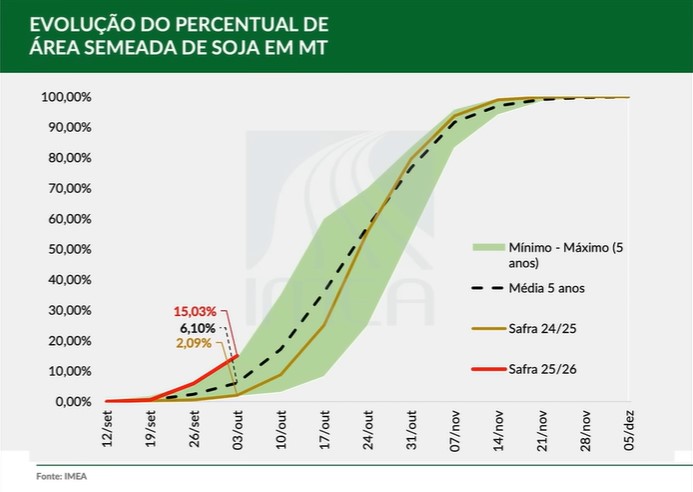

Brazil Soybeans are now 15% Planted. Brazilian corn planting is 40% complete. This is the 2nd fastest pace for both corn and beans

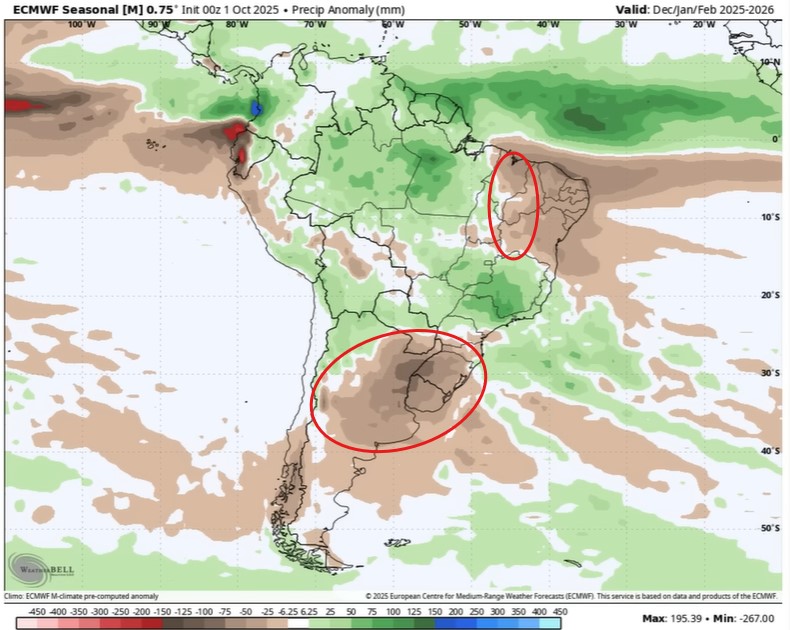

The Dec/Jan/Feb Seasonal Anomaly Map suggests there will be moisture through most of Brazil, while leaving Argentina mostly dry.

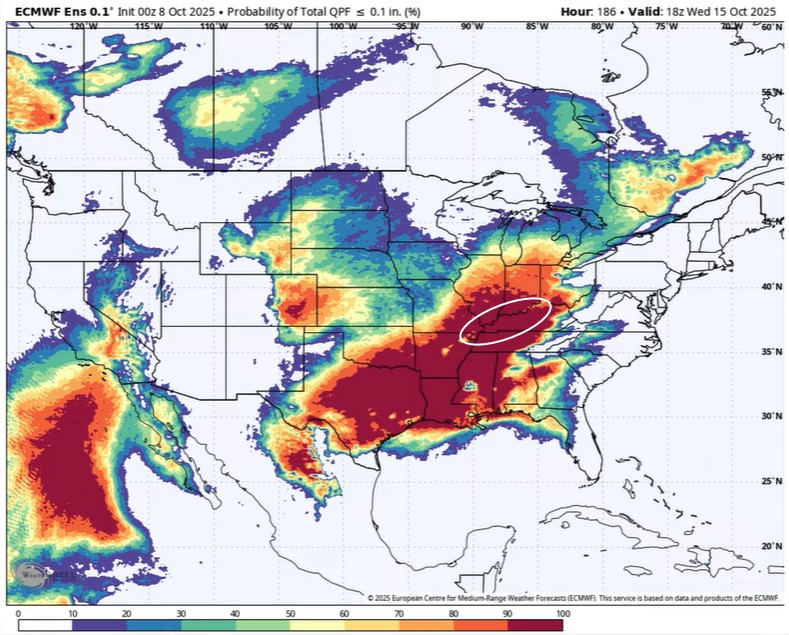

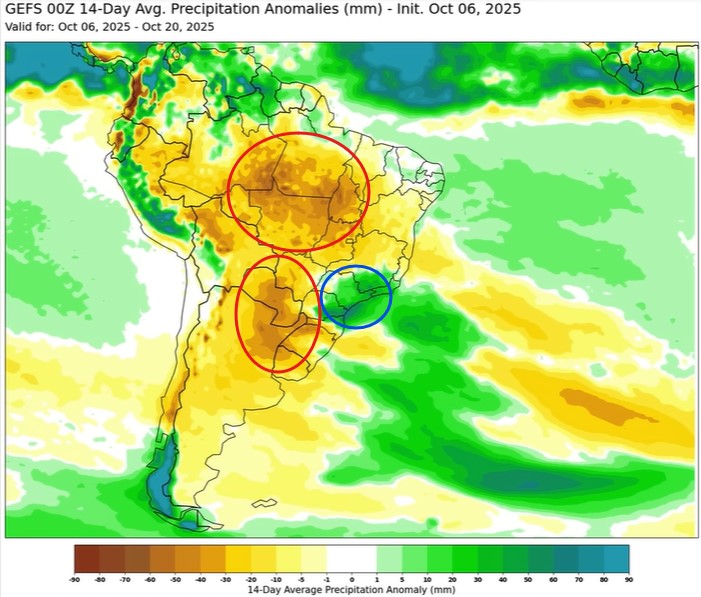

The GEFS 14-Day Precip Anomaly Map showing signs of dryness which may be welcome to some farmers needing clear weather to continue planting.

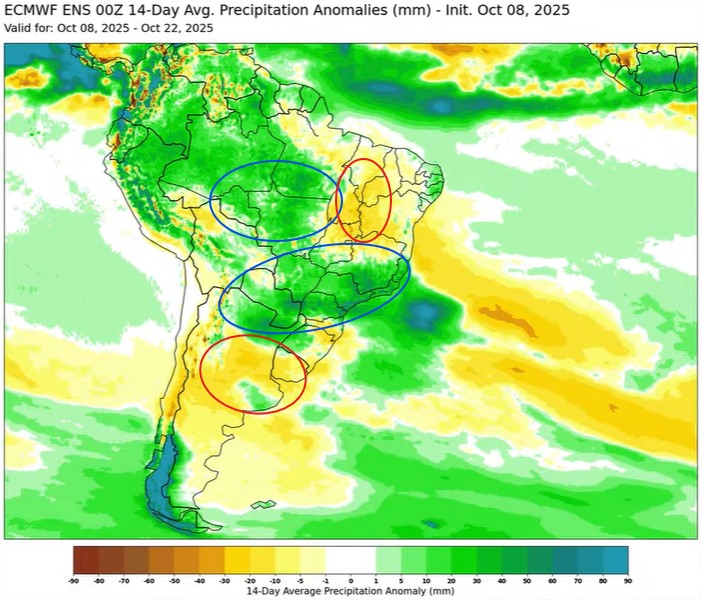

The European 14-Day Disagrees with the GEFS.The European forecast below suggests plenty of rain in Brazil over the next 14 days. They are still showing dryer than normal Argentina and northeastern Brazil.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.