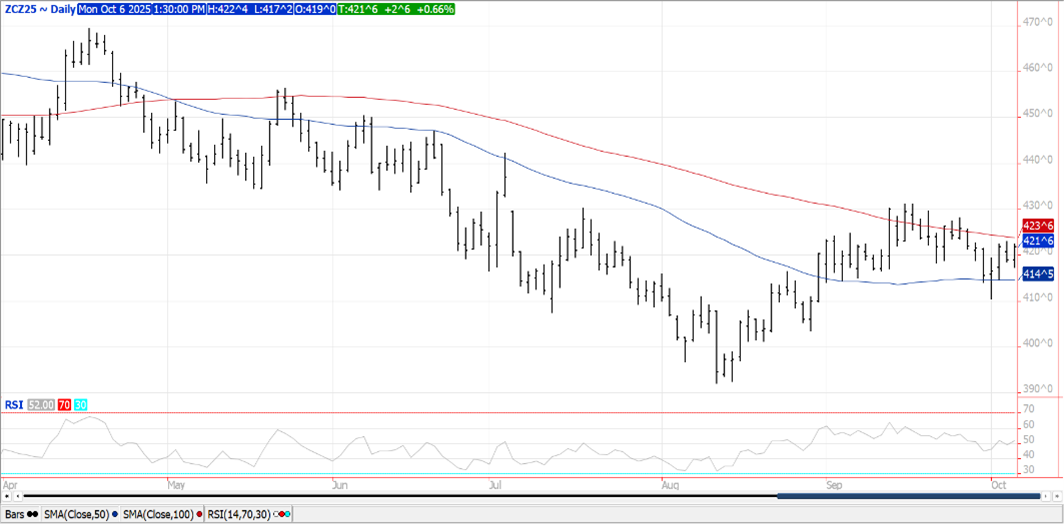

CORN

Prices firmed late closing with gains of $.01 ½ – $.02 ½. Spreads also firmed. Dec-25 wasn’t able to trade above the Friday high and seems trapped between its 50 day MA support at $4.14 ½ and its 100 day MA resistance at $4.23 ¾. No CFTC-COT data on Friday. Export inspections at 63 mil. bu., were a marketing year high and in line with expectations. They were also above the 57 mil. needed per week to reach the USDA forecast. YTD inspections at 264 mil. bu. are up 56% from YA vs. the USDA forecast of up 5%. The USDA stated they wouldn’t update crop progress and conditions. Wire services are still taking surveys however. Corn harvest is expected to have reached 31% vs. 29% YA and 5-year Ave. of 28%. Ratings are expected to slip 1% to 65% G/E. AgRural is reporting Brazil’s 1st crop plantings have reached 40%. Brazil’s Ag. Ministry reports corn exports in Sept-25 reached 7.56 mmt, up 18% YOY. Sales to date in 2025 have reached 23.3 mmt, down 4.34% from YA. Ukraine’s exports for the 25/26 MY are off to a slow start at only 947k mt since the beginning of July, vs. 3.12 mmt YA.

SOYBEANS

Prices were mixed with beans steady to $.01 lower, meal was down $1-$2 while oil was up 30-35 points. Oil and bean spreads firmed meal spreads weakened. Deliveries against Oct-25 meal slipped to 193 contracts while oil plunged to only 26. Resistance for Nov-25 beans is at its 100 day MA at $10.28 ¾. Dec-25 oil continues to consolidate just above $.50 lb. Spot board crush margins were steady at $1.46 bu. while bean oil PV improved to 47.6%. It would appear that for China to turn to the US for soybeans ahead of South America’s harvest would require the Trump Administration to drop the 20% fentanyl tariff, which could hinge on China making a $1 trillion investment in Chinese owned factories here in the US. China may also be stalling to see if the US Supreme court upholds the lower appeals court ruling that the Trump Admin. use of tariffs were illegal. Scattered showers across the US Midwest today before dry conditions return by midweek. Above normal temperatures look to extend into the 3rd full week of Oct. Thru Friday close I’d guess MM’s are net short roughly 112k contracts of meal, short a couple thousand beans while long a couple thousand oil. Export inspections at 28 mil. bu. were in line with expectations however below the 33 mil. needed per week to reach the USDA forecast. YTD inspections at 111 mil. bu. down 15% from YA vs. the USDA forecast of down 10%. Biggest takers were Mexico and Egypt with 7-8 mil. bu. each. Bean harvest is expected to have reached 39% vs. 44% YA and 5-year Ave. of 38%. Ratings are expected to hold steady at 62% G/E. AgRural is reporting Brazil’s soybean plantings have reached 9%. Brazil’s Ag. Ministry reports soybean exports in Sept-25 reached 7.34 mmt, up 20% YOY. Sales to date in 2025 have reached 93.9 mmt, up 4.85% from YA.

WHEAT

Prices were $.01 to $.03 lower across the 3 classes in choppy 2 sided trade. Export inspections at 19 mil. bu. were in line with expectations and above the 15 mil. bu. needed per week to reach the USDA forecast. Saudi Arabia reportedly bought 455k mt of wheat for Dec/Jan shipment in their most recent tender paying an average of just over $263/mt CF. Most is believed to have been sourced from Russia along with other Black Sea origins. SovEcon is reporting Russia exported 4.6 mmt in Sept while forecasting shipments will rise to 5 mmt in Oct-25. IKAR is reporting Russia’s wheat export price ended last week at $232/mt FOB, up $2 from the previous week. Ukraine’s wheat shipments since July at 4.8 mmt are down 29% YOY.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.