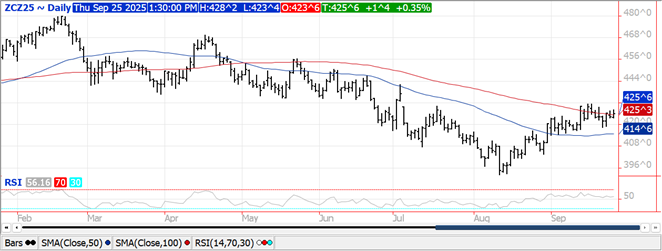

CORN

Prices were steady to $.01 ½ higher today while spreads firmed. Dec-25 traded to a new high for the week, however unable to challenge LW’s high at $4.31 ¼. Support is at the 50 day MA at $4.14 ¾. Exports at 76 mil. bu. were above expectations while bringing YTD commitments to 1.014 bil. bu. up 75% from YA, vs. the USDA forecast of up 5%. Commitments represent 34% of the USDA forecast above the historical Ave. of 27%. Noted buyers were Mexico – 35 mil. and unknown with 11.5 mil. bu. The European Commission lowered their EU corn production forecast 1.4% to 56.8 mmt, still just above the USDA forecast of 55.3 mmt. Both the Reuters and Bloomberg surveys shows analysts are expecting slightly higher corn stocks in next Tues. Quarterly stocks report. My est. at 1.344 bil. bu. is 19 mil. above the USDA forecast in the Sept-25 WASDE and slightly above the Ave. trade guess. US corn acres in drought increased 1% to 26%, the highest since April.

SOYBEANS

Prices were mixed across the complex today. Beans were $.02-$.03 higher, meal was off $2-$3 while oil was up 40-45 points. Meal spreads softened while both soybean and oil spreads firmed up. Inside trade for Nov-25 beans as it consolidates between $10.05-$10.20. Rally attempts in Oct-25 oil continue to stall out near $.50 lb. Fresh 2-month low for Oct-25 meal as it nears its CL at $266.10. Spot board crush margins slid another $.05 today to $1.42 bu., a new 3 month low, while bean oil PV rebounded to 47.9%. Argentina reinstated their export taxes on agricultural products having reached their goal of generating $7 bil. in export revenue. During this 48 hour tax holiday China is believed to have purchased between 30-40 cargoes of Argentine soybeans. Total volume between 2.0 – 2.6 mmt continues to cut into potential US demand. The ASA called on the Trump Admin. to “prioritize securing an immediate deal on soybeans with China.” USDA Sec. Rollins stated her Dept. was working with the Trump Admin to provide additional financial aid to American farmers. Today Pres. Trump stated his administration would use tariff revenues to fund an aid package for US farmers. Soybean exports at 27 mil. bu. were at the low end of expectations. YTD commitments at 404 mil. bu. are down 37% from YA vs. the USDA forecast of down 10%. Commitments represent 24% of the USDA forecast vs. the historical Ave. of 40%. Still no sales to China. Only noted buyers were Egypt – 6 mil. and Taiwan – 4 mil. Soybean meal sales at 227k tons were at the low end of expectations. Old crop commitments are up 14% YOY in line with the USDA forecast. Bean oil saw large switching from old crop to new crop. Old crop cancellations of 51 mil. lbs. reduced 24/25 commitments to 2.415 bil., lbs. 97% of the USDA forecast. New crop sales at 117 mil lbs. saw new crop 25/26 commitments jump to 178 mil. lbs. USDA Sec. Rollins also stated today the US Justice Dept. antitrust division will examine high seed and fertilizer costs. US soybean acres in drought increased 1% to 37%, the highest since March.

WHEAT

Prices ranged from $.05-$.07 higher across the 3 classes. Decent export demand and expectations for slightly lower US production likely driving some speculative short covering into the end of the month and Qtr3. The USDA has lowered WW production in the September report 7 of the last 8 years. Exports at 20 mil. bu. were in line with expectations. YTD commitments at 501 mil. bu. are up 24% from YA, vs. the USDA forecast of up 9%. By class commitments vs. the USDA forecast are: HRW up 112% vs. USDA up 49%, SRW up 7% vs. USDA up 3%, HRS down 7% vs. down 4%, and white down 5% vs. down 14%. The European Commission raised their EU soft wheat production forecast 4.5 mmt to 132.6 mmt. They also raised their export forecast 4% to 31 mmt. IKAR also raised their Russian production forecast again, up .5 mmt to 87.5 mmt, vs. the USDA est. of 85 mmt.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.