USDA WASDE PRODUCTION HIGHLIGHTS

Biggest surprise was USDA raised the harvested corn acres again, lowered yields.

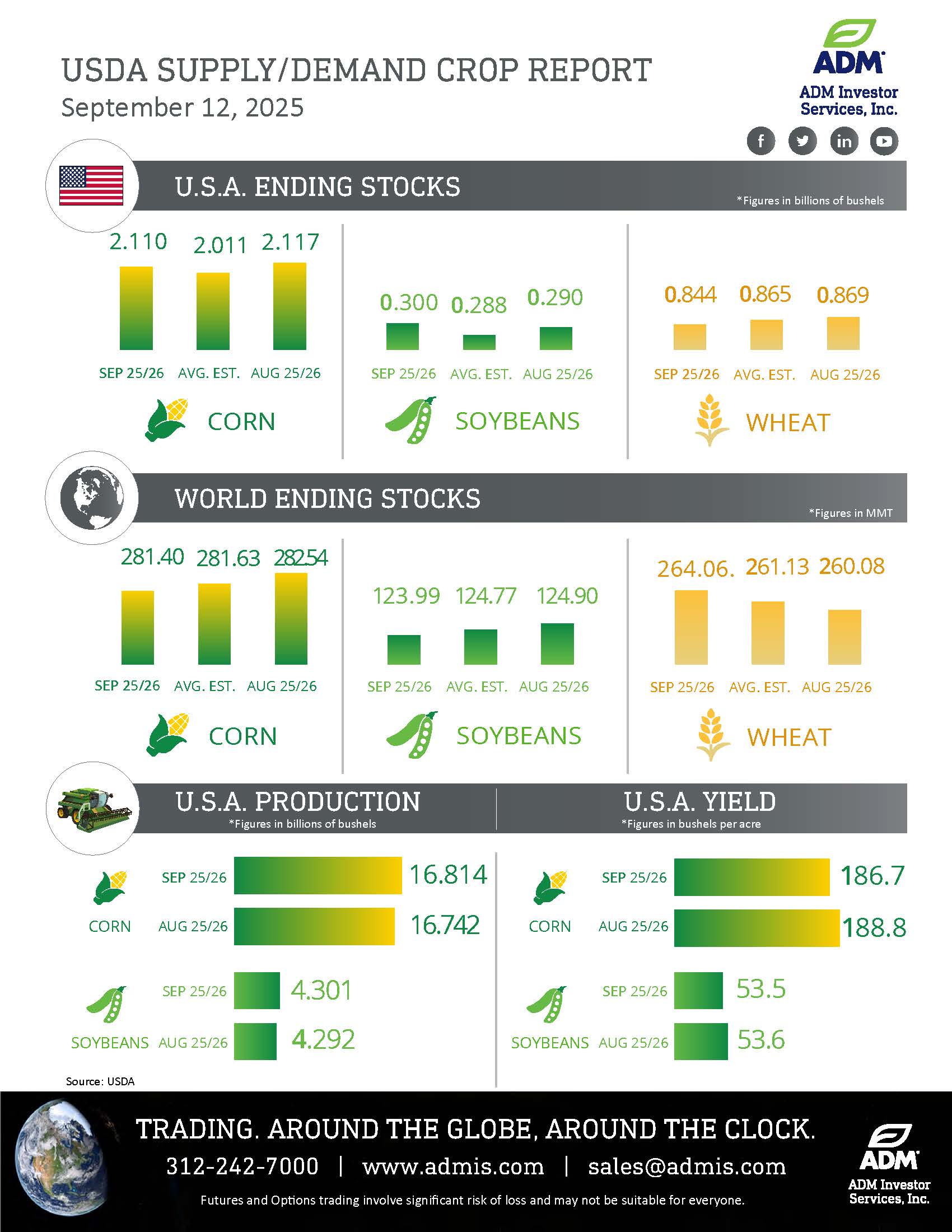

Corn:

- US Production rose 72 mil. bu. to 16.814 bil. 300 mil. above expectations

- Harvested Acres rose another 1.35 mil. to 90.047 mil.

- Average yield fell 2.1 bpa to 186.7 bpa, still a record high

- 2024/25 US ending stocks rose 20 mil. bu. to 1.325 bil. on lower demand

- 2025/26 US ending stocks at 2.110 bil. bu. 100 mil. above expectations

- 2025/26 exports up another 100 mil. to record 2.975 bil.

- 2025/26 world stocks at 281.4 mmt in line with expectations

- Brazil’s 2024/25 production up 3 mmt to 135 mmt

Soybeans

- US production up 9 mil. bu. to 4.301 bil., 30 mil. above expectations

- Harvested acres rose 209k while yields slipped .1 to 53.5 bpa, still a record high

- 2024/25 US ending stocks unchanged at 330 mil. bu.

- 2025/26 US ending stocks at 300 mil. bu. 10 mil. above expectations

- 2025/26 exports cut 20 mil. bu. crush up 15 mil.

- 2025/26 world stocks at 124 mmt at the low end of expectations

Wheat

- 2025/26 US ending stocks down 25 mil. bu. to 844 mil., 20 mil. below expectations

- Exports increased 25 mil. to 900 mil. the highest in 5 years

- 2025/26 Global stocks up 4 mmt to 264 mmt, 3 mmt above expectations

- Global production rose 9.3 mmt to 816.2 mmt, global demand up 5 mmt to 814.6 mmt

- Production increased in Australia, Canada, Russia and Ukraine

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.