AFS Afternoon Comments

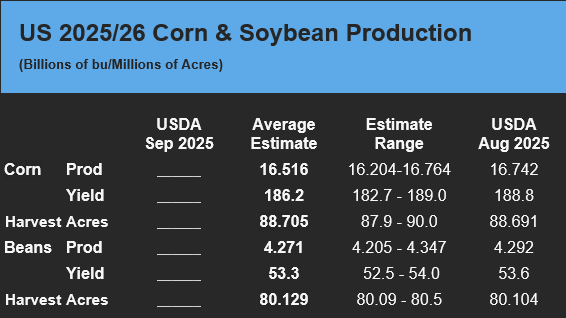

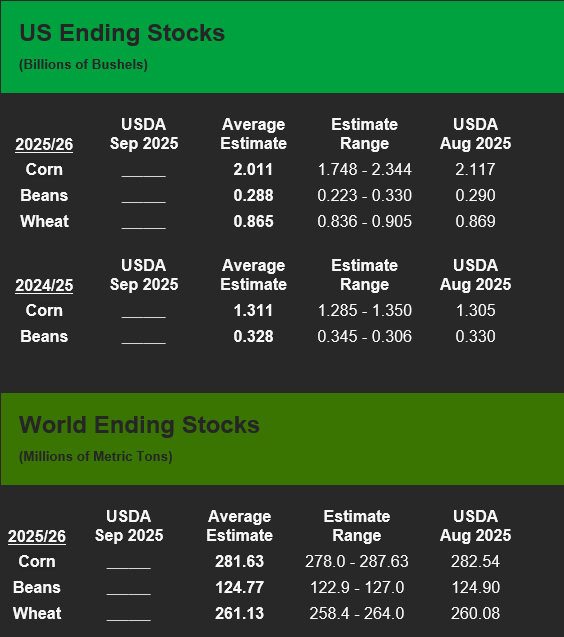

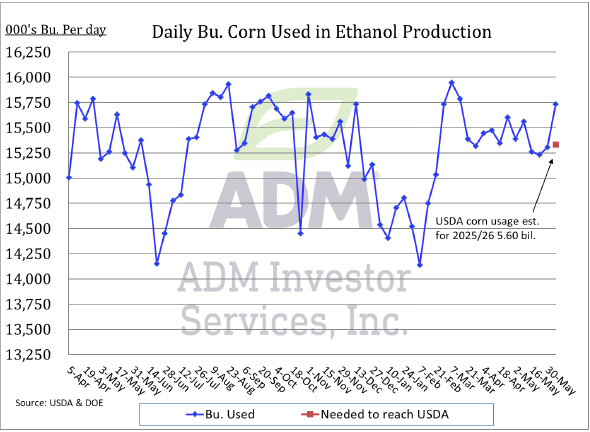

The USDA will release their September WASDE Report tomorrow at 11:00am CST. The market is expecting a significant correction in corn yields and an adjustment lower on soybean production as well. Aside from lowering yields traders are expecting an increase to corn exports-regardless of this morning’s poor weekly sales, lower ethanol usage, and overall lower corn ending stocks. The trade is also anticipating higher soybean crush and lower exports leaving ending stocks nearly unchanged.

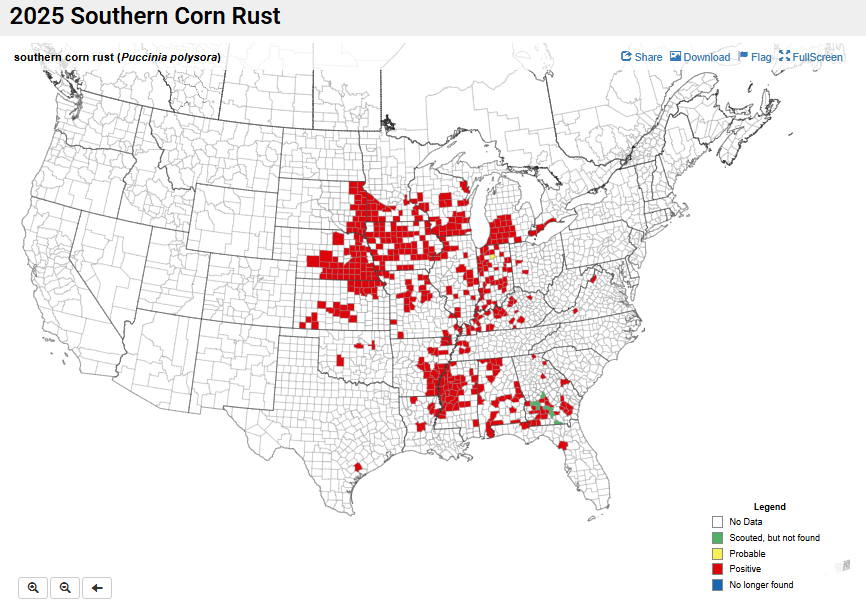

Southern Corn Rust Map below shows areas where rust was found between Mid-July and today.

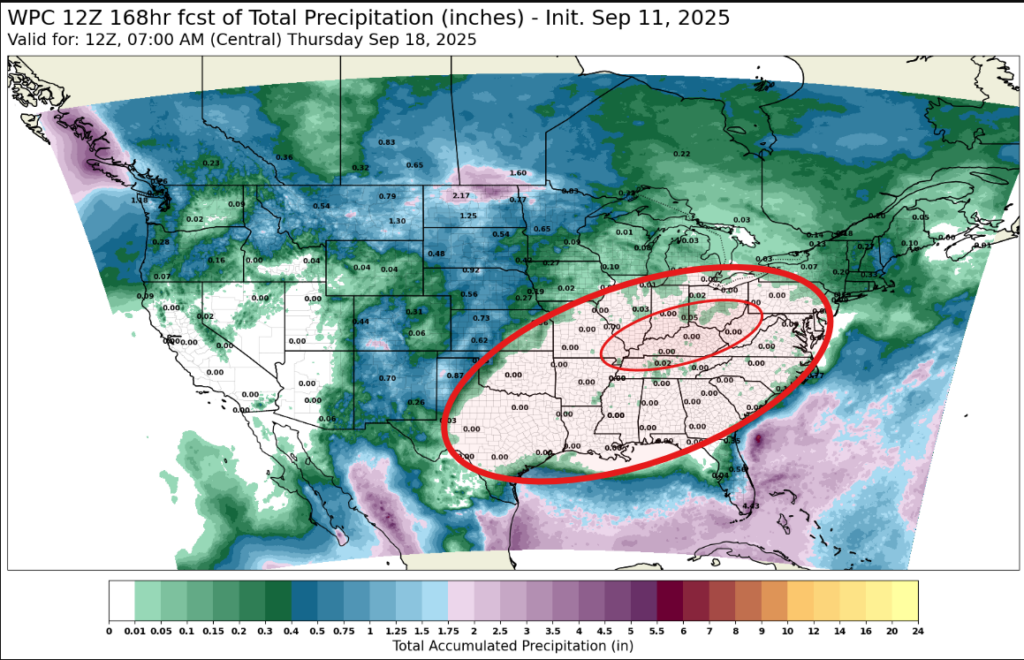

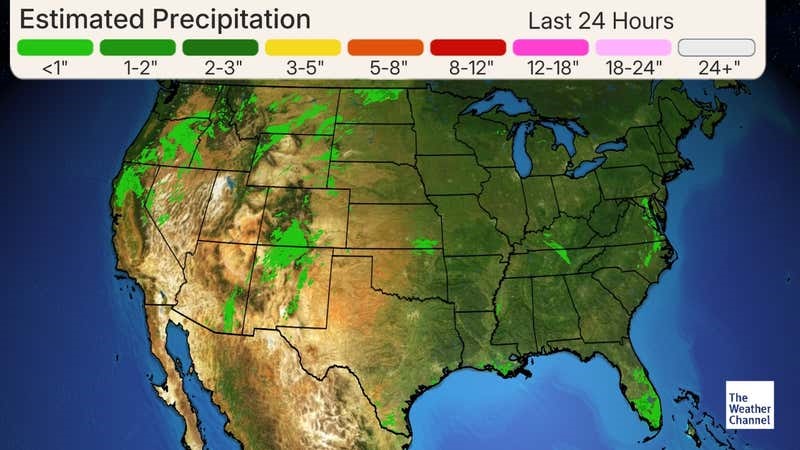

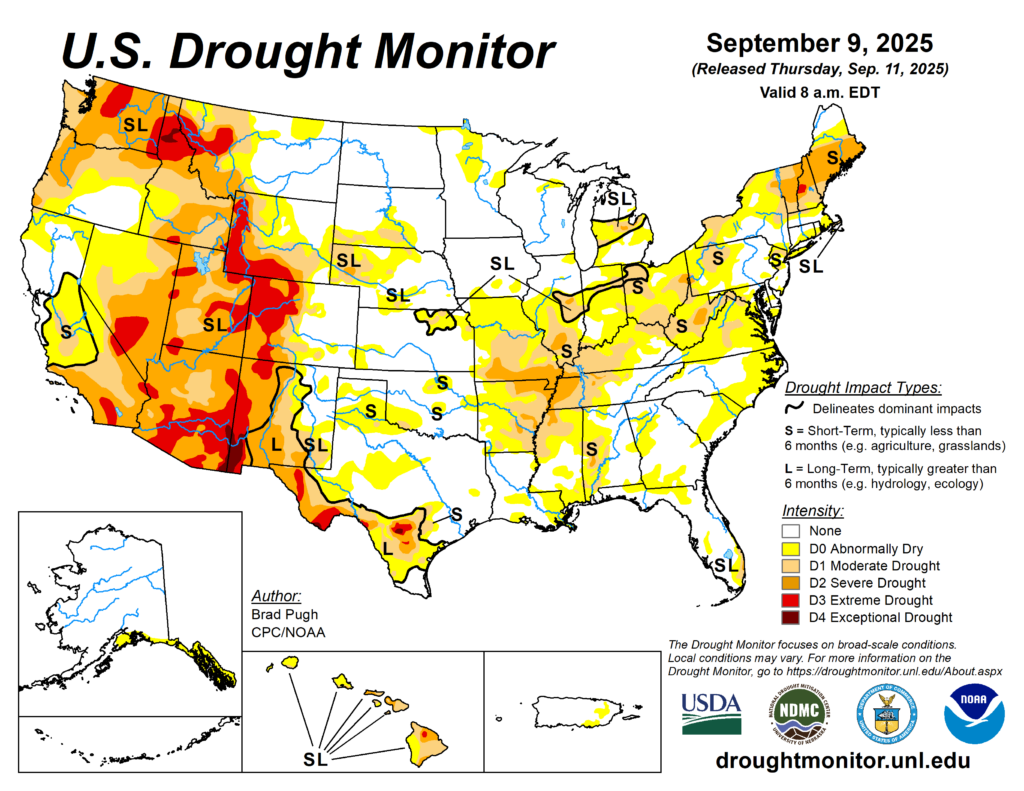

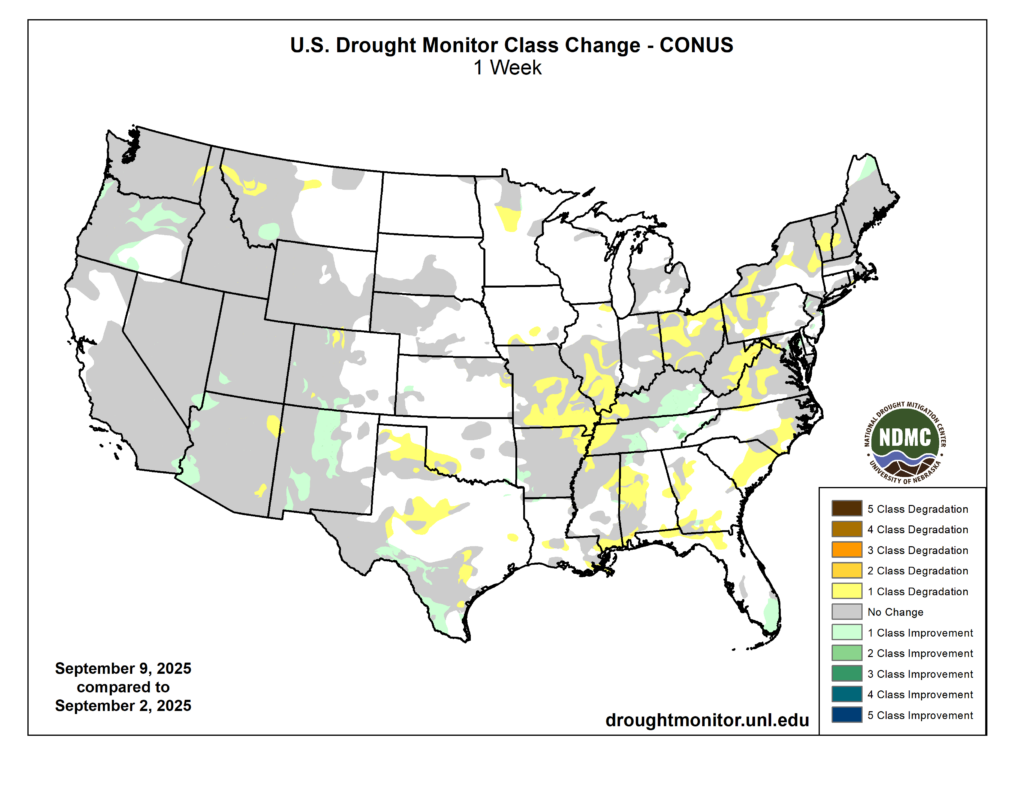

Rain is needed in the Ohio River Valley (7-Day Forecast below). River levels are not extremely low, but they are starting to raise concerns in the Mid-south where it is likely we see a record row crop production. They are in the middle of harvest in the southern regions and lo0ngterm storage is not their strong suit.

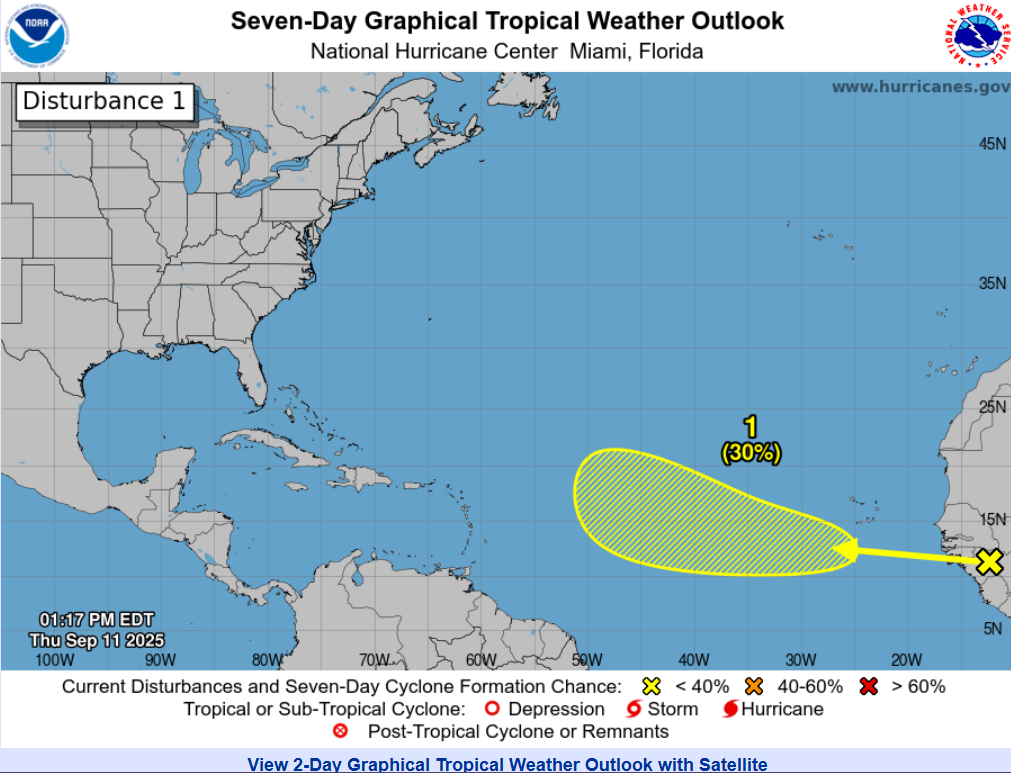

Chances of a Hurricane hitting the Gulf are still slim and likely more than 10 days out if at all possible.

Ethanol Production increased to 1.105 million barrels per day last week. This is the highest production in 12 weeks, beating expectations. Currently the USDA is projecting a 5.6 billion bushel usage.

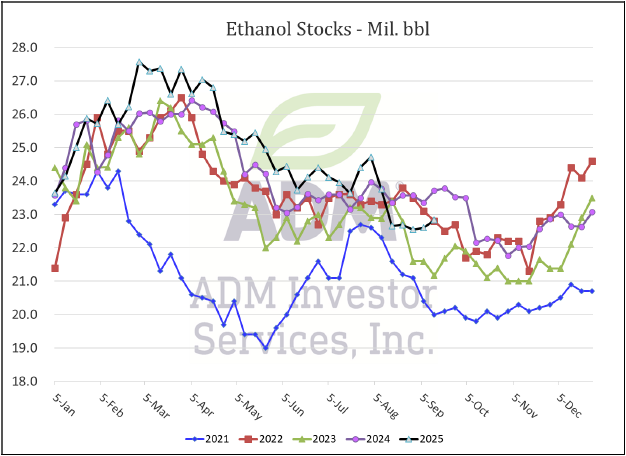

Ethanol Stocks inched higher this week. Now up to 22.89 million barrels. This was in line with expectations.

Weekly Export Sales

| Sales 24/25 | Est Range | Sales 25/26 | Est Range |

Wheat | na | na | 305,400 | 300K -650K |

Corn | na | na | 539,900 | 900K – 2.4M |

Beans | na | na | 541,100 | 400K – 1.6M |

Meal | 33,400 | 50K – 500K | 324,100 | 0 – 400K |

Soyoil | 6,400 | 0 – 16K | 0 | 0 |

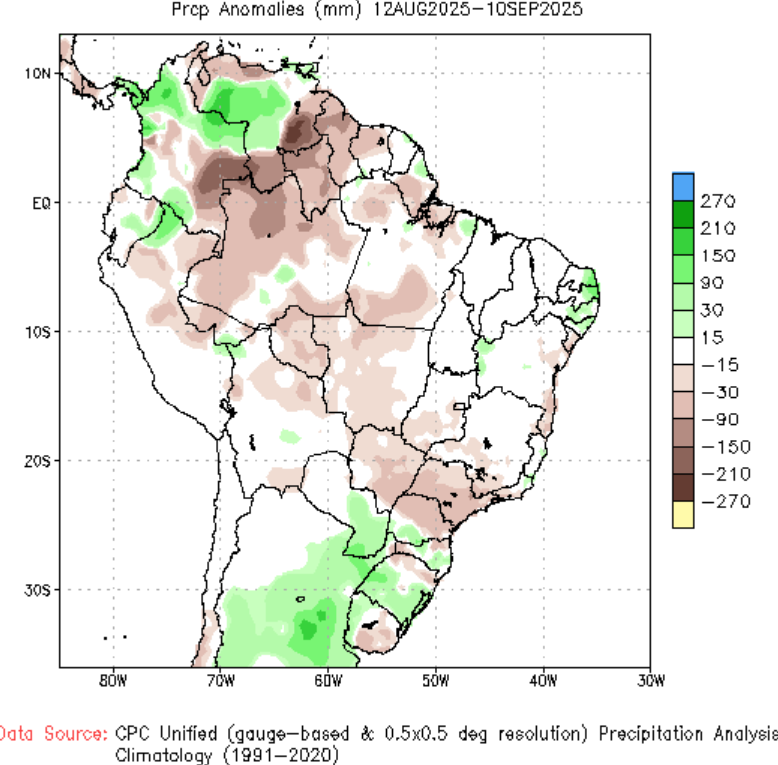

The Last 30 Days of SA Precip compared to Normal:

South America has been drier than normal over the last 30 days while their planting season gets underway. This morning, CONAB raised their 2025 Brazilian production forecast to a record 139.7 MMT of corn and 171.5 MMT soybeans.

Weather Outlook

Pointless Interest: The world’s largest silver nugget was found in Colorado.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.