OPENING COMMENTS

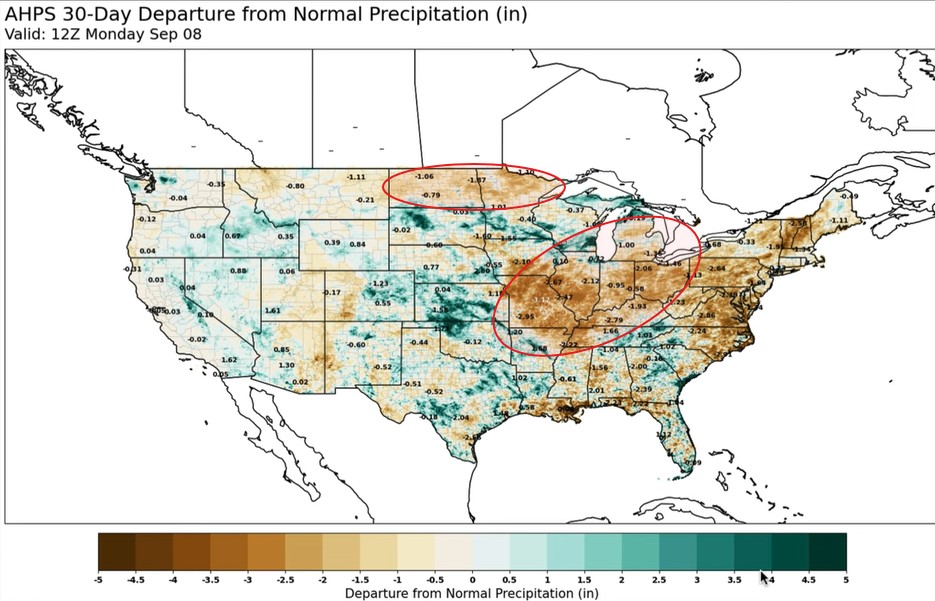

The Last 30 Days of Rain Compared to Normal

I have circled the areas that have had -1.5 to -3 inches less than normal rainfall. The Ohio River Valley is thirsty and the 7 day forecast is not helping that situation. I expect the lower Mississippi River to fall another 2 feet in the next 10 days.

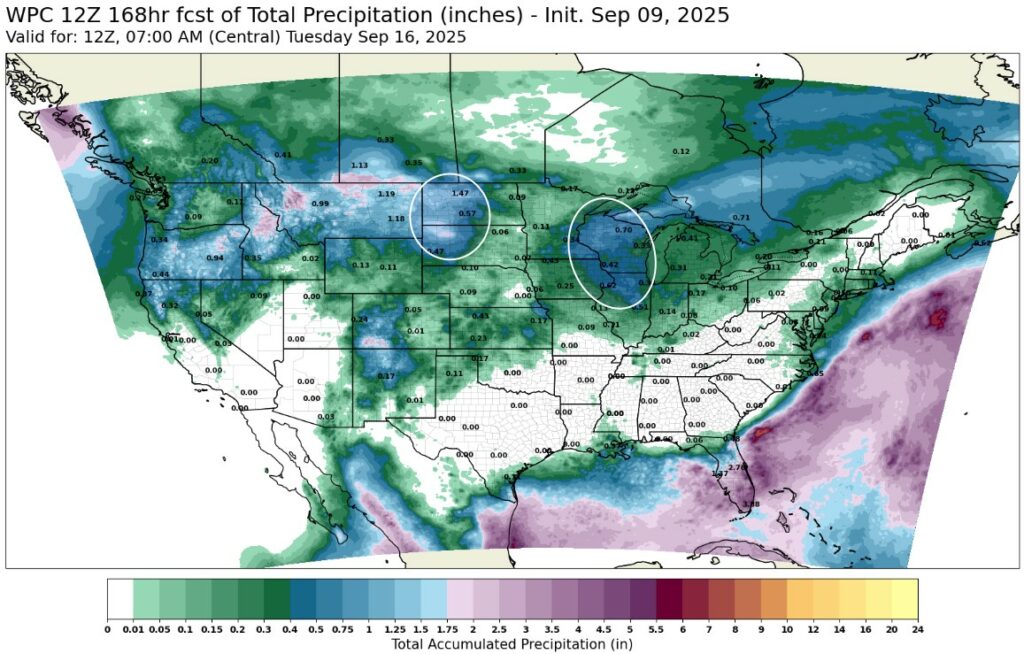

The 7-Day Rain Forecast really only have two areas (circled) that will get over a 1/2 inch of rain between now and Sep 16th.

The Nov-Jan Soybean Spread could firm if the dryness continues to drag bean yields in the Mid-south and southern Midwest. Missouri has been very dry. Yes, harvest pace will most likely be ahead of schedule (similar to last year) due to the recent flash drought. Additionally, hope is at all time lows for a China deal, this could be an opportunity to capture a few cents on this spread. If barges can’t hold full drafts, then it will be that much more difficult to satisfy the export commitments.

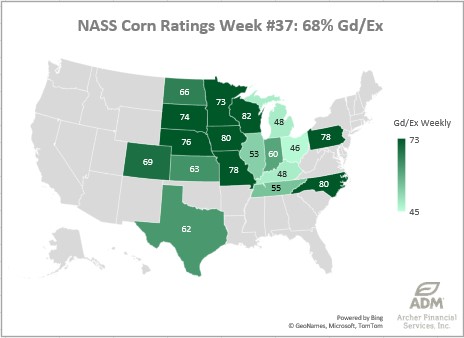

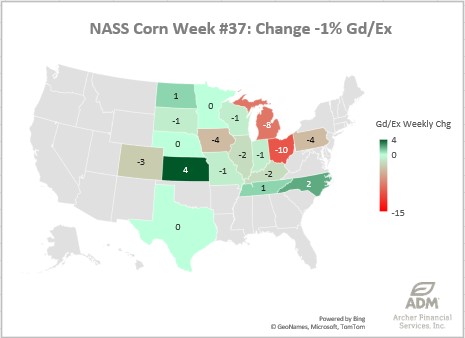

US Corn Crop Condition

Corn Crop Conditions fell -1% from last week to 68% good/excellent. There is only one state harvesting corn that is notably behind pace and that is Kansas. Everyone else is either on pace or well ahead. Tennessee is 28% harvested which is -1% behind last year’s pace but 15% ahead of the 5-year average. Kentucky is 8% ahead of the 5-year average at 18% harvested, and Missouri is 9% shelled which is 4% ahead of the 5-year average

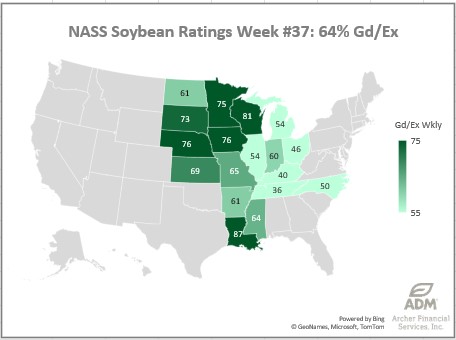

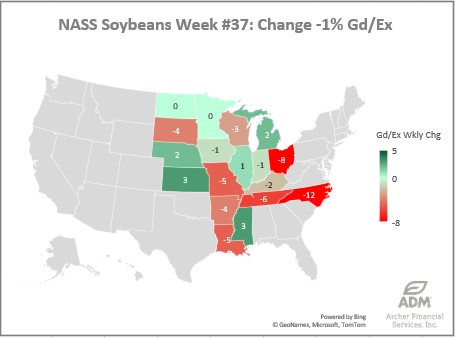

US Soybean Crop Condition (64%)

Soybean Crop Conditions dropped -1% in the last week to 64% good/excellent. Leaves are dropping at a pace -2% slower than last year. Dryness in the 7 day forecast may both worsen conditions cause more leaves to begin dropping.

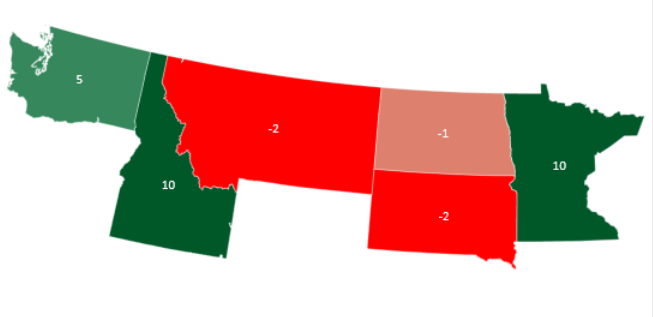

Spring Wheat Harvest Pace (85%)

The Spring Wheat Harvest Pace is 1% ahead of the 5-year average and 2% ahead of this time last year. Spring wheat harvest advanced 13% in the last week. Below is an imagine depicting the relationship between the current harvest pace and the 5-year average pace (%).

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.