CORN

Prices were steady to $.02 lower in choppy 2 sided trade. Spreads weakened. Dec-25 traded to a fresh 6 week high before pulling back. Next major resistance is at the 100 day MA at $4.30. Dec-25 needs to trade up to $4.32 ¼ to fill a chart gap from early July-25. While northern fringes of the Midwest experienced a light frost overnight, damage to this year’s corn and soybean crop is expected to be minimal. Its impact likely felt more so on quality than yield. Late yesterday StoneX lowered their corn yield 1.2 bpa to 186.9 however raised their production forecast 254 mil. bu. to 16.577 bil. as they adopted the higher USDA acreage est. from last month. Their current production forecast is 165 mil. bu. below the USDA forecast in Aug. At midday, S&P Global estimated US corn production at 16.768 bil. with an average yield of 189.1 bpa. This week’s exports at 72 mil. bu. (-11 mil.–24/25 MY, 83 mil.–25/26) were in line with expectations. Old crop commitments at 2.763 bil. are up 26% from YA, vs. the USDA forecast of up 25%. New crop commitments jumped to 823 mil. bu., up 86% from YA. Noted buyers were Mexico – 20 mil., Colombia – 19 mil. while unknown bought 13 mil. Argentine harvest has reached 99%.

SOYBEANS

Prices are mostly lower with beans off $.05-$.06 making lows into the close, meal was up less than $1 while oil was off 70 points. Beans spreads were mixed, meal spreads firmed while oil spreads weakened. Nov-25 closed back below its 100 day MA after rejecting trade below both the 50 and 100 day MA’s yesterday. Oct-25 oil barely held support above yesterday’s 3 month low. Oct-25 meal closed right at its 50 day MA. New crop board crush margins slipped $.01 to $1.61 ½ with bean oil PV slipping to 47.4%. Seasonally cool and dry conditions across much of the nation’s midsection over the next 7 days before a warmup by the middle of the next week. Dry conditions of late in the midsouth and parts of the ECB has led to a modest increase in drought readings, however they still remain at historically low levels. StoneX cut their soybean yield from 53.6 to 53.2 bpa. Their production forecast at 4.257 bil. is 35 mil. bu. below the USDA est. in Aug. S&P Global forecasts US soybean production at 4.306 bil. 12 mil. bu. above the USDA, with an average yield of 53.8 bpa. Soybean sales at 29 mil. bu. (-17 mil –24/25 MY, 30 mil. – 25/26) were in line with expectations. Old crop commitments slipped to 1.868 bil. up 12% from YA vs. the USDA forecast of up 10%. New crop commitments at 296 mil. bu. are down 32% YOY and represent 17% of the USDA forecast, vs. the historical average of 32%. Still no sale on the books to China. Soybean meal sales at 142k tons were below expectations. Bean oil sales were nearly zilch. The USDA also announced fresh sales of 328k mt (12 mil. bu.) to an unknown buyer. Soybean plantings in Brazil will begin later this month. Most acreage forecasts range from 1-2% above YA vs. the USDA est. at 48.8 mil. HA, up 3%. Agricultural loan delinquencies are near 4%, vs. 2.45% YA.

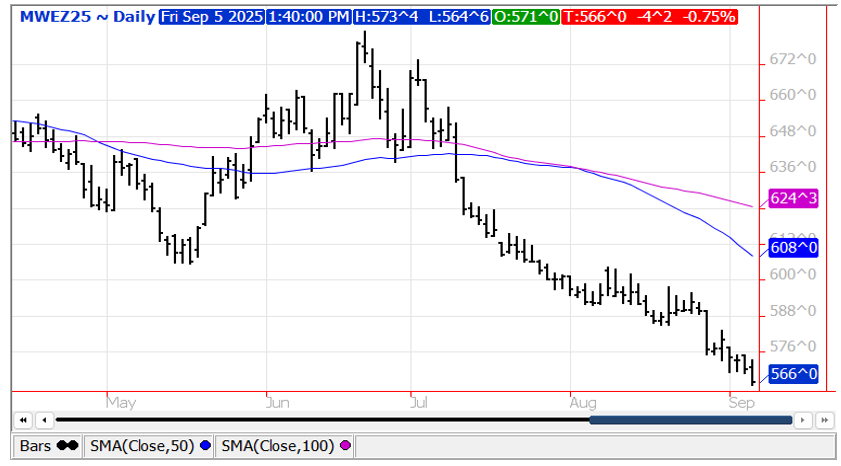

WHEAT

Across all three classes prices were steady to $.04 lower. All three classes experienced two-sided trade. Dec-25 MIAX closed into fresh contract lows. Exports at 11.5 mil. bu. were an 11 week low and below expectations. YTD commitments at 456 mil. bu. remain at a 5 year high up 22% from YA, vs. the USDA forecast of up 6%. By class commitments vs. the USDA forecast are: HRW up 108% vs. USDA up 38%, SRW up 3% in line with the USDA, HRS down 7% vs. down 4%, and white down 12% vs. down 14%. Ukraine’s wheat harvest has reached 22 mmt, vs. 21.8 mmt YA. Russia’s Ag. Ministry states their grain harvest has reached 100 mmt of the expected 135 mmt for their 2025 crop cycle. They also raised their wheat export tax 25% to 168.6 roubles/ton for the period ending Sept 16th. Recent rains are keeping Argentine crop prospects high as the BAGE reports 98% is in G/E health.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.