Geopolitics: President Trump threatens 100% tariffs on Russia and possible secondary tariffs on any country that trades with Russia. According to the report, Russia has 50 days to end it’s invasion of Ukraine before their trade partners are subject to “secondary tariffs”. Alongside this leverage against Russia, the US has recently sent military support in the form of billions of dollar worth of weapons and equipment. Trump made a similar move against countries who buy Venezuelan oil and gas as well as Iranian oil.

Macroeconomics: The dollar index is at it’s highest level this month, just above 98.00 on the index. There is still downside risk with tomorrow’s CPI data coming out at 7:30am CST and PPI data releasing Wednesday morning at 7:30am. Both CPI and PPI are anticipating an increase of 0.3% month over month which is triple to June print of 0.1%. These two releases this weak could set the tone for the next leg in the equity market. Additionally we have 15 days until the Fed meeting announces federal interest rates which have a 5% chance of decreasing 0.25 basis points as of today. Bitcoin also hitting all time highs says alot about both adoption, institutional investment and the unattractiveness of the dollar. JP Morgan’s CEO Jamie Diamond called bitcoin “stupid” when it was under $6K/BTC. Up nearly 2000% since then. Of course If I owned a major public outhouse, I would be shaming those installing indoor plumbing in their homes too.

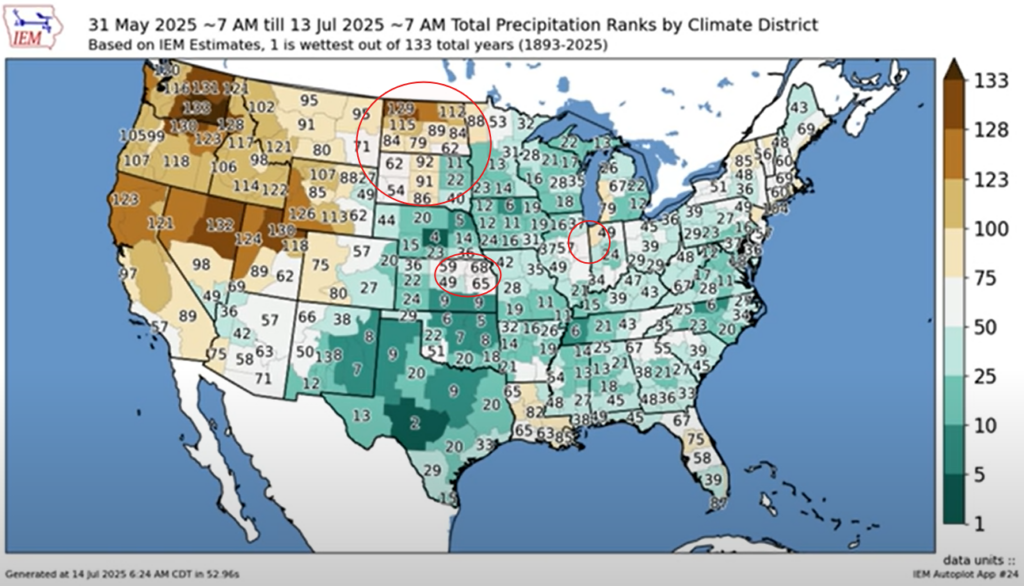

June 1st Thru Today: Total Precip Ranking of the last 133 years. The Problem areas circled in red are still receiving some rain, just not as much as the rest of the growing regions.

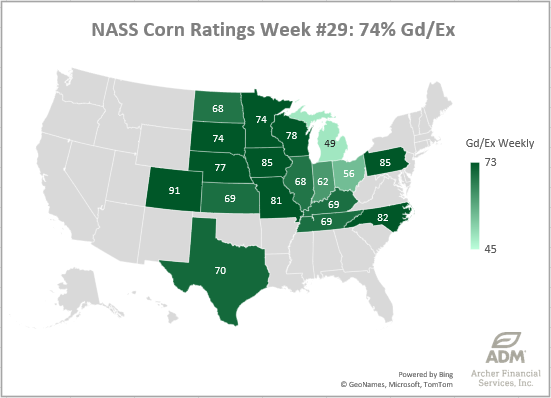

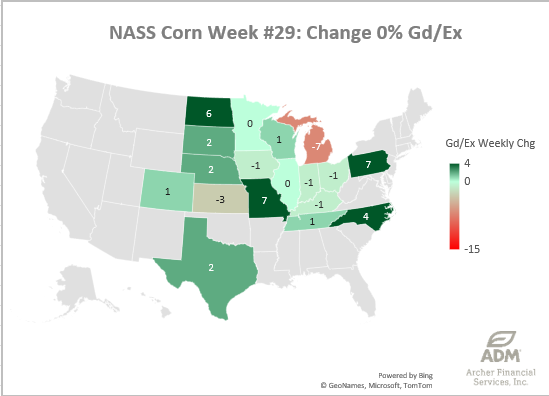

US Corn Crop Condition (74% gd/ex) (No Change)

The outer edge states seemed to have reported the largest changes, mostly higher with Michigan losing 7% good/excellent. Iowa and the surrounding sates all receiving outstanding condition ratings for this time of year

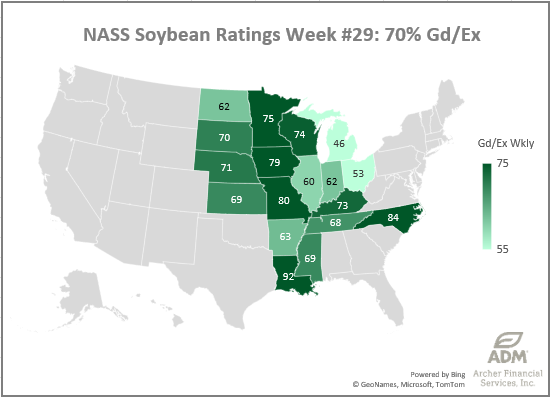

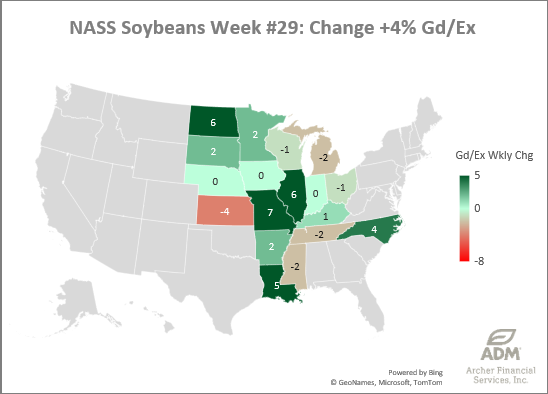

US Soybean Crop Condition (70% gd/ex) (+4% Change)

Missouri, Illinois and the northern plains boosting this week’s soybean crop conditions +4% to 70% and I doubt this is as good as it gets. Ohio and Michigan are trailing the rest of the country, but there is still time for full recovery.

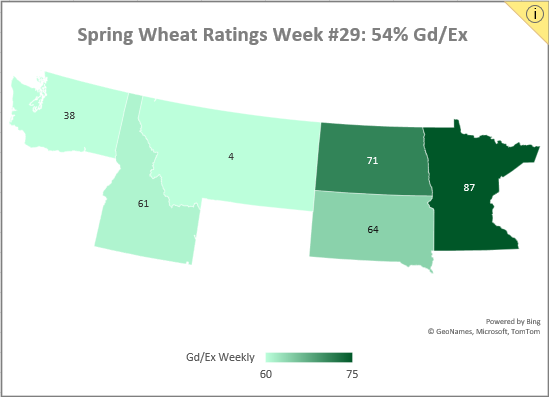

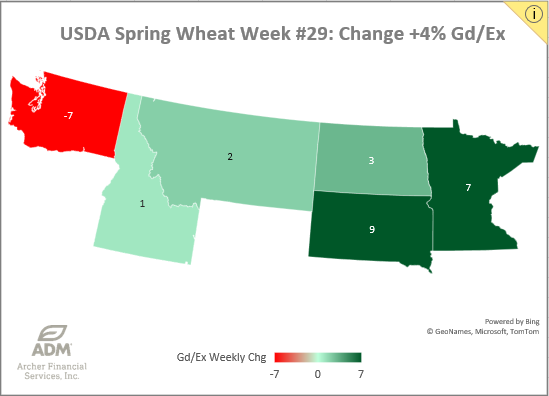

Spring Wheat Crop Condition (54% gd/ex) (+4% change)

USDA gives Minnesota back it’s 7% this week that it took away last week. There shouldn’t be too much argument here. Minnesota planted everything early and on time with ample rain to start this summer. The PNW has been dryer than normal.

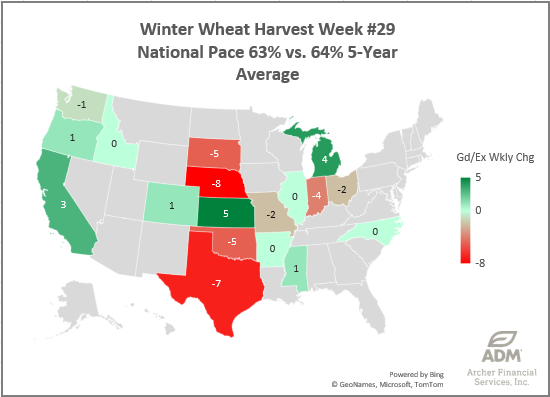

Winter Wheat Harvest Progress (-1% behind the 5-year pace)

Winter wheat harvest progresses 10% to 63% done. that is -1% behind the 5-year average pace. Kansas leading the way for the wheat belt.

|

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.