Ag Fundamentals: Weather is king. Looking back over the last 3 months, the mid south and southern Midwest has provided a bucket of protection against drought for the rest of the US growing ares. Storms are carrying across southern Indiana and Ohio today (the potential problem areas getting moisture). More rain is coming over the next 14 days and because the ground is already saturated, it will likely come to fruition. Northern North Dakota may by one of the only areas I see issues, but they will probably receive close to an inch or more in the next 10 days. Last year August and early September were dryer than normal and yet we still produced a sizable crop. Yields above trend line are more likely than not, but how high above trend? 1%-3% puts you around a 183.5-185 bu yield on corn which holds production at or above 16 billion. The USDA may not touch yields on Friday, and if they don’t consider it a gift. The forecasts were wrong about the last month and they could be wrong about Aug/Sep being below normal precip. Even if we are bone dry in August, I’m not convinced it will make much difference unless fertilizer drag throws a wrench in. China demand is set to decrease, but they are seeing some dryness creep into their growing areas. Despite this, Brazil crop production estimates probably increase to offset the global needs. If anyone is still penciling profits for corn in the US, take some profit. This is primarily for those who have difficulty storing grain until next spring. Spreads likely to widen to higher carries. |

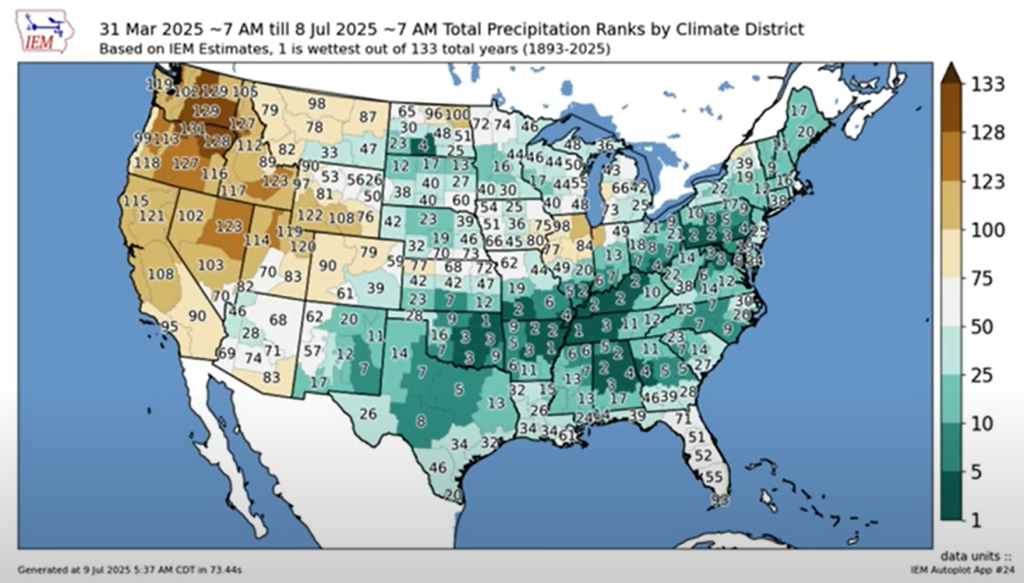

133 Year Precip Ranking from March 31st – July 8th

This spring, the mid south and lower Midwest experienced near record rains while most of the growing areas saww average to above average levels.

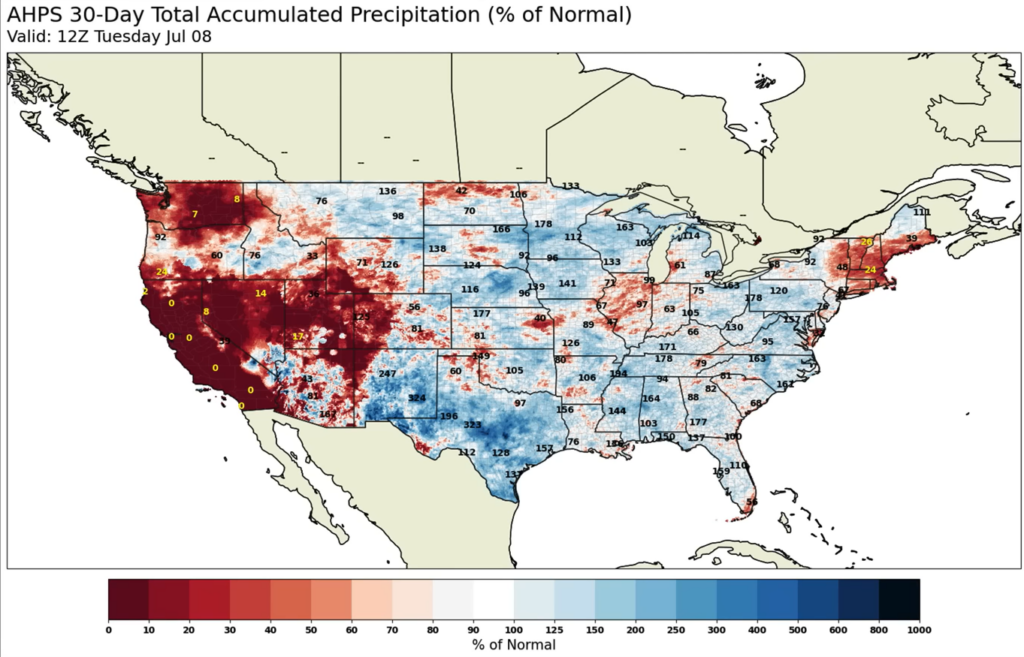

Last 30 Days of Precip Compared to Normal

The only areas I see cause for concern are northern North Dakota, and a pocket in eastern Kansas. North/central Illinois just received rain yesterday to cover most of it’s red areas and they will see more moisture over the next 14 days.

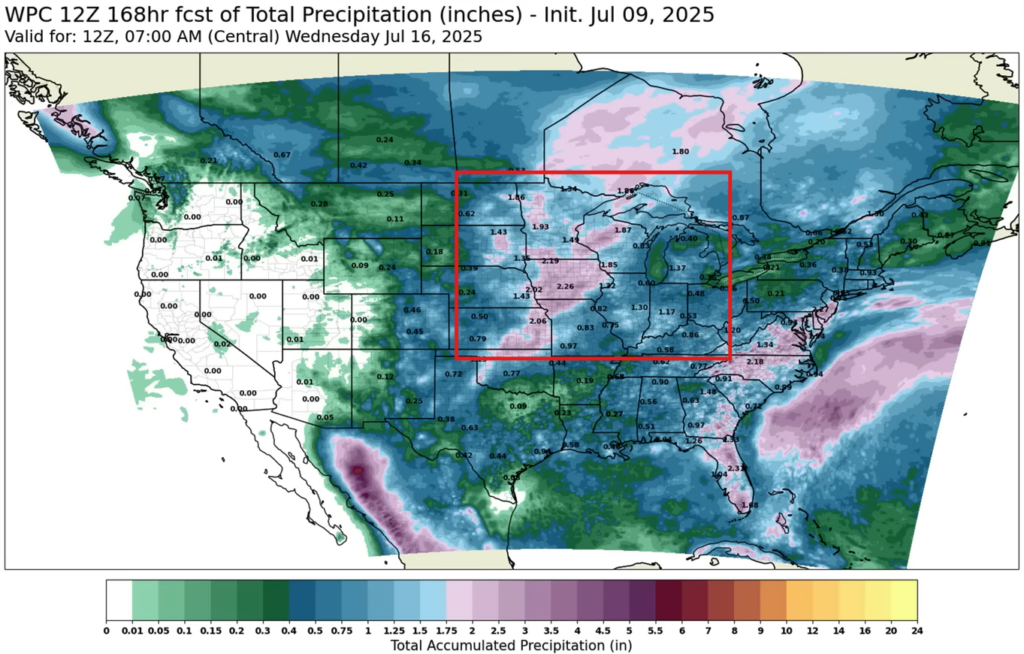

Next 7 Days. More rain. Dry in the Delta, which isn’t a bad thing. I am also betting week 2 also sees more moisture too. Following the month of July, the Us will not need much more rain to produce a bumper corn crop. (Despite the fertilizer lag)

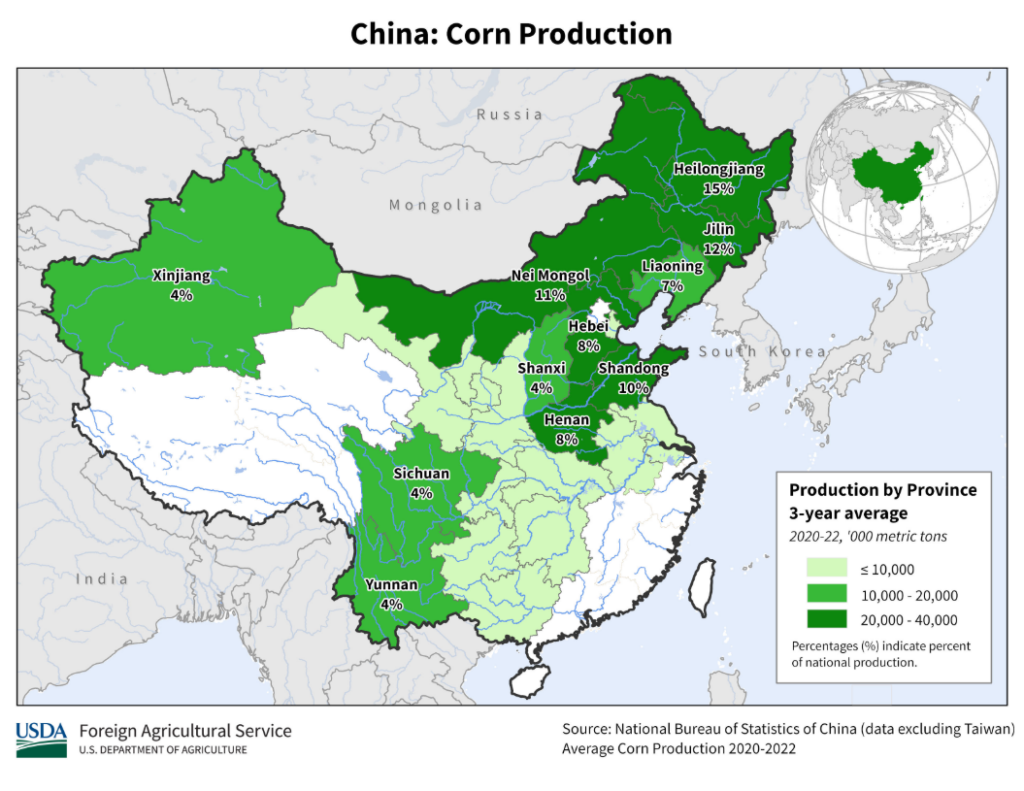

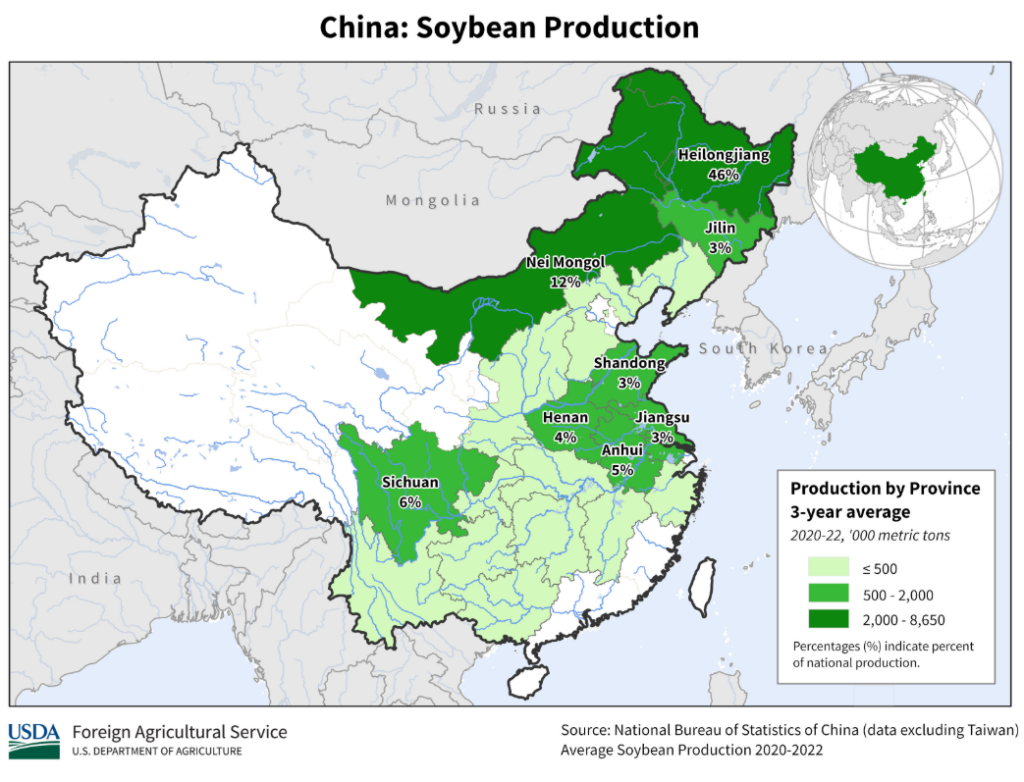

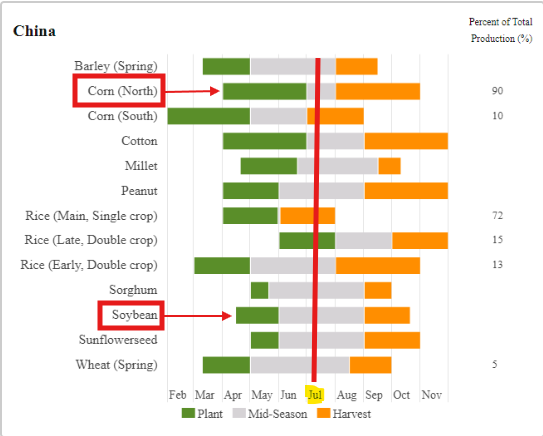

China Crop Schedule:

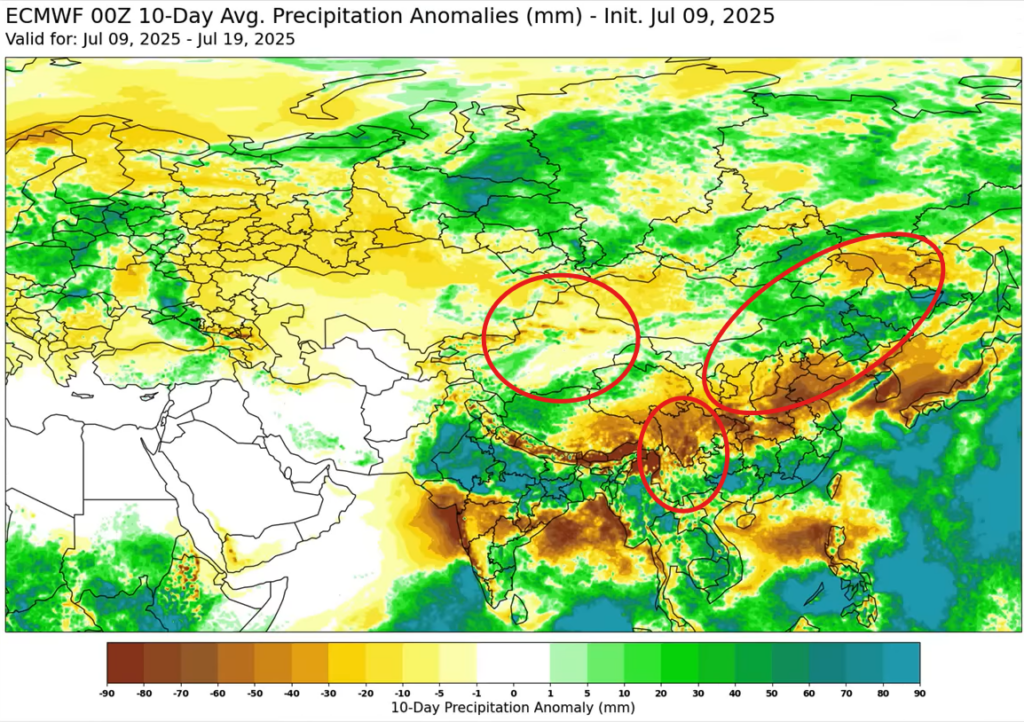

China 10-Day Precipitation Anomaly Map (now-July 19th)

Mixed bag for the Chinese crops which are in beginning growth stages. Plenty of rain in the north where most of their crop is grown, south ans east is dry, but they are expecting some activity to develop off the east coast.

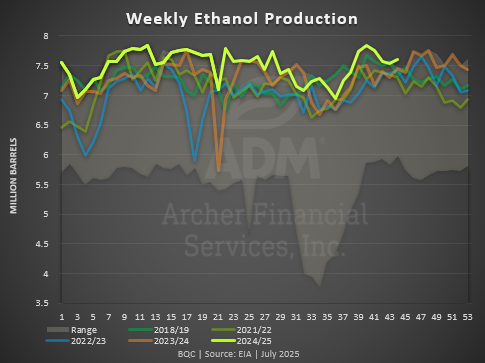

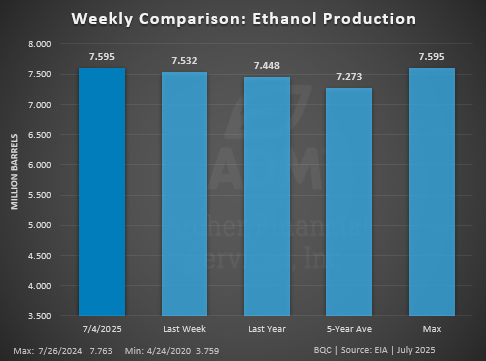

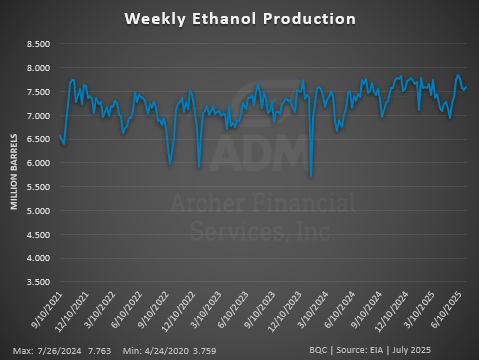

EIA Weekly Ethanol Production (for week ending 7/4/25)

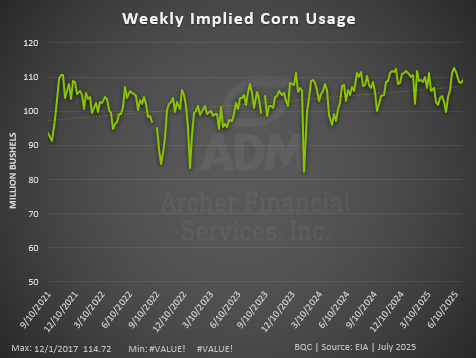

Ethanol Production came in above expectations at 1.085 million barrels per day (319M gal/day). That is 3% higher than this time last year and sets a new record for this week of the year. Production tends to drift downward through the end of the marketing year from here. Expectations are that the USDA leaves corn usage unchanged Friday.

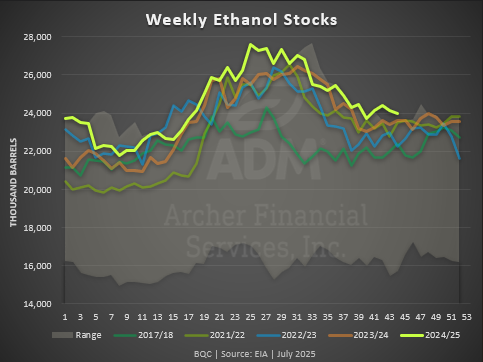

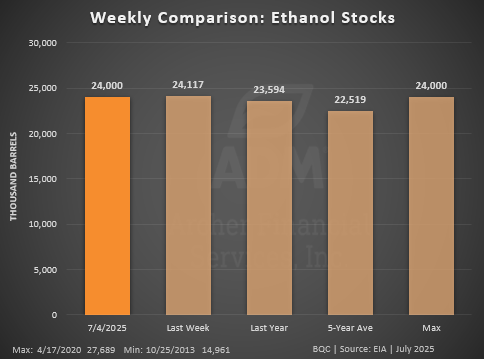

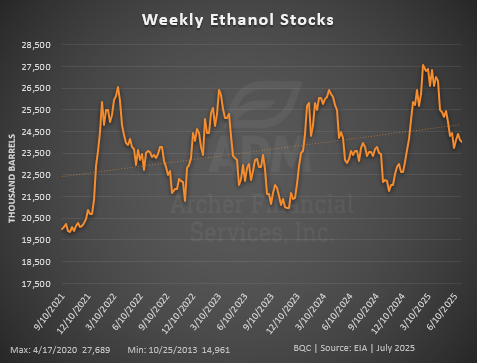

EIA Weekly Ethanol Stocks

Ethanol Stocks was in line with expectations, slightly lower than last week at 24M barrels. It is a new high for this week of the year.

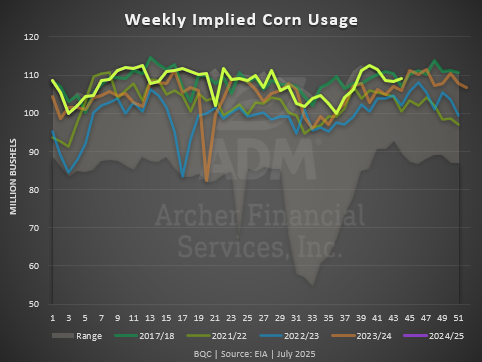

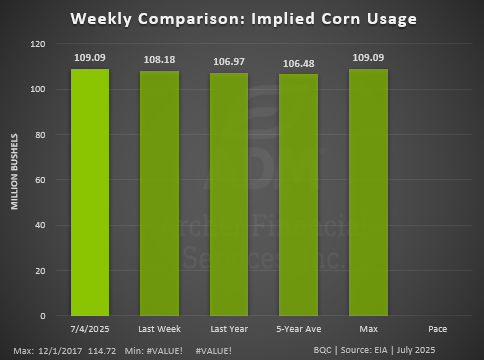

EIA Weekly Implied Corn Usage

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.