OPENING COMMENTS

Geopolitics:

Russia strikes Ukraine’s city of Kyiv in response to the recent drone strikes on Russian warplanes by Ukraine. 407 Russian drones, 40 cruise missile and 6 ballistic missiles were reported by the Ukrainian Air Force. This is the second largest assault by Russia since their recent 500 drone strike last weekend. President Trump has not commented on whether he will be putting more pressure on Russia to come to an agreement. A ceasefire seems about as far away as it has ever been.

Macroeconomics:

Today’s job market reports were friendly to both the equities and possibly the countries sentiment regarding the possibility of recession. Unemployment rate remains at 4.2% as expected. Prior to the report, the market was slightly more pessimistic about the non-farm jobs added due to tariffs and companies being slow to hire while others trimmed their workforce to cut costs. Regardless, non-farm payrolls were higher than expected but still trending lower from 2022 peak. Wages were up 0.4%, slightly higher than expected. The Federal Reserve is still projecting caution and the market is pricing in a near 0% chance the Fed moves interest rates in 12 days (June 18th).

Ag Fundamentals:

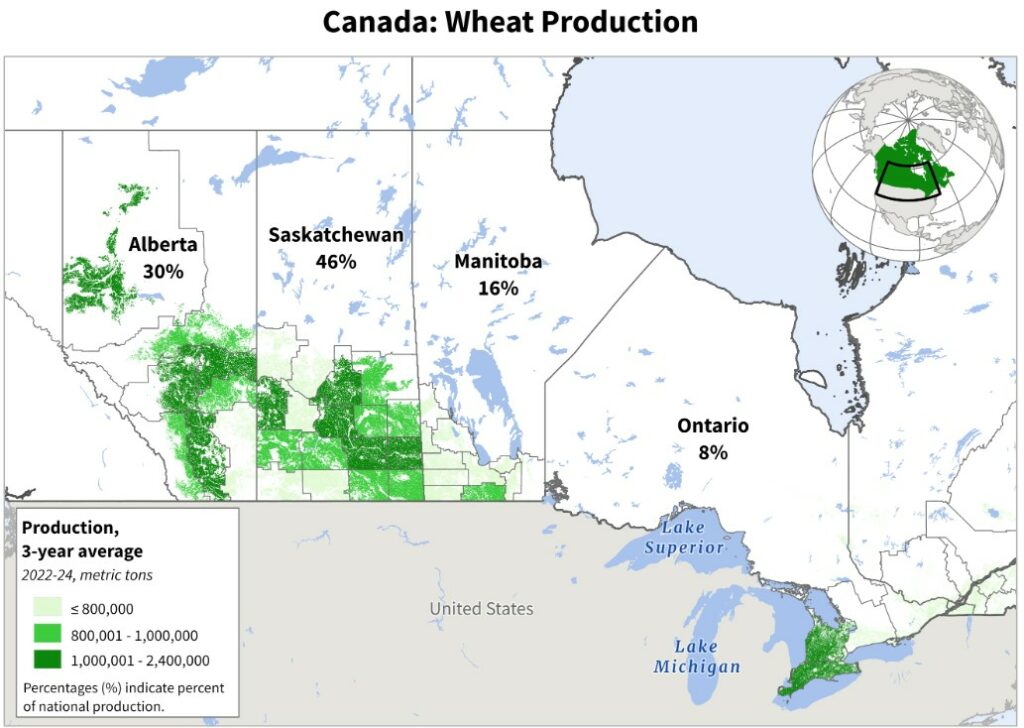

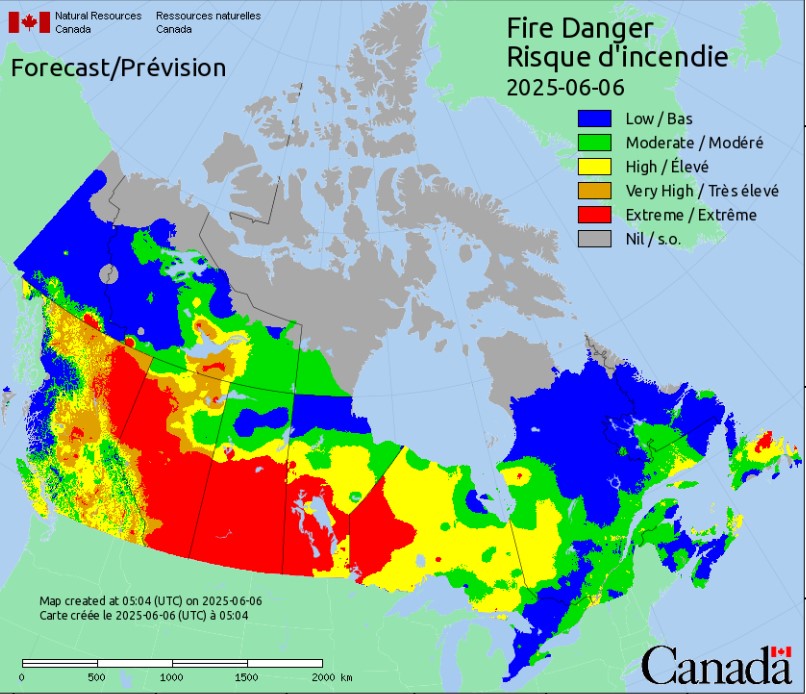

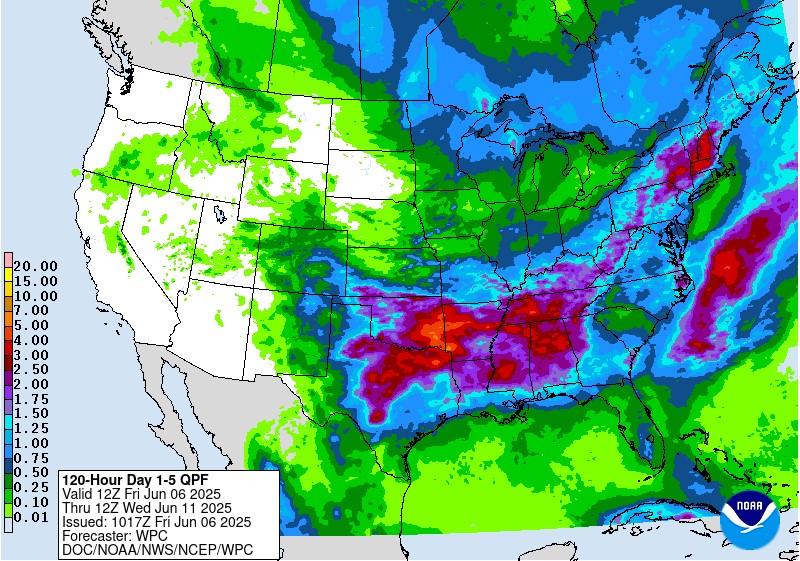

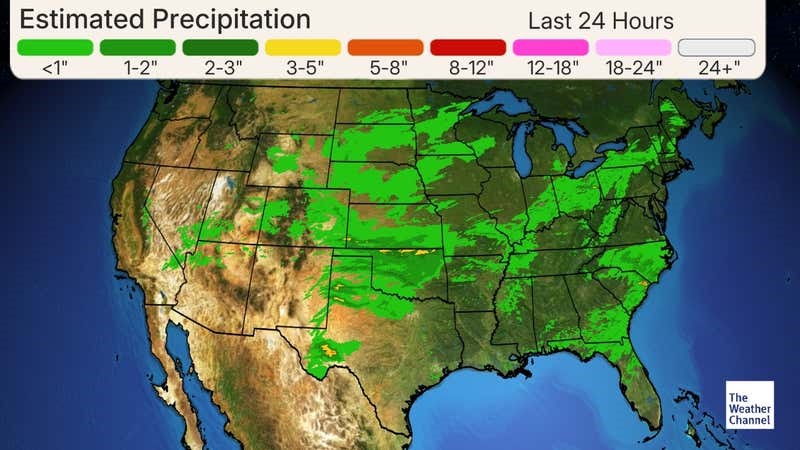

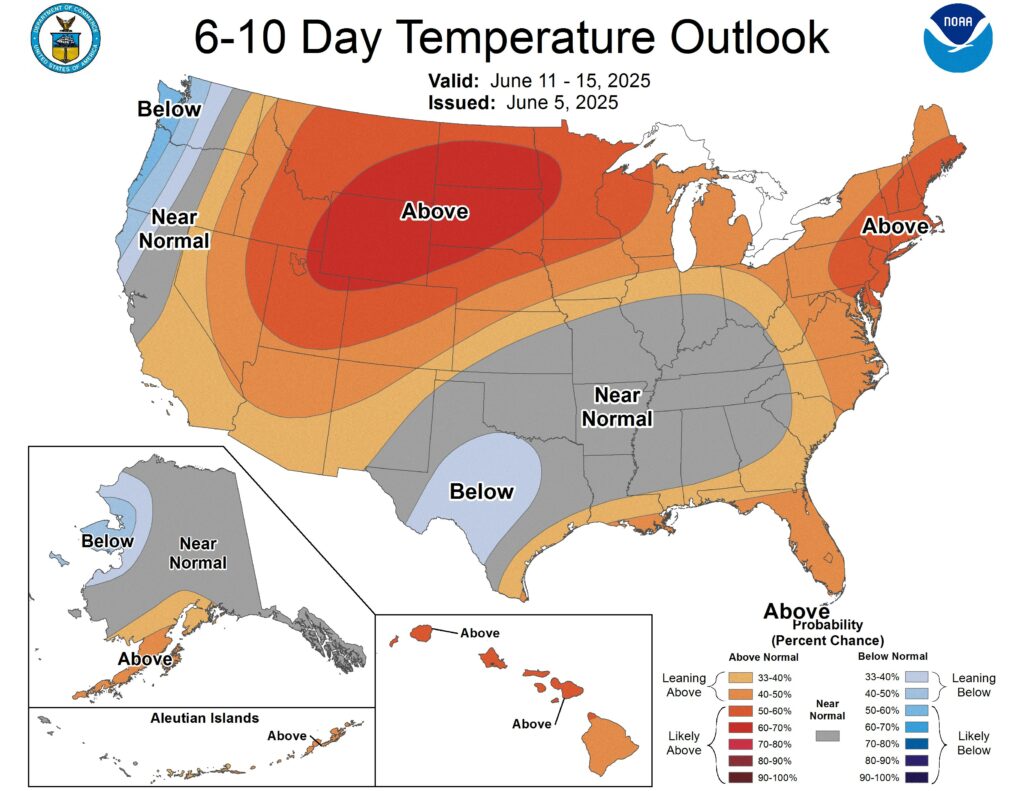

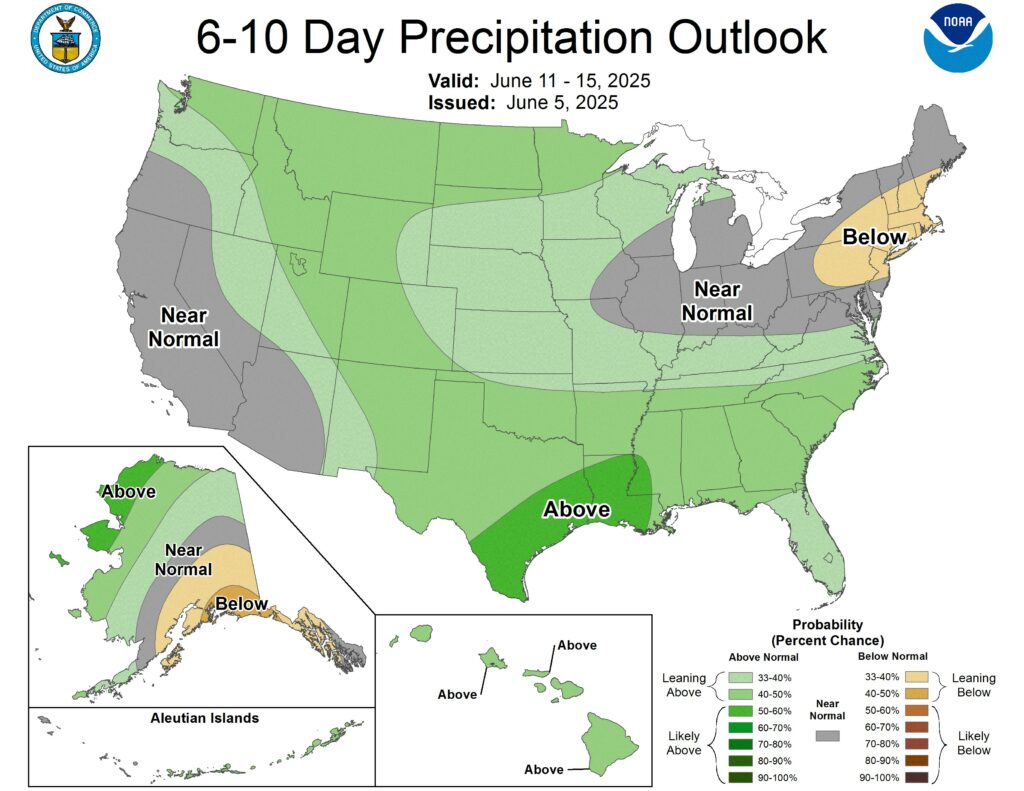

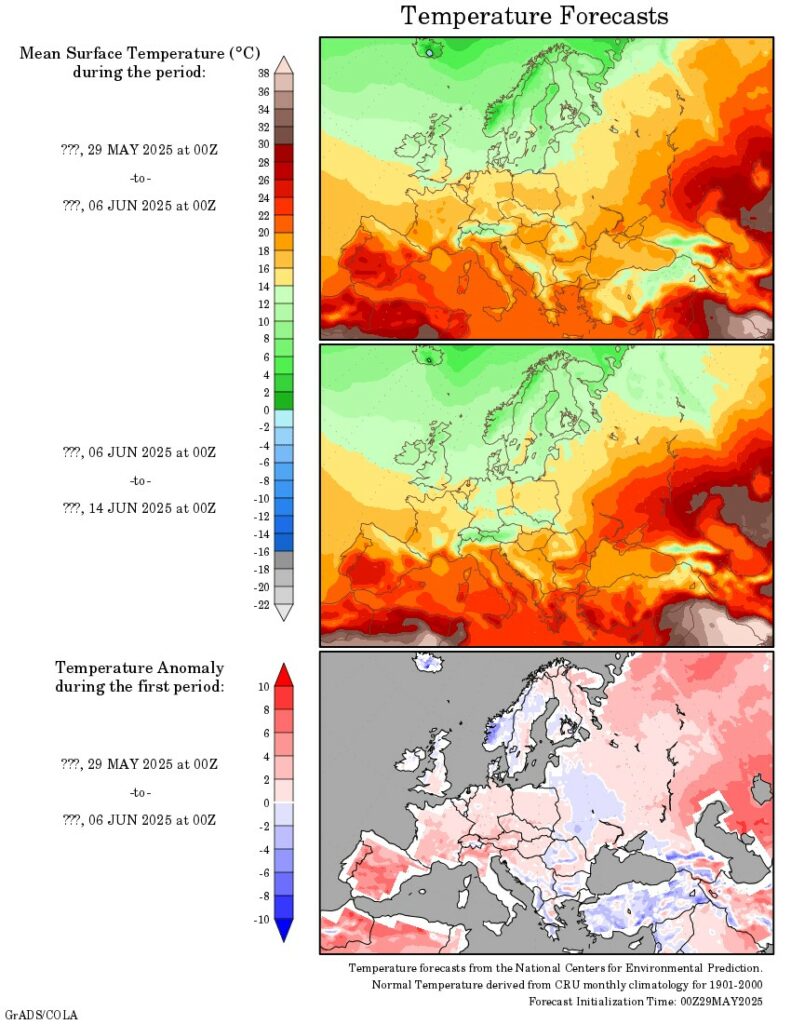

The USDA WASDE Report is less than a week away as grain markets continue to trade on war and weather. Demand is strong enough now that any sort of supply shock would allow row crops to rally. Debates over corn acres shifting to either beans of prevent plant in the eastern corn belt will continue until the USDA makes adjustments. They are likely to remain conservative in next week’s report and the more accurate estimates may not come until July. Corn exports are expected to rise, and ethanol usage remain 5.5 billion bushels or better. Soybeans could see additional acres, and I doubt we see a breakthrough in biofuel policy anytime soon. The southern half of the country will see precipitation over the next 5 days, leaving room for more dry condition concerns for the central Midwestern farmers. Canada’s wildfires are still causing a haze to sit over much of their wheat while keeping temperatures lower than normal. We are starting to see concerns of lacking growing degree days in the northern plains and Iowa.

Unemployment Rate remains at 4.2% as expected; while US payrolls increase 0.4% (+0.1% better than expected) and non-farm employment added 139K new jobs (15K better than estimate).

Active Wildfires in Canada

Extreme Danger Areas stretch from northeast British Columbia, cover most of Alberta, the southern half of Saskatchewan and into Manitoba and western Ontario.

Week-Over-Week Drought Change shows areas of northwest IL, southeast IA and northeast MO are slightly dryer while the wheat belt overall saw an improvement in drought conditions.

Export & World News

South Korea bought about 326K MT of corn (animal feed corn) from multiple sources in three separate international trades.

Malaysian palm oil futures were up 15 ringgit overnight, now at 3918.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

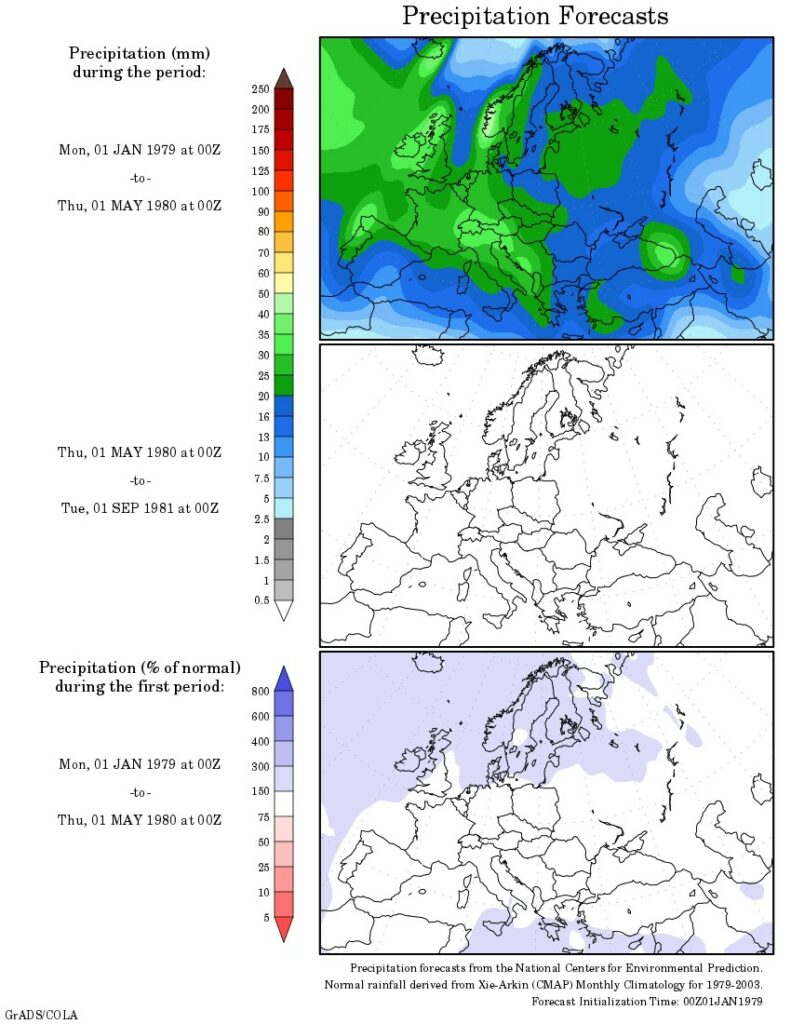

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.