OPENING COMMENTS

Geopolitics:

Talks between the US and China begin today in London to hopefully defuse tensions between the two nations. Rare-earth minerals and the exchange of advanced chip technology will be the main talking points to start. China seems to be loading up on soybeans as they set a new record for soybean purchases in the month of May, 13.92 million MT. Brazil is now their largest soybean supplier. The deadline for a deal between US and China will be mid to late August before the 90-day tariff grace period is removed.

Ag Fundamentals:

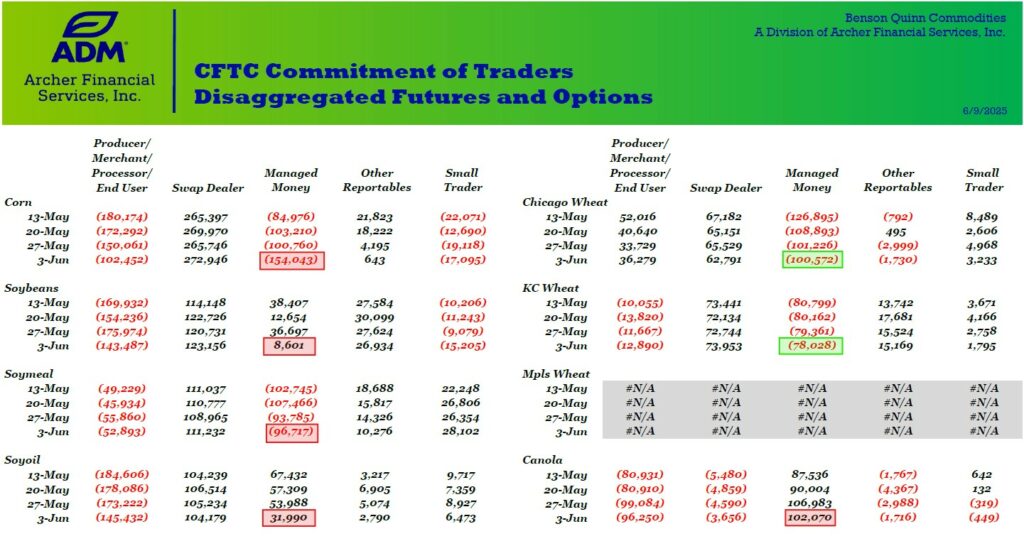

The Commitment of Traders Report out on Friday afternoon showed money managers extending their short position in corn, and soymeal, while selling length in their soybean, soyoil and canola positions. Money managers covered a small amount of shorts in both KC and Chicago wheat. If we see a reduction in acres in the eastern corn belt with more than expected prevent plant or swaps with bean acres, they may need to unwind this aggressive corn short position which would cause a brief rally in corn. US weather will be the main focus for the next couple months. The USDA will release their June WASDE report on Thursday June 12th at 11:00am CST. US production is not expected to change from last months estimates. Even though a 181 corn yield and a 52.5 bu/acre bean yield seems optimistic. Both ethanol and export business has been better than expected for corn over the last month. There is still hope of a new biofuel policy boosting the domestic demand for soybeans here in the US, but nothing established yet.

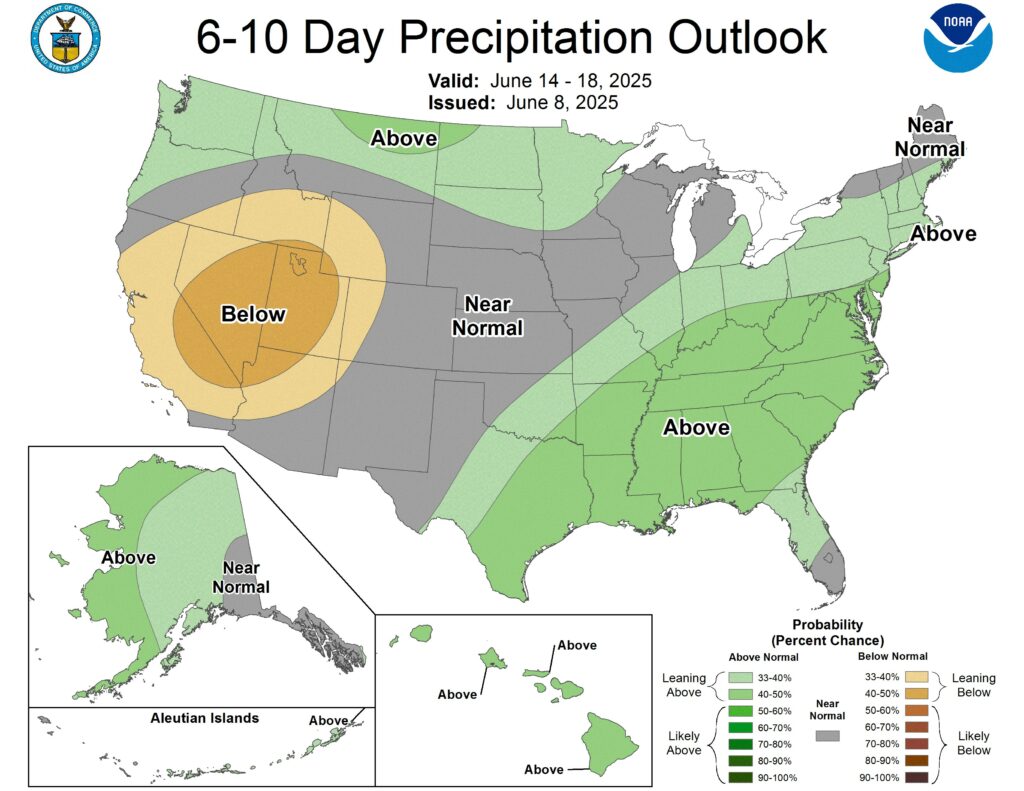

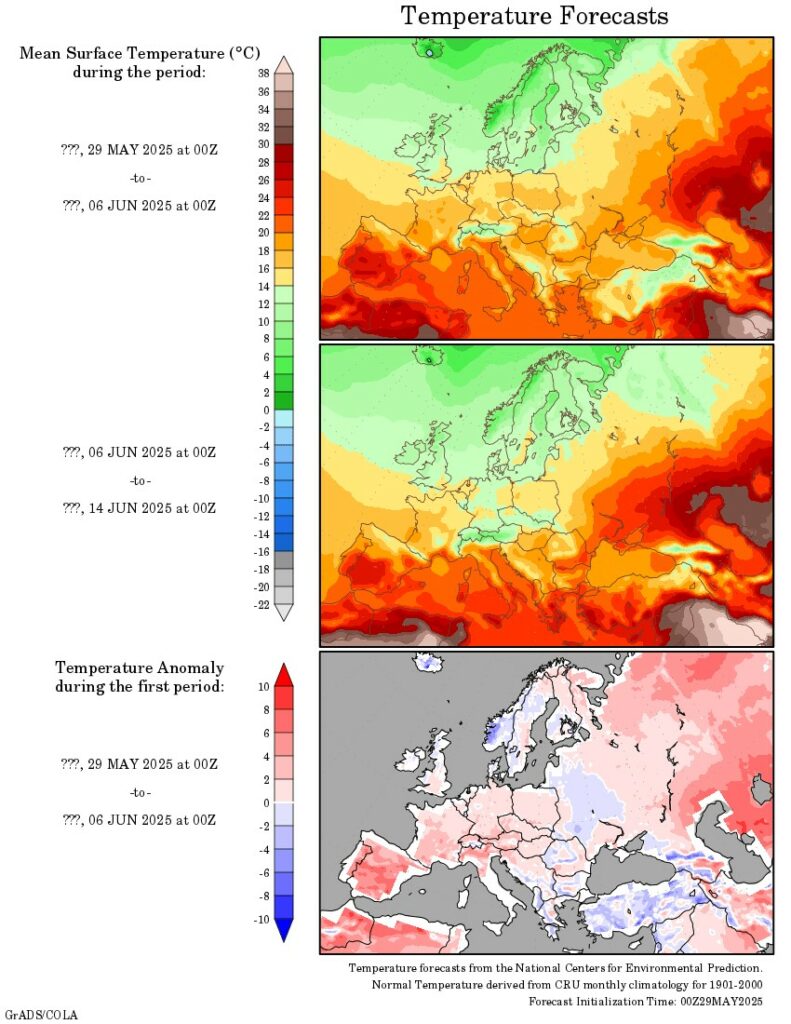

Weather:

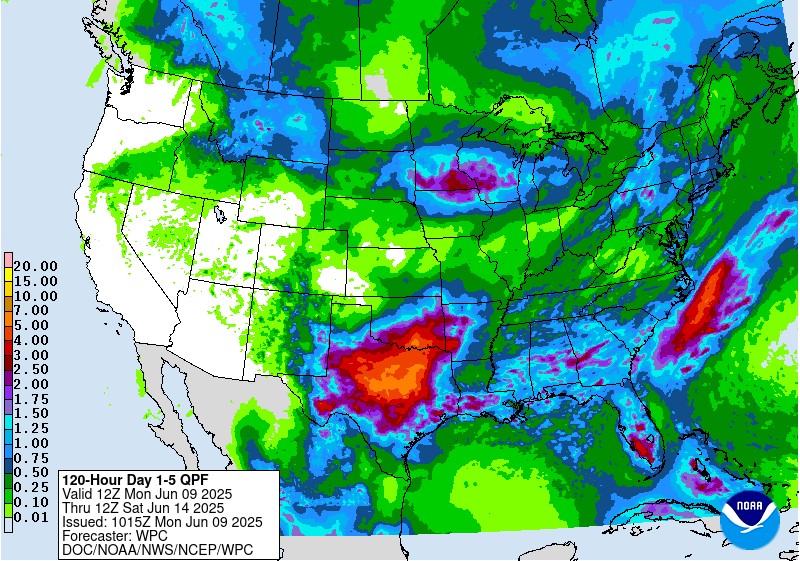

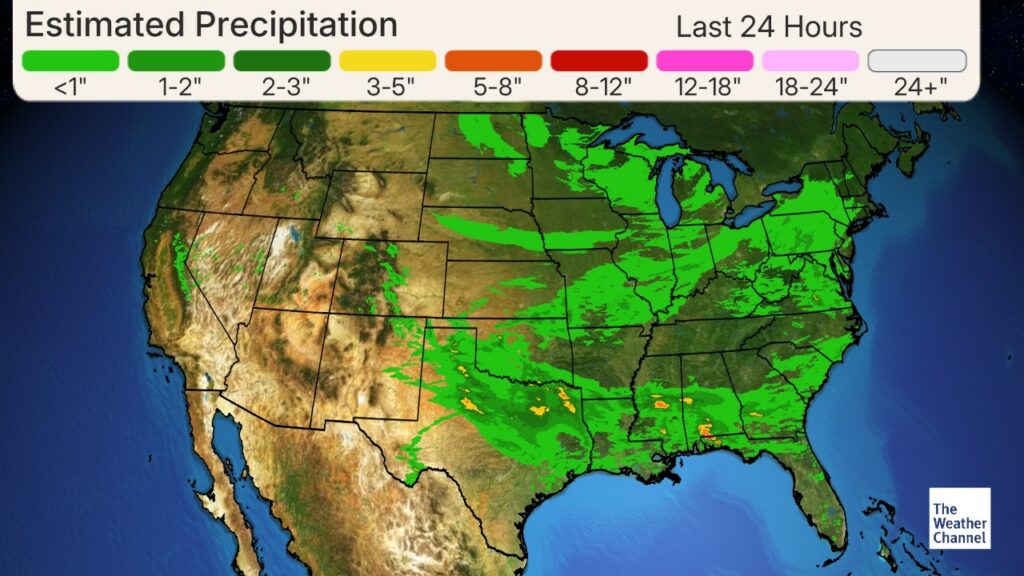

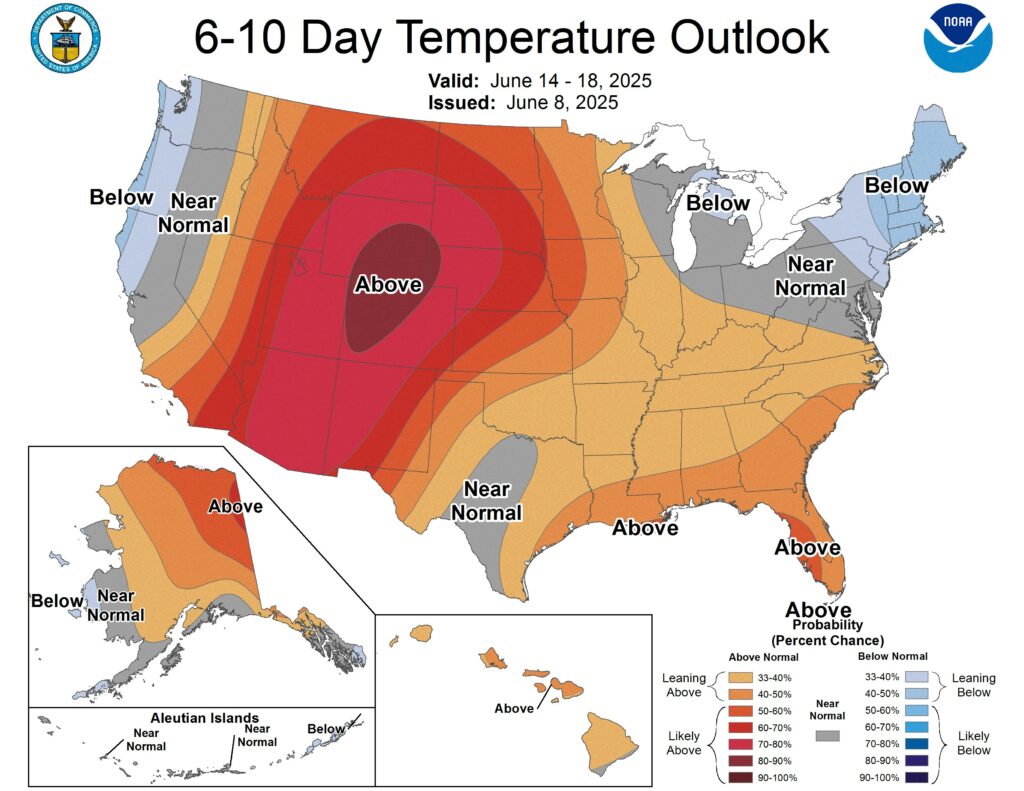

Northern Iowa and southern Minnesota/Wisconsin are expecting rain this week. Texas and Oklahoma are going to get hit the hardest with up to 4-7 inches of rain expected. warmer temps are creeping their way in from thew west into most of the Midwest. Growing degree days are playing catch-up from the colder than normal start to the growing season.

The CFTC Commitment of Traders Report

Change in Managed Money Positions

Corn: -53,283

Soybeans: -28,096

Soybean Oil: -21,998

Soybean Meal: -2,932

Chi Wheat: +654

KC Wheat: +1,333

Canola: -4,913

Export & World News

China has imported a record 13.92 MMT of global soybeans in the month of May. Most of this tonnage came from origins outside of the US.

Malaysian palm oil futures were up 8 ringgit overnight, now at 3925.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

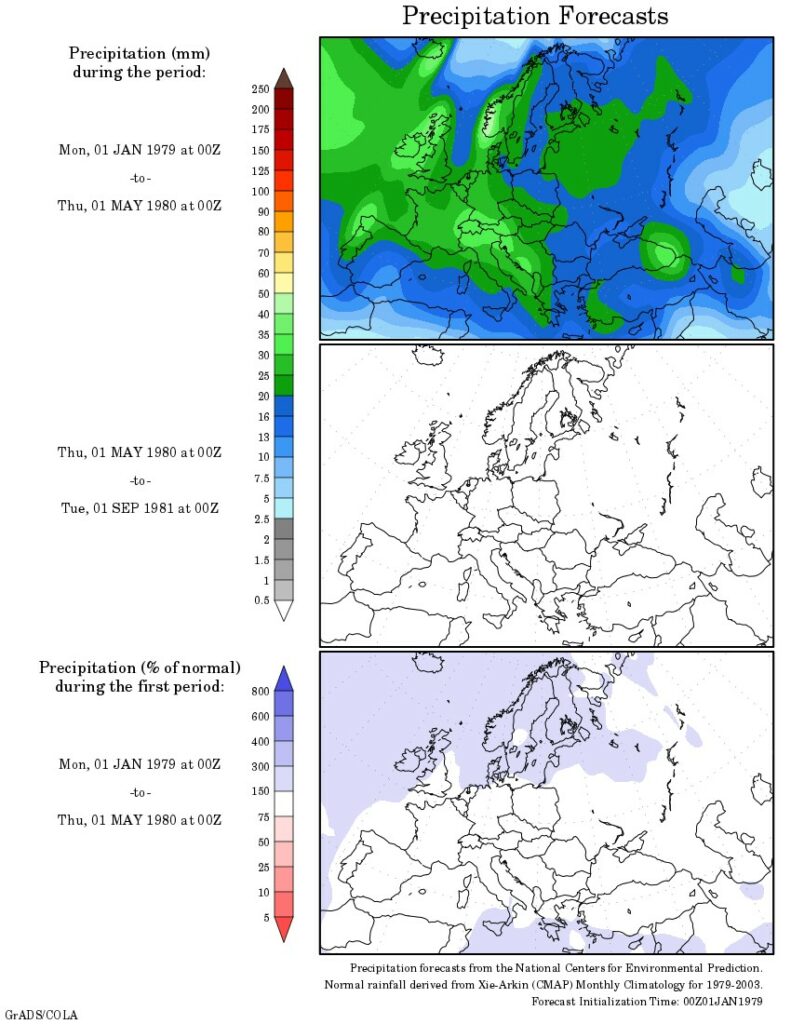

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.