OPENING COMMENTS

Geopolitics:

Reuters reported this morning that President Trump and China’s leader Xi held a phone call. No details were reported about the subject matter, only that President Trump requested the call.

Ag Fundamentals:

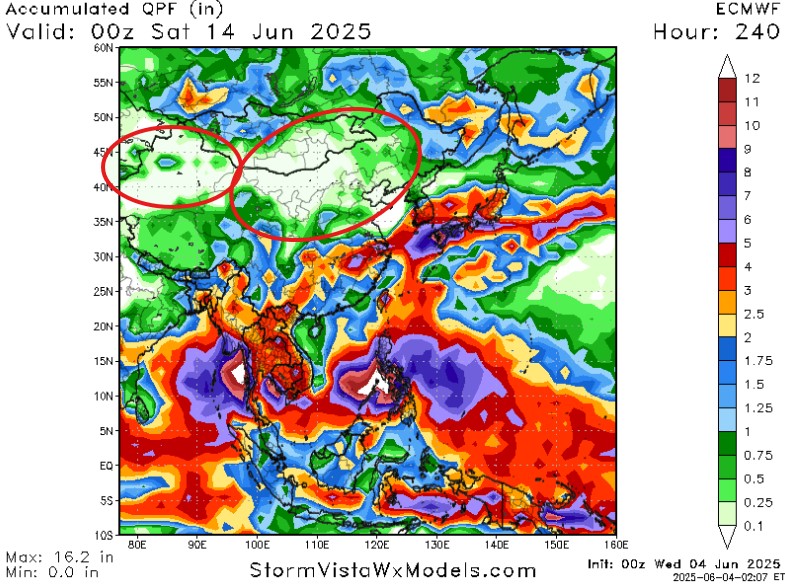

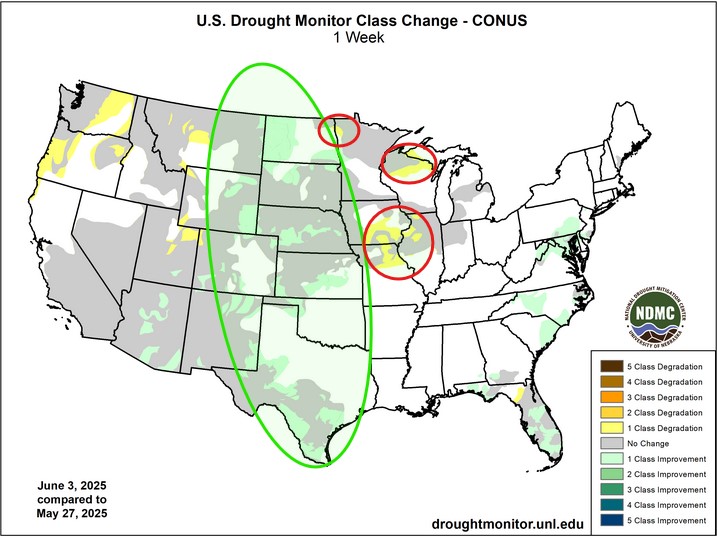

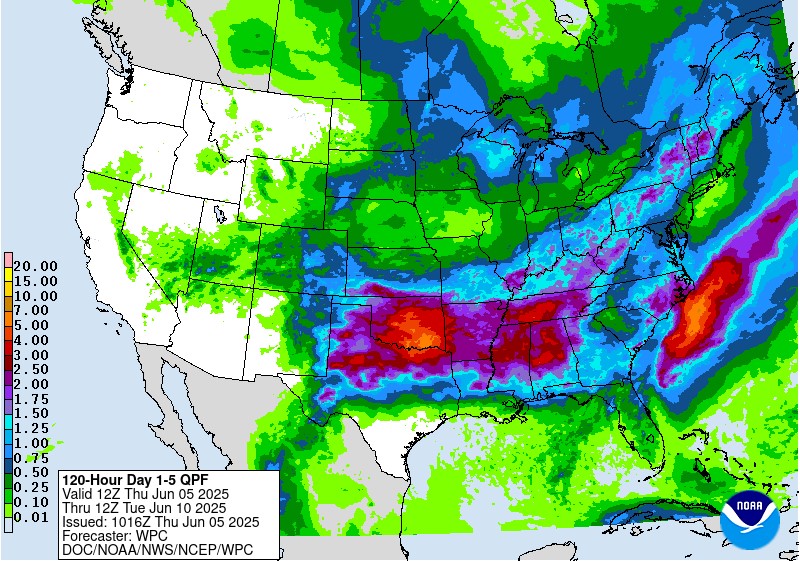

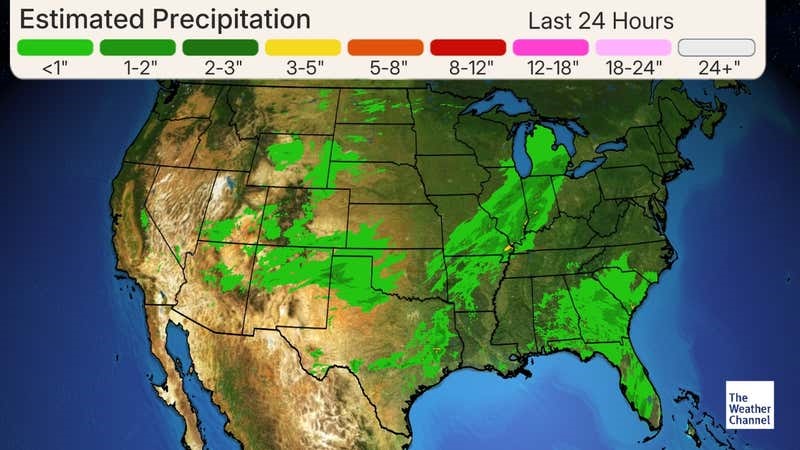

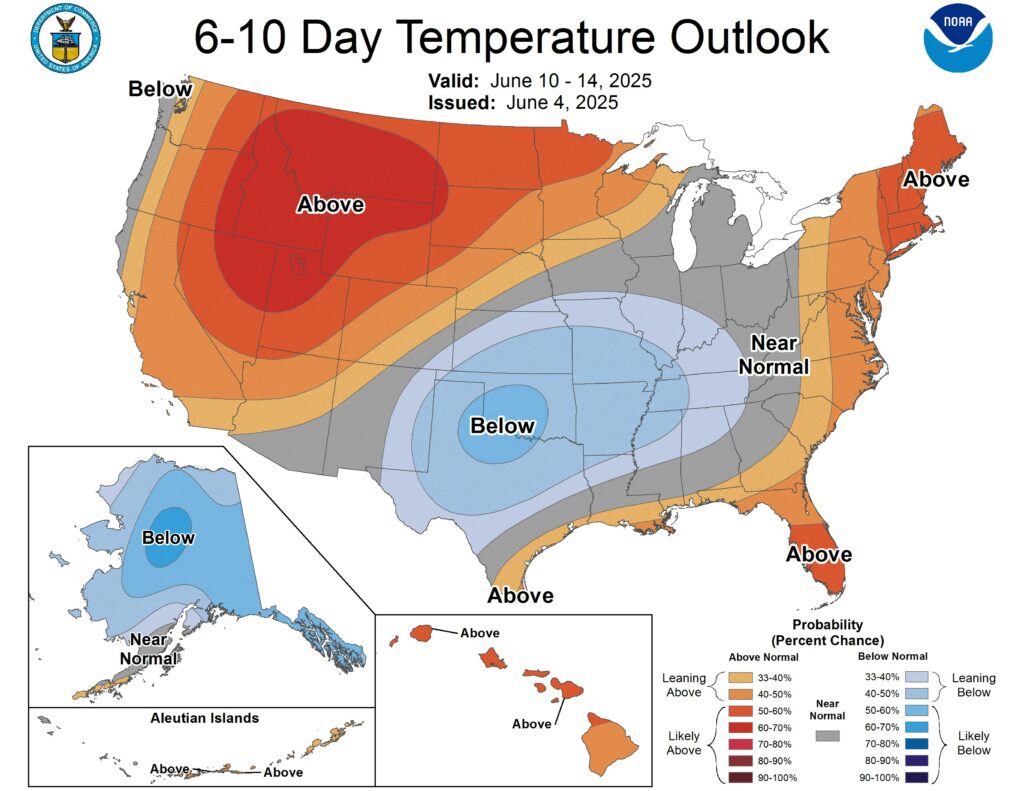

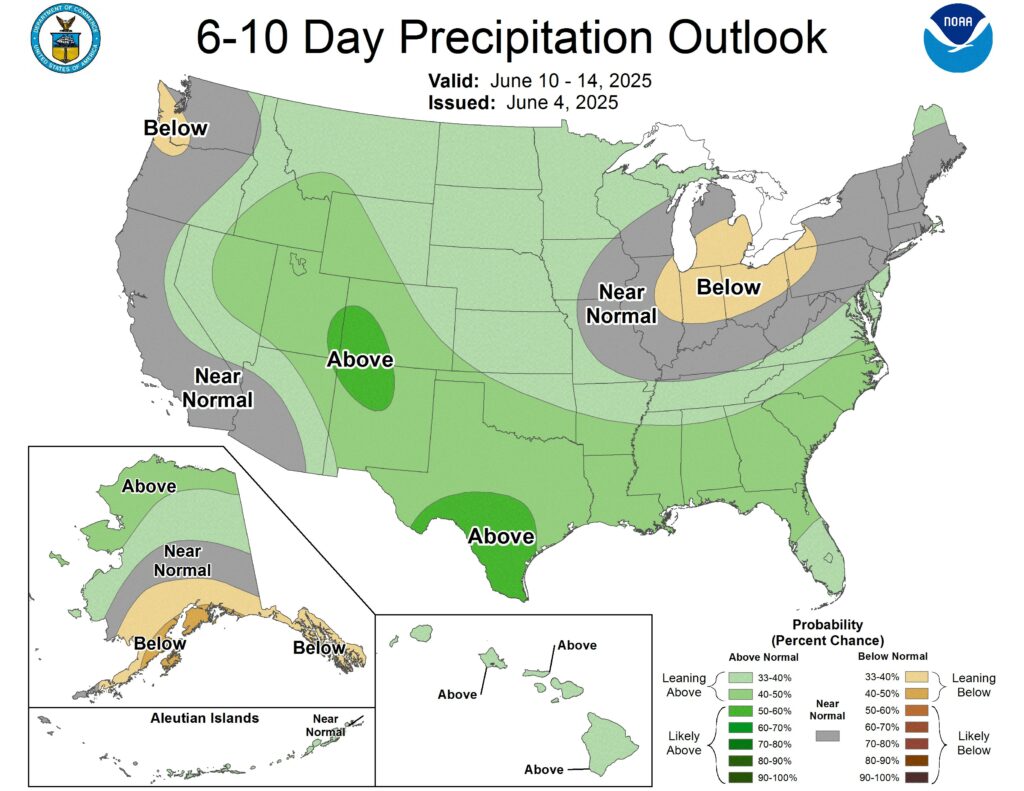

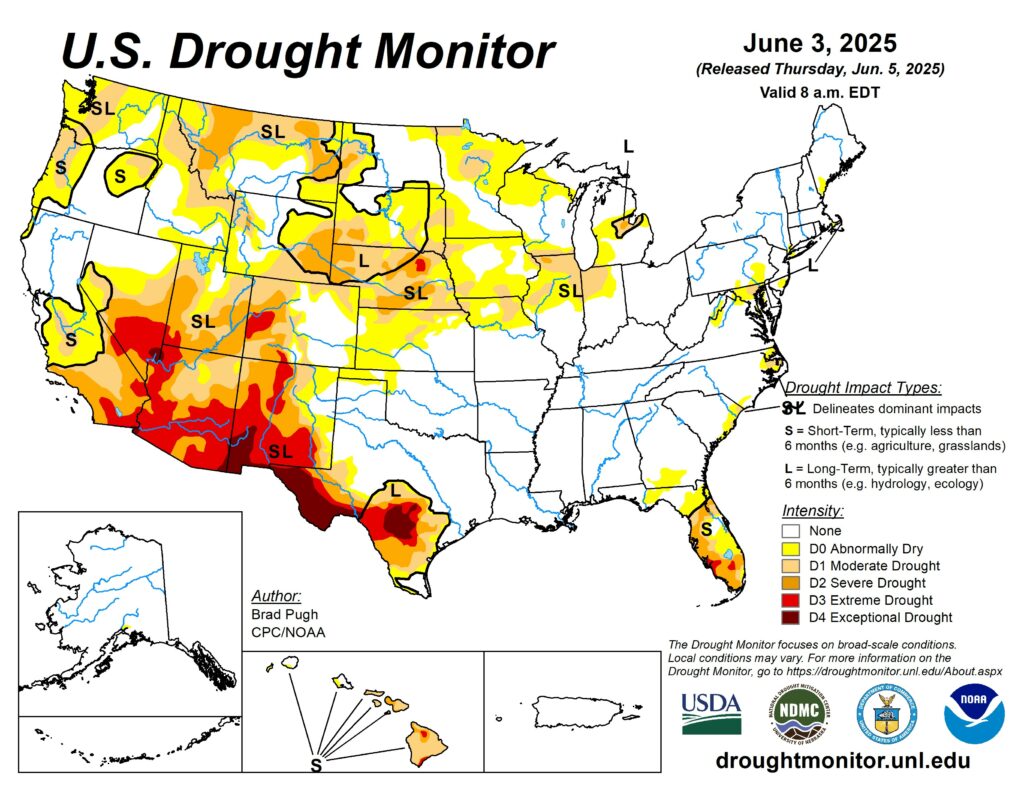

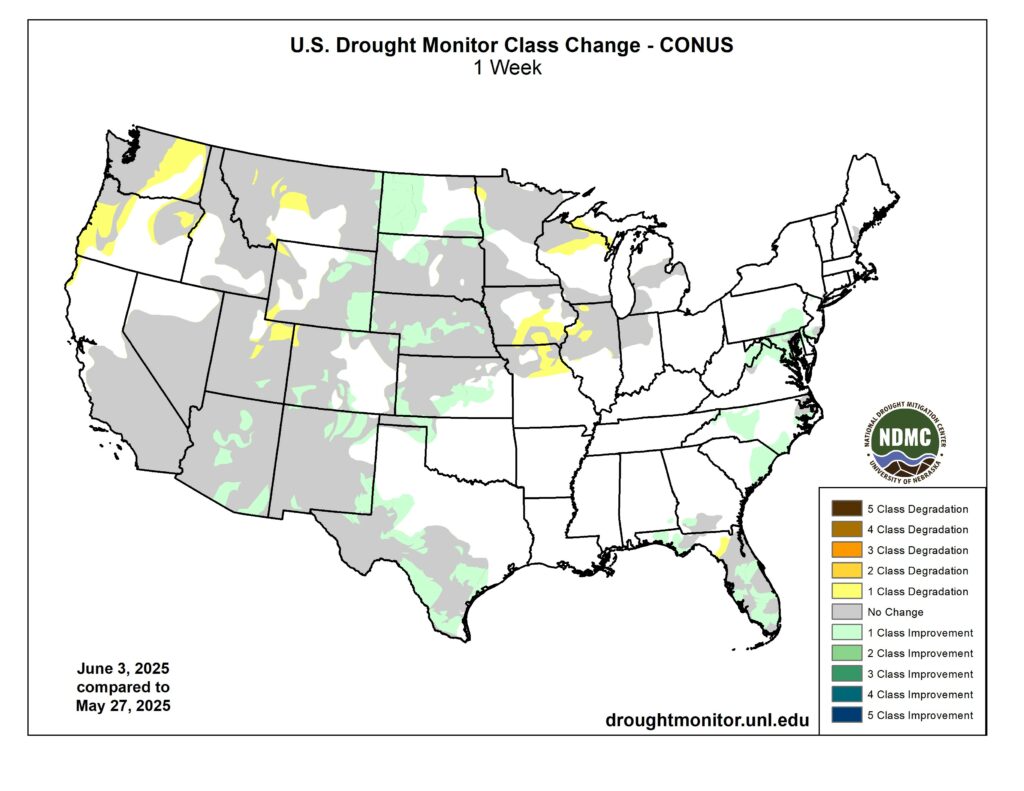

This morning’s export sales all fell in line with trade range estimates. 24/25 corn export sales average estimate was 1.156M and only 942K bu reported. Soybeans and meal fell closer to the bottom side of the range, but overall no surprises. Ethanol production hit season highs in yesterday’s weekly report.Weekly ethanol production last week was 1.105M barrels per day, an 11 week high. The drought monitor mostly improved week-over-week. The next 5-days of rain will mostly hit Oklahoma and the mid-south/delta regions. China’s weather is starting to draw concerns for their crop. Their northern plains are dry and they just getting done planting their northern crop. Temperatures are also higher than normal in the north vs. southern China. China is rumored to have a large stock pile of corn from last year’s crop. These weather concerns may be enough to reintroduce Chinese importers to the US corn market.

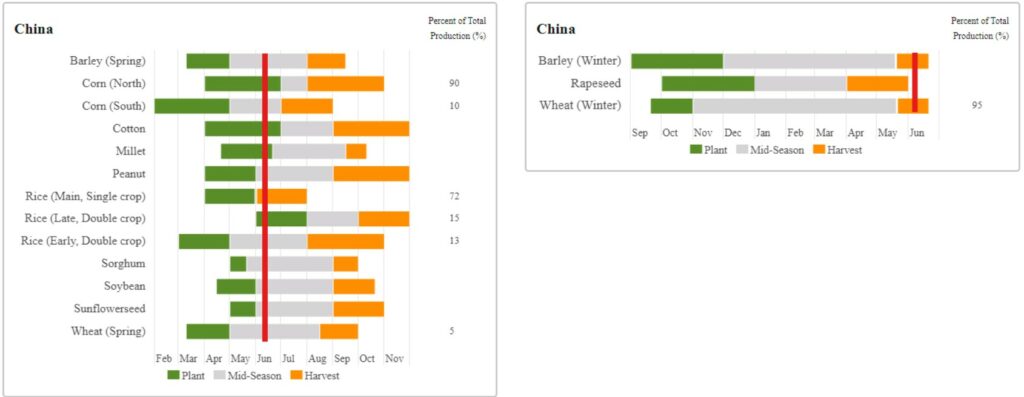

China’s Crop Schedule: They are currently finishing planting corn in the north and in the middle of crucial growth stages for their southern corn. they have finished planting soybeans and are in the middle of winter wheat harvest.

The Northern Plains of China are dry and they are roughly in the same growth stages as our corn crop, early. They need a shot of rain soon to kick start their crop.

China Corn Production Map:

Week-Over-Week Drought Change shows areas of northwest IL, southeast IA and northeast MO are slightly dryer while the wheat belt overall saw an improvement in drought conditions.

Weekly Export Sales

|

Export & World News

Jordan purchased about +60K MT of animal feed barley in an international tender. South Korea is looking to buy up to 210K MT of animal feed corn.

Malaysian palm oil futures were down 44 ringgit, now at 3904.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.