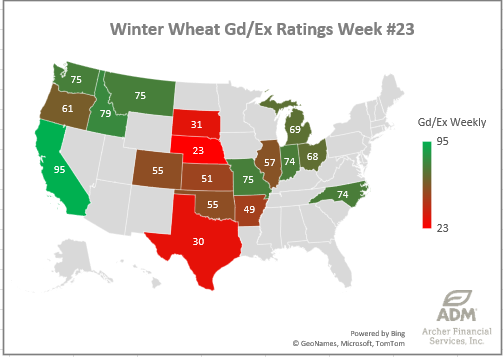

Winter Wheat Crop Condition (52% G/E)

Winter Wheat Crop Conditions are +2% better this week, now at 52% good/excellent. Oklahoma jumps +9% from 42% g/e to 51% this week. Additionally the whole primary wheat belt (SD, NE, KS, OK, and TX) all saw improvements to quality last week. Illinois took the biggest hit at -5% weekly change.

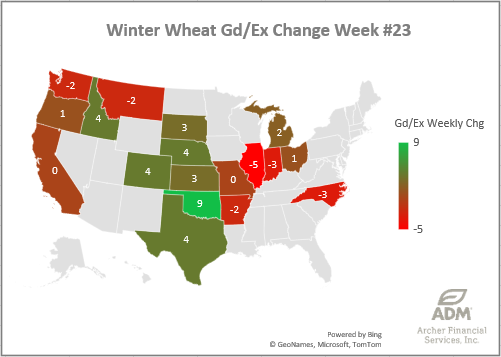

Winter Wheat Harverst Progress vs. 5-Year Avg.

Winter Wheat Harvest Progress is on pace at 3% nationally, but Oklahoma, Texas and Arkansas are all behind the average pace to start harvest. While most states are just getting started (below 10%), Texas is 25% done as of today.

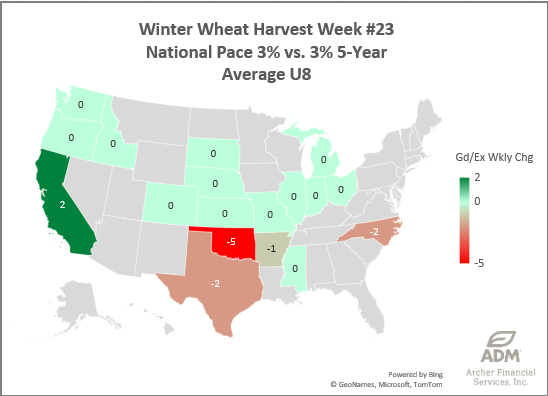

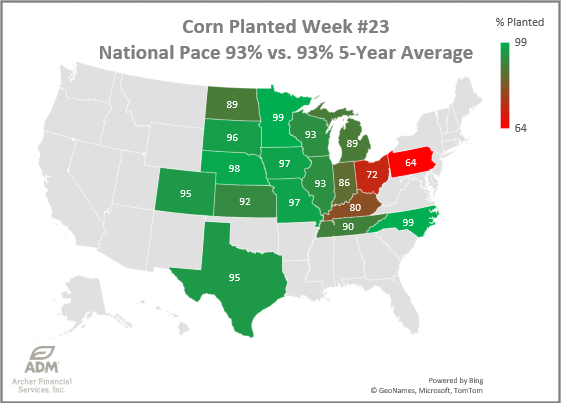

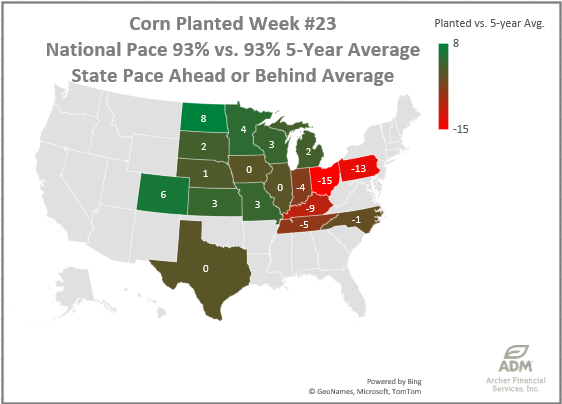

Corn Planting Progress (93%)

Corn Planting Progress was finally caught by the 5-year average, now matching it at 93% planted. Progress advanced 6%. The western half of the US growing region is ahead of pace and the eastern states are all behind pace. Ohio is in the worst position for both corn and bean planting progress.

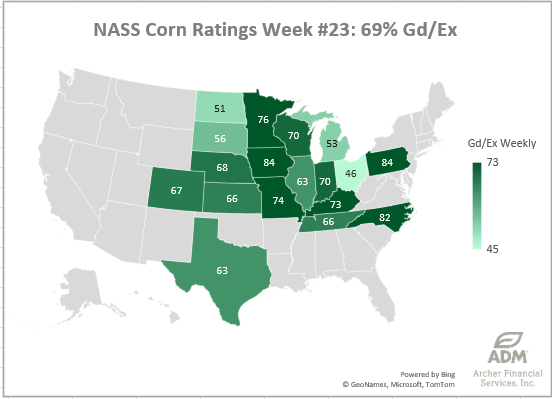

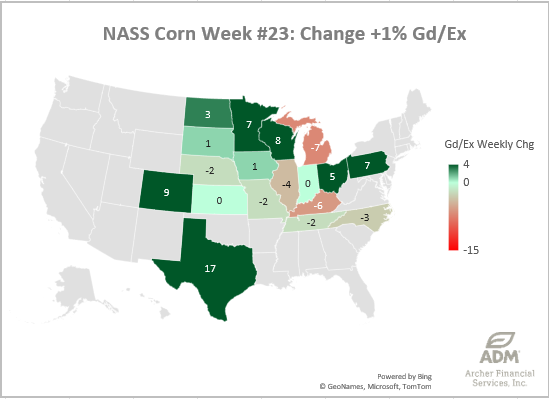

Corn Crop Conditions (69% G/E)

Corn Good/Excellent Ratings were +1% better week-over-week, now at 69%. This week’s biggest losers were Michigan, Kentucky and Illinois, while Minnesota, Texas, Ohio, and Wisconsin were able to move the needle to the positive.

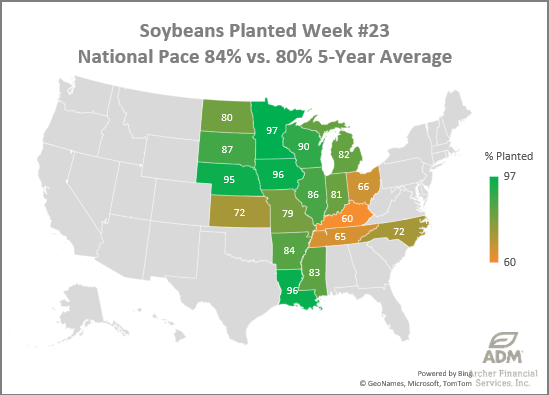

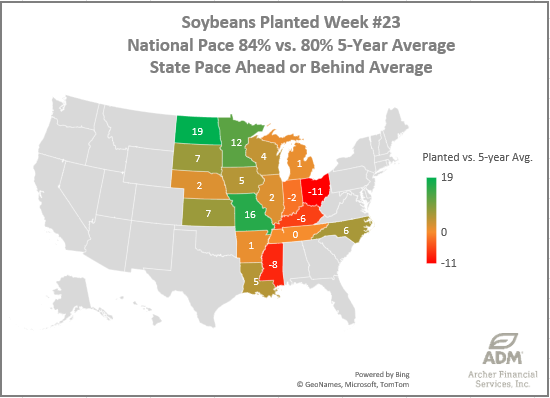

Soybean Planting Progress (84%)

Soybean Planting Progress is +4% faster than the 5-year average. Progress advanced 8% to 84% now. The eastern states (Ohio, Kentucky, Indiana) have fallen behind the 5-year pace. Soybean final planting dates are within the first week of July in Ohio.

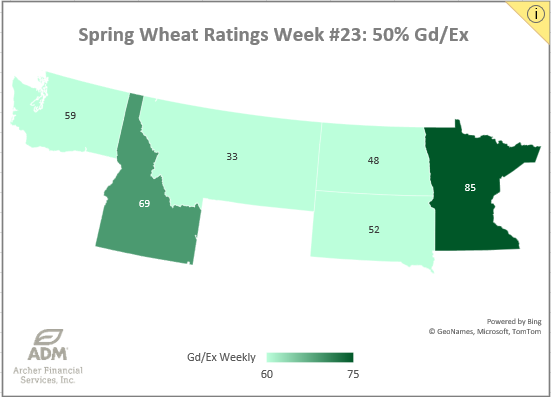

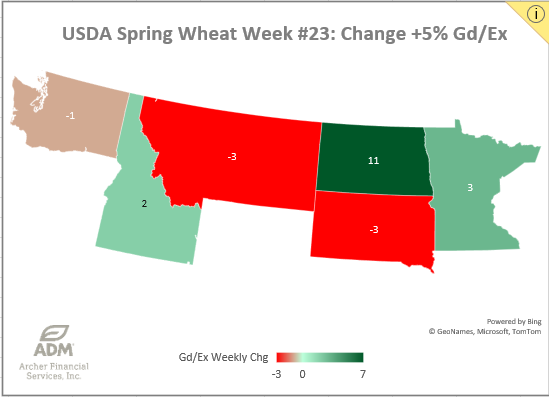

Spring Wheat Crop Condition (50% G/E)

US Spring Wheat Crop Conditions landed at 50% good/excellent, that’s +5% better than last week. Montana, North Dakota and South Dakota are still about 30% below their conditions this time last year. Minnesota is running about 10% better than this time last year. biggest change week-over-week is North Dakota’s +11% improvement. This week’s ratings are the 2nd lowest in the last 10 years.

(Spring Wheat Planting Progress 95%)

Calendar Spreads and Cost of Carry

Spread | Last | Chg | Full | % of FC |

CN25/CU25 | 17 1/2 | -3 1/4 |

|

|

CU25/CZ25 | -15 | +1/4 | -30 3/4 | 49% |

SN25/SQ25 | 6 1/4 | +1 1/4 |

|

|

SQ25/SX25 | 10 1/4 | 1/4 |

|

|

SN25/SX25 | +16 1/2 | +1 1/2 |

|

|

MWN25/MWU25 | -13 | -1 1/4 | -21 | 62% |

WN25/WU25 | -14 1/4 | 0 | -16 | 89% |

KWN25/KWU25 | -13 3/4 | 0 | -16 | 86% |

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures Settlements & Technicals

Symbol | Close | Chg | High | Low | Support | Resist | 20-Day | 50-Day |

CN25 | 438 1/4 | -5 3/4 | 451 | 437 3/4 | 440 | 470 | 450 1/2 | 465 3/4 |

CU25 | 420 3/4 | -2 1/2 | 427 3/4 | 420 1/4 | 425 | 450 | 430 | 438 1/2 |

SN25 | 1033 1/2 | -8 1/4 | 1042 3/4 | 1032 1/2 | 1015 | 1065 | 1043 3/4 | 1053 3/4 |

SQ25 | 1027 1/4 | -9 1/2 | 1038 | 1026 1/2 | 1010 | 1060 | 1049 3/4 | 1039 1/4 |

SX25 | 1017 | -9 3/4 | 1028 1/4 | 1015 1/2 | 1000 | 1040 | 1038 1/2 | 1026 3/4 |

MWN25 | 626 | +1/2 | 634 1/4 | 624 | 600 | 630 | 598 1/2 | 604 3/4 |

MWU25 | 639 1/4 | +2 | 646 1/4 | 635 3/4 | 610 | 640 | 611 1/4 | 618 |

WN25 | 539 | +5 | 549 1/2 | 533 1/4 | 520 | 550 | 532 1/4 | 543 |

WU25 | 553 1/4 | +5 | 563 1/2 | 547 3/4 | 525 | 565 | 546 3/4 | 558 |

KWN25 | 539 3/4 | +6 1/2 | 550 1/2 | 531 3/4 | 520 | 550 | 528 | 551 |

KWU25 | 553 1/2 | +6 1/2 | 563 1/2 | 545 1/4 | 525 | 565 | 542 1/4 | 565 1/2 |

SMN25 | 293.9 | -2.40 | 296.3 | 293.2 | 290.00 | 300.00 | 294.60 | 294.70 |

BON25 | 46.28 | -0.61 | 47.17 | 46.23 | 46.00 | 50.00 | 49.03 | 47.88 |

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.