OPENING COMMENTS

Geopolitics: The conflict between Russia and Ukraine is back in the spotlight as drone attacks on Russia warplanes were conducted by Ukraine over the weekend. Zelensky lead the strategic attack on five military airfields. Estimated damage is $7billion. The drones were inside trucks and were remotely release as the trucks rolled within range of the targets. wheat prices jumped overnight, crude oil spiked higher and the dollar dropped to start the week. Commodity markets are currently trading off two subjects that are difficult to predict, war and weather.

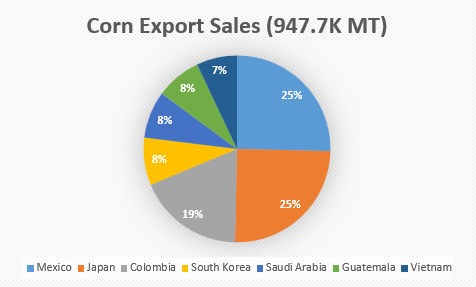

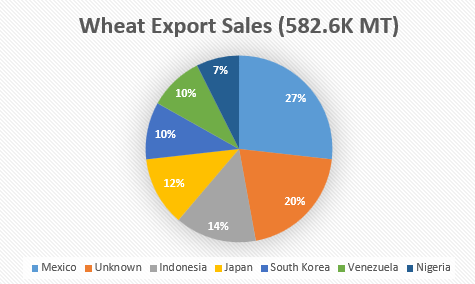

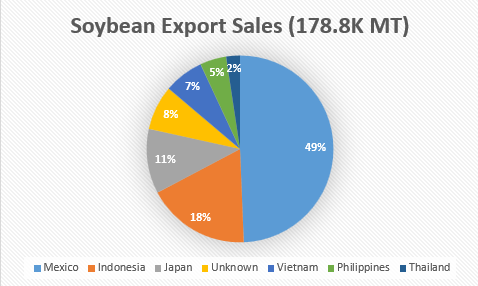

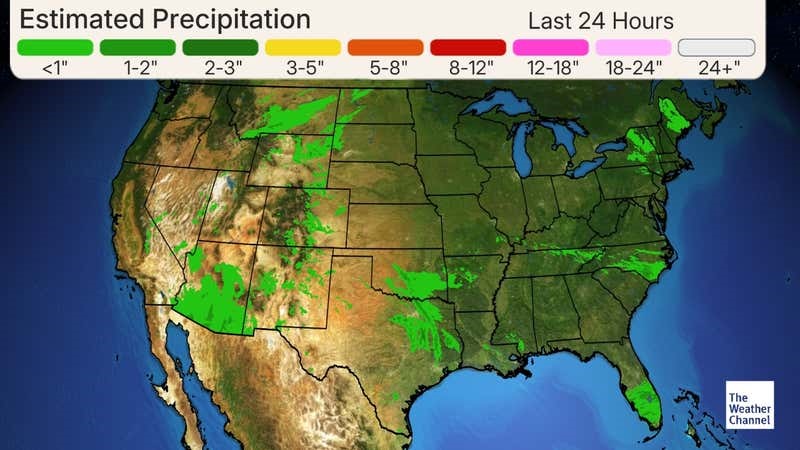

Ag Fundamentals: Favorable weather in the US growing regions is fueling the bear argument for most row crop grains this morning. The Central US will average 1-2 inches of rain over the next 7 days will the only neglected area being North Dakota and South Dakota. Corn is over 90% planted and soybeans are getting close to 80% done at this point. The last 10-15% of this year planting progress may be slightly delayed from weather, but expectations are that it all gets in on time. Mexico was the largest buyer for corn beans and wheat export sales last week; Japan also a large participant.

Export & World News

The Philippines is believed to have bought about 110K MT of animal feed wheat sourced from Australia last Thursday.

Malaysian palm oil futures were down 54 ringgit overnight, now at 3878.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

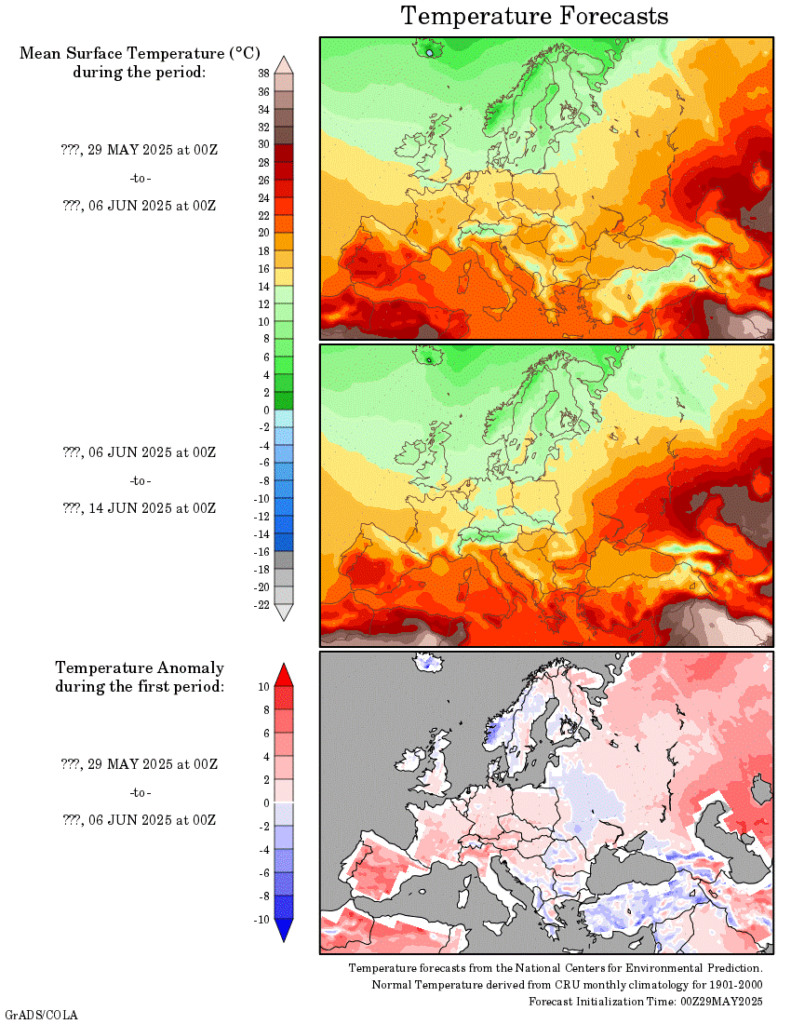

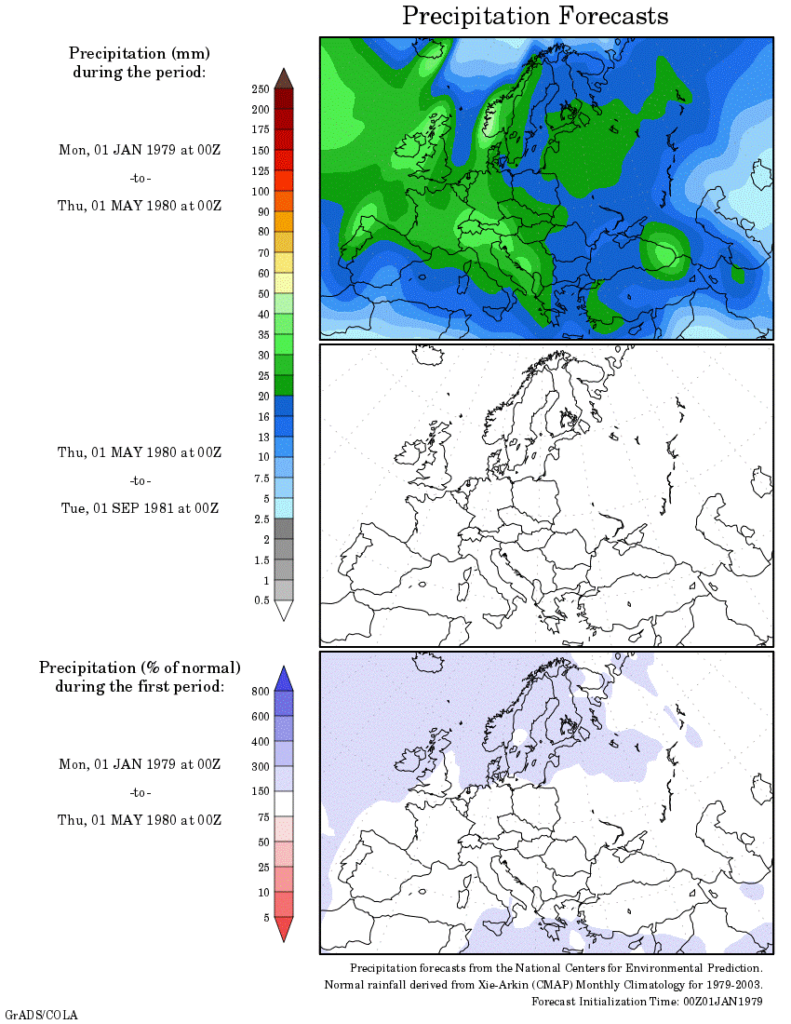

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.