OPENING COMMENTS

Macroeconomics:

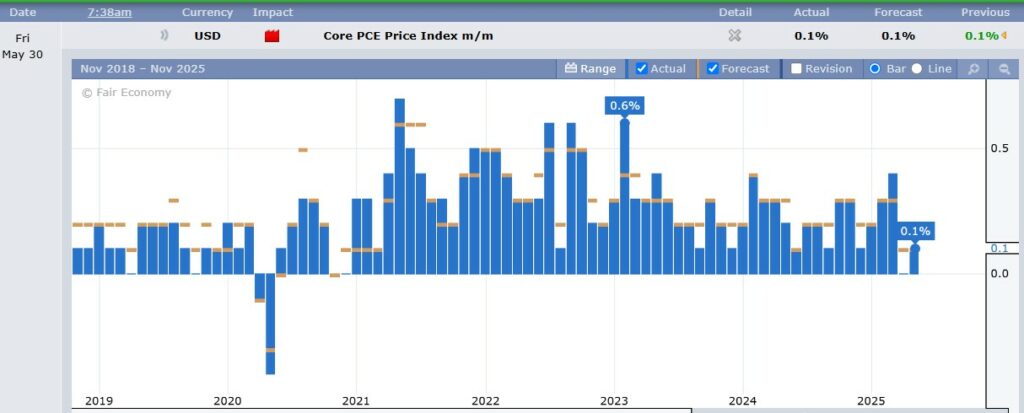

Core PCE came in as expected this morning with only a 0.1% increase in consumer goods in the month of April. Next week we will see plenty of economic data reported. Monday will be ISM Manufacturing PMI, and Federal Reserve Jerome Powell will speak to the nation at noon. Tuesday will be the JOLTS job report, and Wednesday the ISM Services PMI. Thursday will have unemployment claims while Friday morning’s unemployment rate, and average earnings will set the tone for the first half of June. The Federal Reserve will make a decision on interest rates on June 18th, one day after the Japanese bank decides on their interest rates and one day before Juneteenth a national holiday.

Ag Fundamentals:

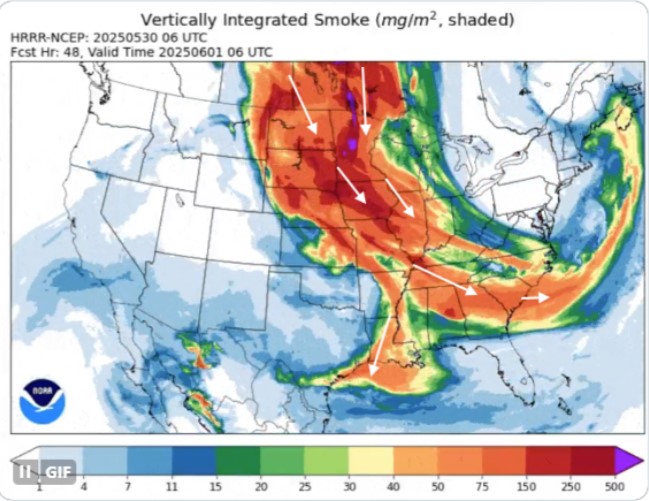

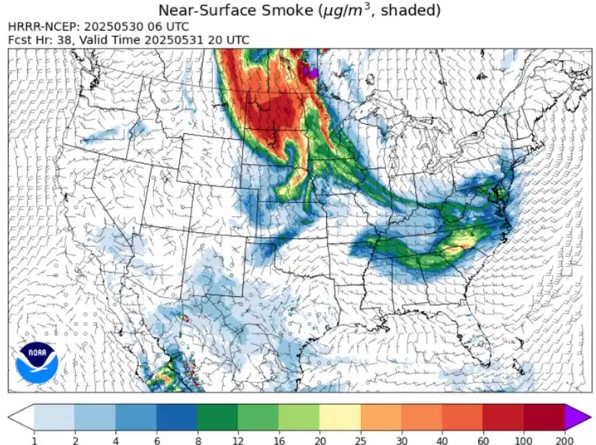

The USDA reported a Flash sale of 210K MT of corn sold to unknown destinations. Most of that will be for 24/25 marketing year, but 65K MT of it will be for 25/26 marketing year. Export sales were somewhat disappointing this week. Weekly sales for 24/25 marketing year came in under estimate ranges for corn, beans and wheat. Western Manitoba has seen some of the worst of Canada’s recent wild fires. 17K people were evacuating the area on Wednesday and They continue to fight the flames today. There are now more than 130 active wildfires across Canada, and of those 50% of them are out of firefighter control. Nearly 200K hectares of forests have been scorched in the past month. smoke will leak into the US this weekend. Surface level smoke will be visible in the Dakotas, Minnesota, and parts of Nebraska and Iowa. The Commitment of Traders Report will be released at 3pm later today. Expectations are that corn fell another -40K contracts to around -140K contracts, soybeans basically unchanged at near +13K contracts, and wheat falling about -10K contracts to near -115K to -120K contracts short.

Core PCE Price Index (month/month) is the change in the price of goods and services purchased by consumers, excluding food and energy. This morning’s numbers came in as expected, 0.1% increase.

Vertically Integrated Smoke from Canada’s Wild Fires (surface up to 15.5 miles into atmosphere) will cover most of the Midwest. This should not effect weather, but air quality will be a concern in some parts of the Dakotas, Minnesota, Nebraska and northern Iowa. Beneath the below image is the surface level smoke.

Weekly Export Sales

| Sales 24/25 | Est Range | Sales 25/26 | Est Range |

Wheat | 128,800 | 300K-500K | 711,400 | 300K-700K |

Corn | 916,700 | 1.1M-1.75M | 31,000 | 50K-500K |

Beans | 146,000 | 175K-550K | 32,800 | 90K-400K |

Meal | 424,600 | 150K-500K | 178,500 | 0-50K |

Soyoil | 19,500 | 5K-30K | 0 | 0-10K |

Export & World News

This morning, the USDA reported flash sales of 210,560 MT of corn to unknown destinations. 145,560 MT of that will be for 24/25 marketing year and 65K for 25/26 marketing year.

Malaysian palm oil futures were down 54 ringgit overnight, now at 3878.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

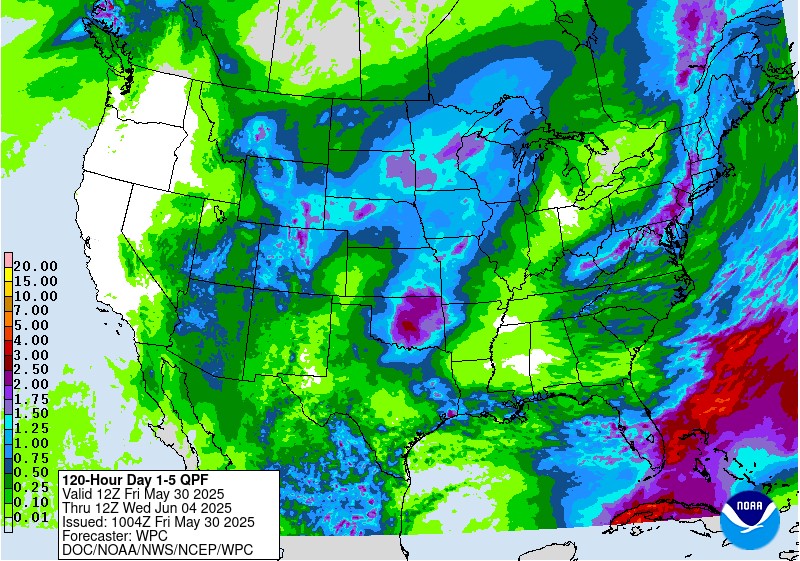

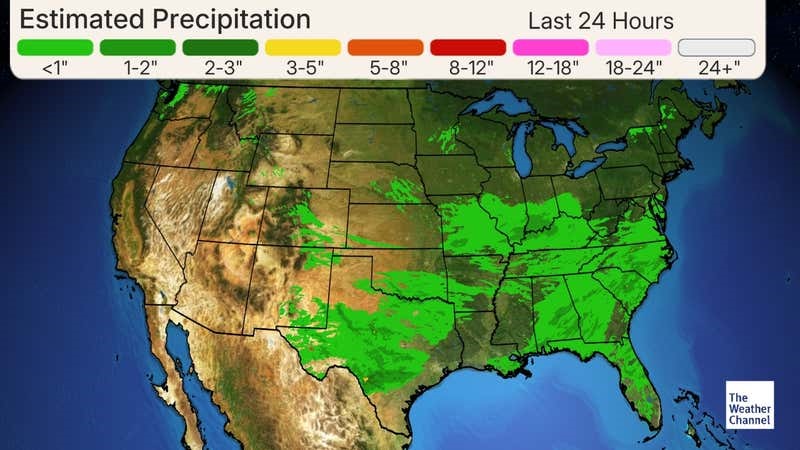

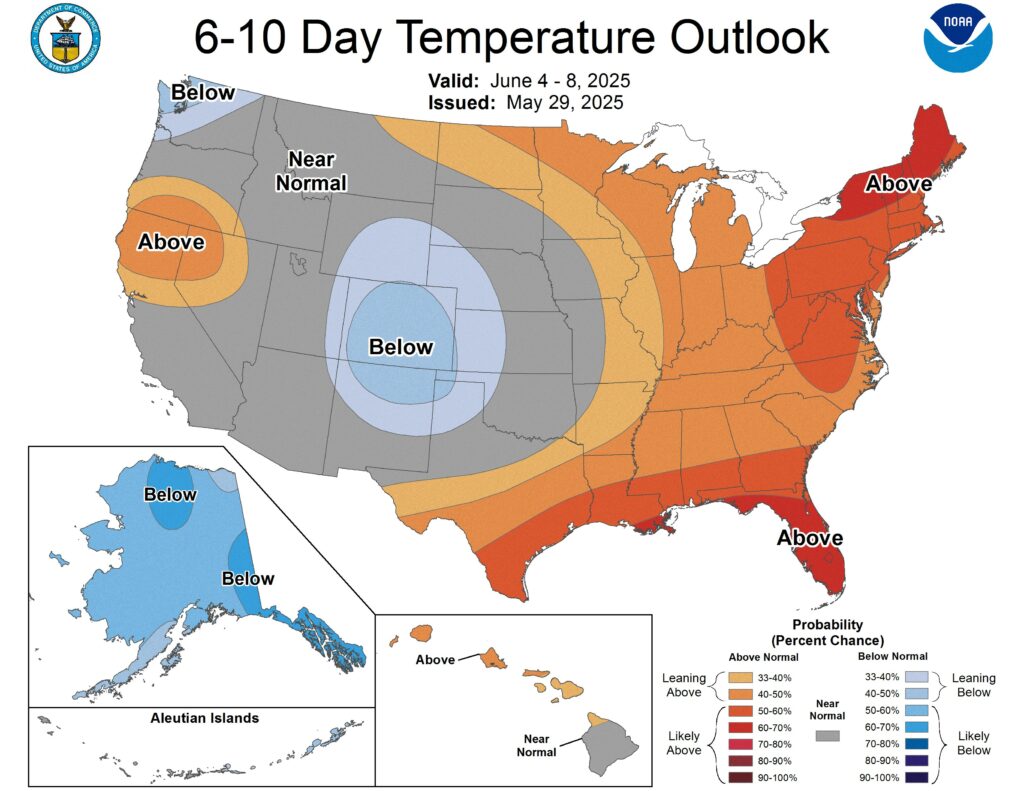

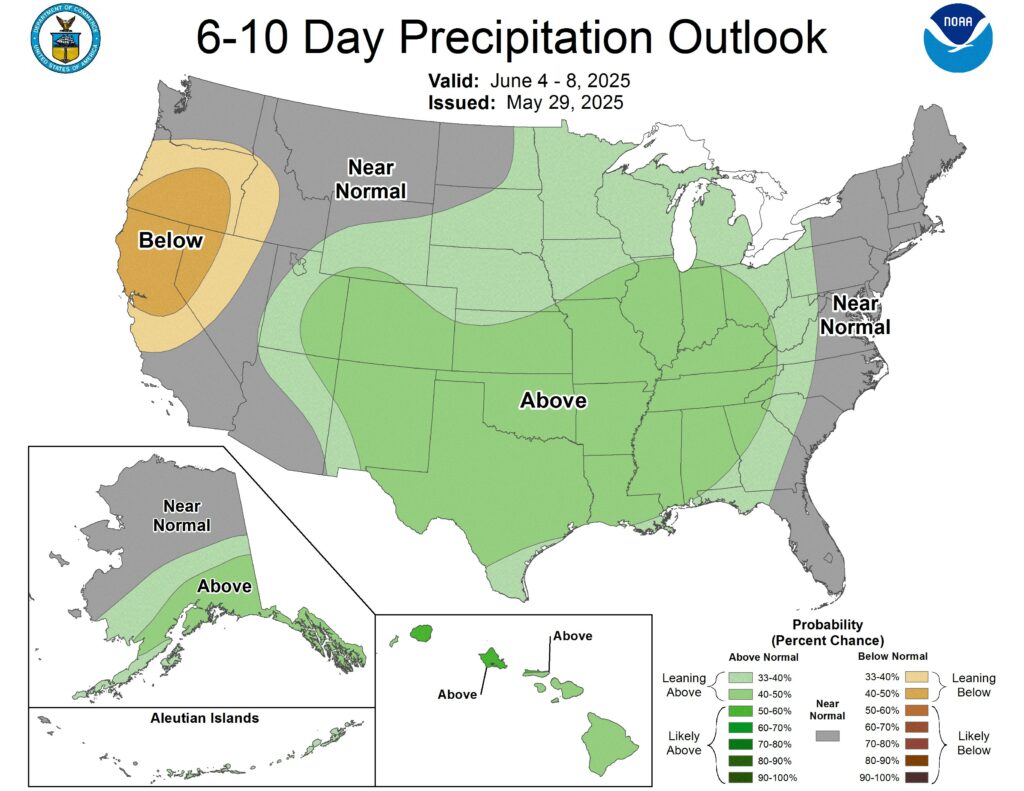

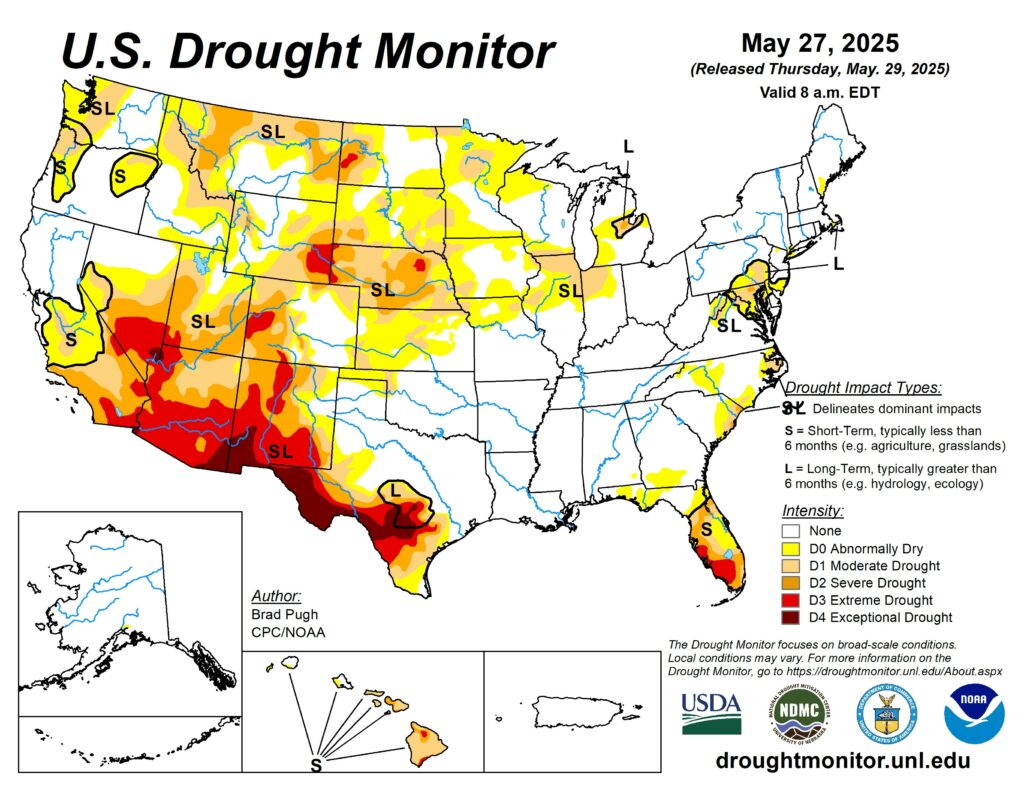

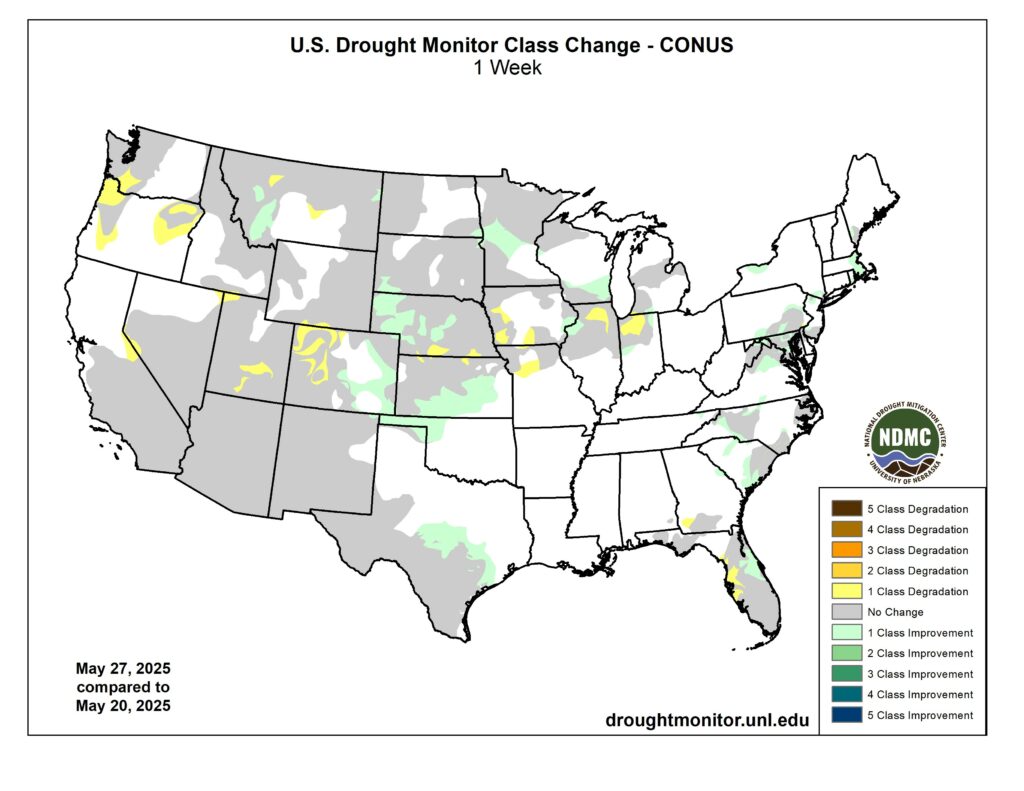

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.