MORNING AG OUTLOOK

Grains are mixed. North America weather forecast is crop favorable. Rains improved US north plains. US Delta, SE and ECB remans wet. General Midwest rains next week. US Court of International Trade ruled Trump did not have the authority to impose sweeping tariffs on nearly every country. Musk leaving administration after criticizing US House spending bill. DOGE was supposed to cut US spending by $2 trillion. Actual cuts are $175 billion. US stocks are higher. Gold is lower. Crude is higher. USD is higher. US weekly export sales are delayed until Friday due to Mondays holiday.

SOYBEANS

SN is near 10.52. Dalian soybean, soymeal and palmoil futures were lower. Brazil soybean export basis was higher on talk of China interest for July-Aug. Wednesday soybean selloff linked to talk of lower US soybean exports. One group dropped US 2024/25 soybean crush 20 mil vu which raised carryout to 374. They reduced 2025/26 crush 75 mil bu vs USDA but added 200 mil bu to their export guess. This leaves a carryout at 500 mil bu vs USDA 295. SMN-SMZ spread widened out to -13 on over supply. No word on new US RVO soyoil policy.

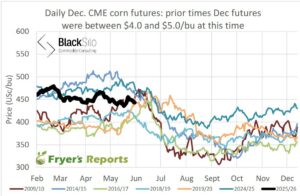

CORN

CN is near 4.49. Dalian corn ended higher. Wednesday corn selloff linked to talk of lower US corn exports. Some feel US 2025/26 exports are 275 mil bu below USDA which increase carryout closer to 2,020. Taiwan bought Brazil corn for July-Aug. There is also talk that some US open and unshipped corn sales could be cancelled. CN-CU spread dropped 4 cents to +20. Some are estimating Brazil 2nd corn crop as higher as 110 mmt.

WHEAT

WN is near 5.29. WN support is 5.25. USD has turned higher. Minneapolis wheat increased premium over other grades after USDA rated US spring wheat crop only 45 G/E vs 71 expected (ND 37). US wheat export 2024/25 market season ends Friday. Australia wheat futures are lower on talk of rain in dry areas. Argentina wheat futures are lower and near 5 month lows. World wheat prices are lower due to slow import buying and upcoming north hemisphere harvest.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.