OPENING COMMENTS

Ag Fundamentals: Soybean oil trading lower this morning due to higher than expected crude oil inventories reported yesterday, and rumors of lower than expected RVO (Renewable Volume Obligations) levels. The EPA Administrator Lee Zeldin said yesterday that the mandates are expected to be set “in the coming months”. This is later than the market was hoping for. Zeldin will go through the rule-making process over the next few months. He mentioned he inherited a “blown deadline”. Export sales this morning were stronger than expected. New crop wheat and old crop corn both posted export sales above the estimate ranges. Moving forward we will need to pay close attention to both 24/25 and 25/26 export books.

Monthly PPI (Producer Price Index -0.5%) which measures the change in price of finished goods and services sold by producers, was much lower than expected. The Market estimated a print of +0.2% and this morning’s report came in -0.7% lower than the estimate. Retail sales were lower than expected at 0.1% vs. the 0.3% expected. Unemployment claims hit the estimate on the nose at 229K open claims.

Weekly Export Sales (MT)

| Sales 24/25 | Est Range | Sales 25/26 | Est Range |

Wheat | 58,600 | (200K)-100K | 746,200 | 350K-600K |

Corn | 1,677,200 | 900K-1.5M | 508,900 | 350K-600K |

Beans | 282,400 | 200K-500K | 490,300 | 350K-500K |

Meal | 286,700 | 90K-300K | 32,700 | 0-50K |

Soyoil | 13,600 | 0-24K | 500 | 0-10K |

Export & World News

Algeria purchased about 660K MT of milling wheat most likely from Russia/Ukraine. South Korea bought around 65K MT of animal feed corn and they are looking to buy up to 138K MT.

Malaysian palm oil futures were down 73 ringgit overnight, now at 3850.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.70 (expanded $1.05); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

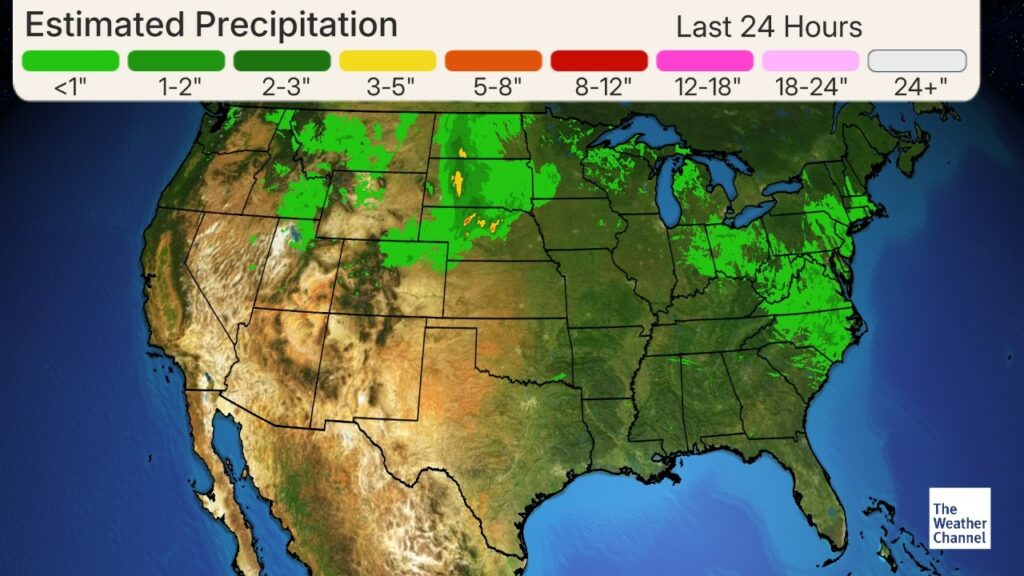

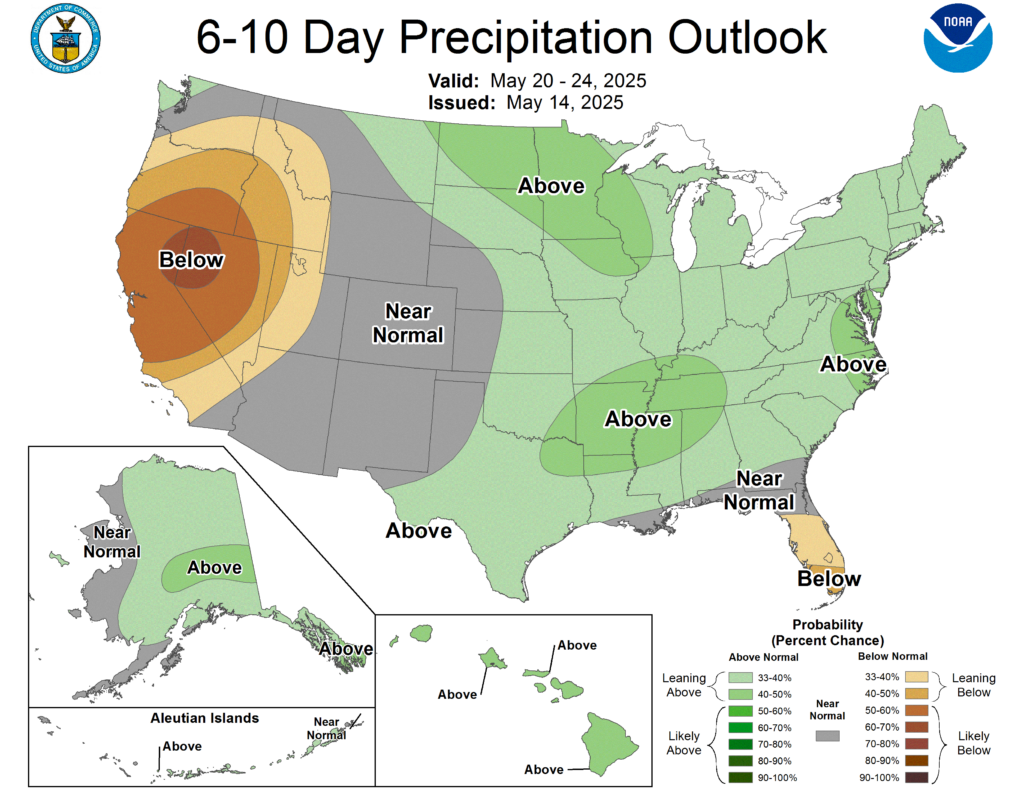

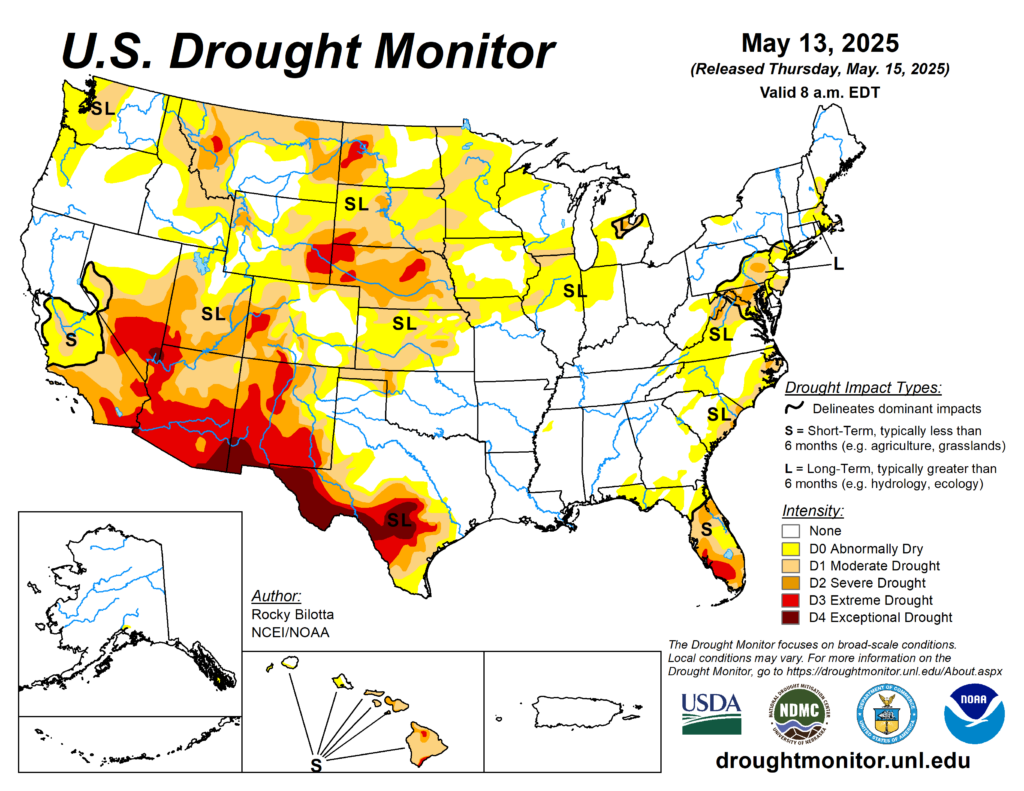

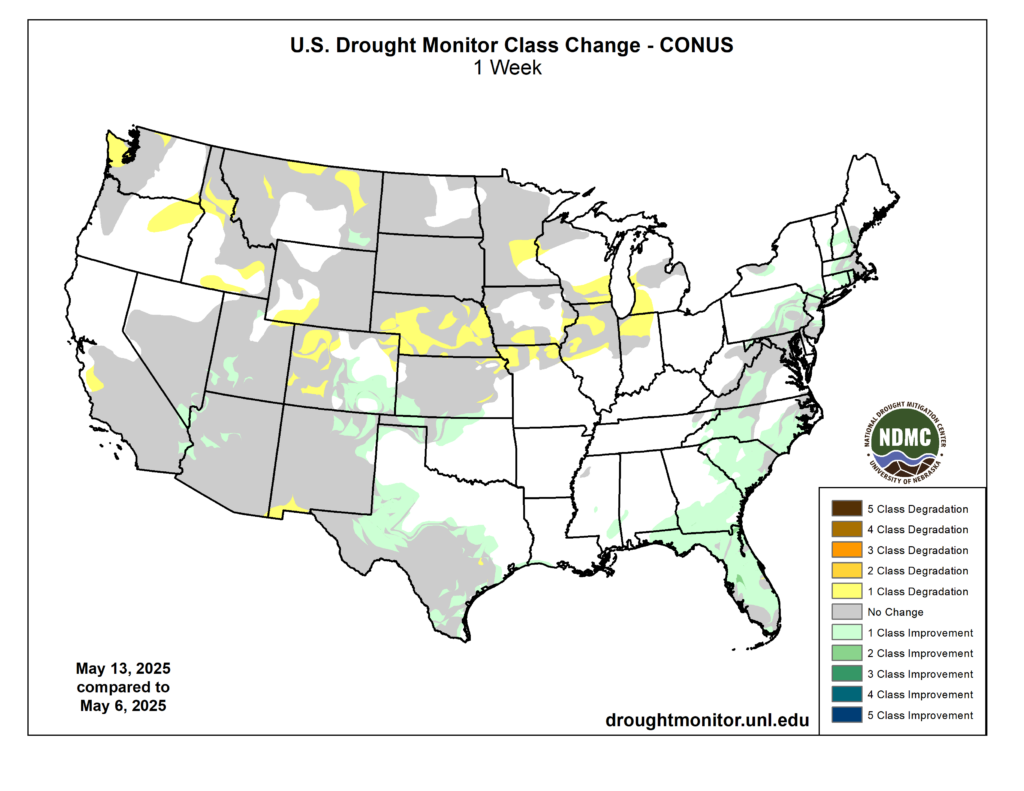

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.